A decent sell-off for a change and stocks even managed to find support at last week's lows.

Profit taking? Volume was relatively light and there was little market data to drive the action. August factory orders dropped 0.5% compared to an anticipted 0.4%, which was hardly cause for a sell-off. Pending home sales increased 4.3% which was better than expected.

But after the sideways action we had last week, a big down day today puts significant pressure on the Seven Sentinels. Enough to flip it to a sell. But not enough to trigger a 28 day trading low in NYMO to confirm the signal. You may remember that the SS was in sell mode at the end of August, gave a buy signal early in September, but it wasn't confirmed for another few trading days. By that time the rally was well underway. Sentiment was pretty bearish though at the end of August and should have been a big red flag to get invested once the initial buy signal was achieved.

This time we have a sell signal in a relatively bearish market, so it's questionable how much damage we'll see. If the market was bullish I'd be bailing fast, but that's not the case. I need to see how the next couple of trading days go first before I get too excited.

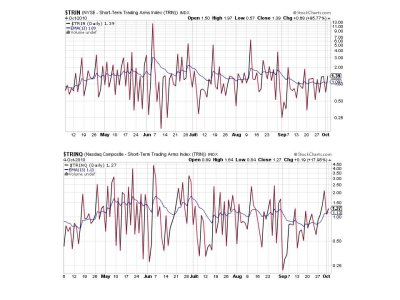

Here's the charts:

Sell.

Sell.

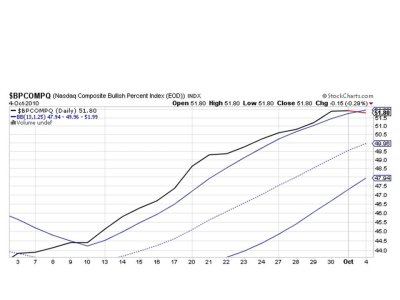

Sell.

Sell.

We have all signals flashing sells, which flips the system to sell, but it's not confirmed by a 28 day trading low in NYMO. Sentiment may very well limit technical damage to the major indexes, but we'll have to see how it plays out.

I pushed another 40% into the market today, but still have 40% in cash. Ill be watching carefully, but I really think sentiment will put a floor under the market. I'd not be surprised to see us break support at 1130 on the S&P in order to shake some weak handed bulls loose, and that should get things beared up even more. It's going to be an interesting week.

Profit taking? Volume was relatively light and there was little market data to drive the action. August factory orders dropped 0.5% compared to an anticipted 0.4%, which was hardly cause for a sell-off. Pending home sales increased 4.3% which was better than expected.

But after the sideways action we had last week, a big down day today puts significant pressure on the Seven Sentinels. Enough to flip it to a sell. But not enough to trigger a 28 day trading low in NYMO to confirm the signal. You may remember that the SS was in sell mode at the end of August, gave a buy signal early in September, but it wasn't confirmed for another few trading days. By that time the rally was well underway. Sentiment was pretty bearish though at the end of August and should have been a big red flag to get invested once the initial buy signal was achieved.

This time we have a sell signal in a relatively bearish market, so it's questionable how much damage we'll see. If the market was bullish I'd be bailing fast, but that's not the case. I need to see how the next couple of trading days go first before I get too excited.

Here's the charts:

Sell.

Sell.

Sell.

Sell.

We have all signals flashing sells, which flips the system to sell, but it's not confirmed by a 28 day trading low in NYMO. Sentiment may very well limit technical damage to the major indexes, but we'll have to see how it plays out.

I pushed another 40% into the market today, but still have 40% in cash. Ill be watching carefully, but I really think sentiment will put a floor under the market. I'd not be surprised to see us break support at 1130 on the S&P in order to shake some weak handed bulls loose, and that should get things beared up even more. It's going to be an interesting week.