Things were looking good most of the trading day until financials rolled over as a result of a midday downgrade of Wells Fargo by widely-followed analyst Dick Bove. That seemed to be the catalyst that began a broader market melt-down. Worse, the selling was on higher volume, which could be a bearish sign.

But it was only one trading day and I still do not have a seven sentinels sell signal. We also have not spiked down to the levels seen at previous downward reversals of the past few months. So for the moment there is no hard evidence that a bigger correction is upon us. I'm still looking higher, even if a rally comes after more follow-through to the downside.

Here's todays charts:

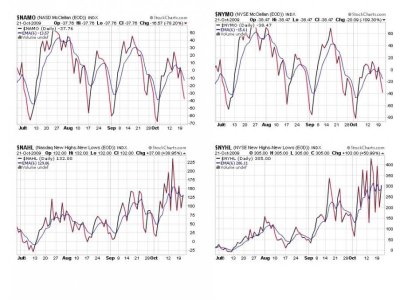

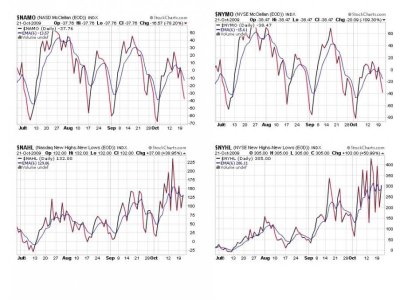

NAMO and NYMO collapsed some more with the late day selling pressure, but NAHL and NYHL flipped back to buy signals. Perhaps the selling wasn't quite as broad-based as it appeared, although it may very well bleed over into tomorrows early trading at the very least.

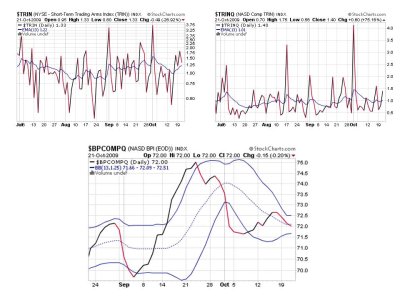

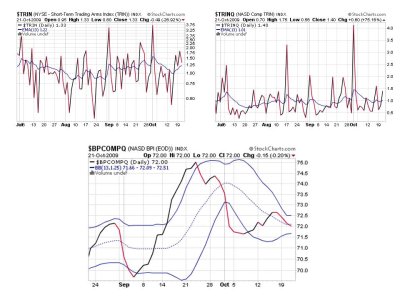

TRIN remains on a sell as does TRINQ, while BPCOMPQ continues to show very little movement and remains on a buy.

So we have 3 buy signals and 4 sell signals, which keeps the system on a buy.

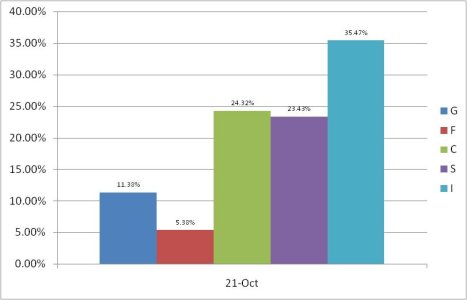

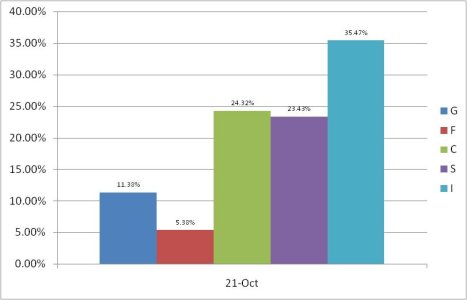

A little bit of cash was raised by our top 25% for today's trading activity, but we remain well within the allocation range we've seen in this data since mid-August.

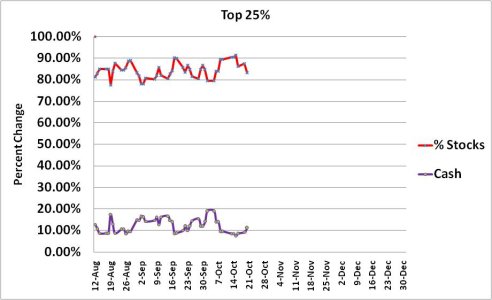

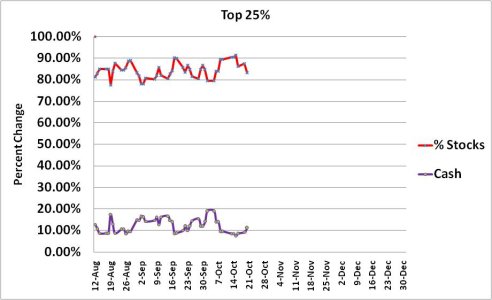

Here, we can see cash levels rising and stock levels dropping, but still by modest amounts, which we have to allow for as we are getting closer to the end of the month and some folks may want to begin positioning themselves for next months action by raising some cash.

So we're still in a buy holding pattern. No SS sell signal, but the caution flag is out and if it's any consolation our top 25% are hanging onto their bullish position. See you tomorrow.

But it was only one trading day and I still do not have a seven sentinels sell signal. We also have not spiked down to the levels seen at previous downward reversals of the past few months. So for the moment there is no hard evidence that a bigger correction is upon us. I'm still looking higher, even if a rally comes after more follow-through to the downside.

Here's todays charts:

NAMO and NYMO collapsed some more with the late day selling pressure, but NAHL and NYHL flipped back to buy signals. Perhaps the selling wasn't quite as broad-based as it appeared, although it may very well bleed over into tomorrows early trading at the very least.

TRIN remains on a sell as does TRINQ, while BPCOMPQ continues to show very little movement and remains on a buy.

So we have 3 buy signals and 4 sell signals, which keeps the system on a buy.

A little bit of cash was raised by our top 25% for today's trading activity, but we remain well within the allocation range we've seen in this data since mid-August.

Here, we can see cash levels rising and stock levels dropping, but still by modest amounts, which we have to allow for as we are getting closer to the end of the month and some folks may want to begin positioning themselves for next months action by raising some cash.

So we're still in a buy holding pattern. No SS sell signal, but the caution flag is out and if it's any consolation our top 25% are hanging onto their bullish position. See you tomorrow.