craigerv

Market Tracker

- Reaction score

- 3

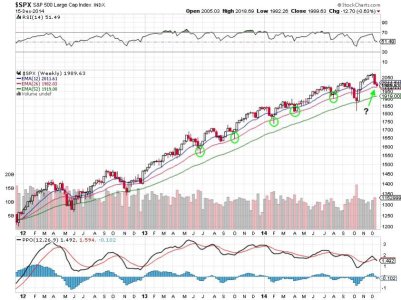

What a ridiculous, whirlwind day. Bonds blew up, then crumbled back to earth. Stocks jumped off the deep end, swam half-way back, then grabbed the scuba gear, and now they learned how to fly? (at least the small caps did). Check your emotions at the door.