-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

craigerv's Account Talk

- Thread starter craigerv

- Start date

craigerv

Market Tracker

- Reaction score

- 3

FAB1 is right, in 2010 we had the "Flash Crash" that led right into a correction. I do believe that type of event is one that you cannot design a system to beat reliably using the TSP's IFT rules. In that particular case, however, you had a chance the following week to make much of your money back before it turned down again. This year I'm trying to be more patient and let my system clear things up for me. If it were last year, I would probably have sold when things flattened out in February and would be wondering how I missed the next bump up while also fearing buying back in at higher prices.

craigerv

Market Tracker

- Reaction score

- 3

Getting close to a sell signal. I would say this week or maybe next I'll at least take half off of the table. I think we may still get a bump back up toward the high before we head down if the past few drops are any indication. Last year we spent around 5-6+ weeks forming the tops. If we are building that top I'd say we're about 4 weeks in. Looks like the tracker has been shaken up a little bit too, good to get the balance off the buy-and-holders for a little bit. Good luck!

craigerv

Market Tracker

- Reaction score

- 3

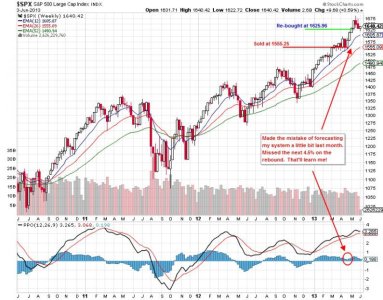

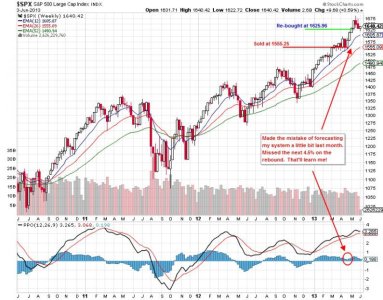

Well, I've reached my sell signal. I'll be 100% F cob 4/19. I'm not very enthused about this sell as from the daily chart you can see we're right at the 50d EMA. Earlier in this rally we've bounced in the vicinity of this area. But ultimately I'm relying on my system to clear things up. It's been a good run, can't complain about being +8% in April. If we drop, depending on how sharply, I'd be looking to buy in the 1470 area, between the 26w and 52w ema's. Good luck out there!

Attachments

craigerv

Market Tracker

- Reaction score

- 3

Well, last week I said I wasn't crazy about selling just as we bounced off the 50d ema and we did have a nice bounce right back up to the April highs. Yesterday did fall off at the end of the day, though. Avoiding a market forecast, I think I'll be waiting to see if it breaks above the April highs before getting back in. If the next few days break out, I may try to move at least 50% back in before the end of the month to get ahead of my IFTs for the next month. My signal is straddling the edge of buy/sell this week so I may have to forfeit a breakout to gain a little more clarity. Good luck!

craigerv

Market Tracker

- Reaction score

- 3

I moved back in cob today. My system has been straddling the edge of a buy/sell signal so I decided to give it a little time to see if the April highs could be broken. Looks like today may be the third close above 1600 in the S&P so I've caved to my buy signal. This market has been relentless. It sure seems like everyone is still looking for the pullback but we just keep drifting higher.

I moved back in cob today. My system has been straddling the edge of a buy/sell signal so I decided to give it a little time to see if the April highs could be broken. Looks like today may be the third close above 1600 in the S&P so I've caved to my buy signal. This market has been relentless. It sure seems like everyone is still looking for the pullback but we just keep drifting higher.

I don't know anything about anything, but it seems like that talk about a PULLBACK has been on this MB for months and months. the market has had ups and downs, but nothing has stopped/slowed it down for long. we have had some horrific events happen and the market just shakes it off. its as if the market has hypnotized those that are out into believing that the savior (pullback) is coming and the bystanders are caught like deer in headlights. i listen to what most everyone has to say about the market and then filter to my style of trading, which is B&H. i have considered moving out listening to some folks about the up coming pullback, but then i gain my senses about how resilleint it has been and back down. i even considered the May and go away, then said nay this thing is gonna run. just my 2 cents. good luck to all

craigerv

Market Tracker

- Reaction score

- 3

Another vote for the system. I made the mistake a month ago of trying to forecast my system by a few days in order to save myself a few %. How did that go? Well, I cheated myself out of about 4.5% gains off the 50d EMA bounce (5.5% for the S Fund)! Just more fuel for my conviction to stick with the system. I took my medicine and got back in for the remainder of May with a very modest gain. I have my defined sell stop for this week though so I'm in unless we break about 1591.

craigerv

Market Tracker

- Reaction score

- 3

For my system I mostly use moving averages and MACD (which is made from MA's). I use the S&P 500 to indicate a buy or sell and then buy the S Fund since it tends to outperform the C. It's pretty straight-forward but I also have some rules that I follow to go along with it to help me buy/sell when the market corrects. It's pretty low-maintenance, on average I'd say it makes only 4-5 trades a year so it works well within the IFT restrictions of the TSP.

I have worked on a shorter term system for the I fund a few times to see if I can grab some quick gains reliably but I have found the I fund to be very difficult to get a handle on.

I have worked on a shorter term system for the I fund a few times to see if I can grab some quick gains reliably but I have found the I fund to be very difficult to get a handle on.

craigerv

Market Tracker

- Reaction score

- 3

Well, for now it looks like the 50d EMA produced at least a small hop. But that looks like it could be changing by the minute. The past two bounces off the 50d came from very quick inflated peaks. This last peak seems to have built up for the past few weeks so it looks like there is some momentum to the downside from there. My sell stop is still 1590 for this week, but if we finish the week about where we are, I will likely be pushed to a sell next week. Good luck out there!

craigerv

Market Tracker

- Reaction score

- 3

Looks like we could stay up today above my stop and push the sell signal to next week. When we hit the 50d EMA in April, I anticipated my system rolling over to a sell and sold at the start of a great rebound. This time I'm willing to wait a few days further to see if we rebound or not.

craigerv

Market Tracker

- Reaction score

- 3

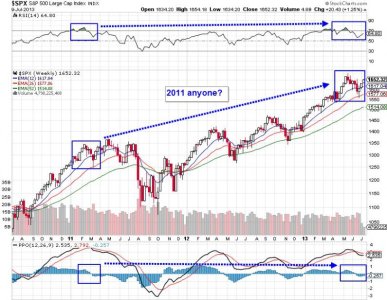

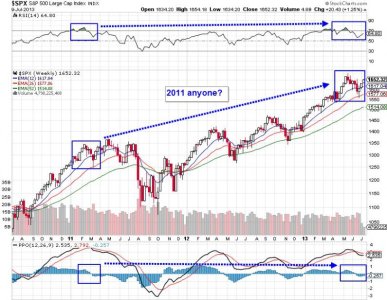

If you've kept up with the daily commentary from Tom you've undoubtedly seen the comparison to the 1987 chart. Well, now that we've seen a pretty sizable rebound, doesn't this look a little bit more like 2011? Curious methinks.

My system is on a sell based on the PPO cross a few weeks ago. I am thinking we could bounce up and down in the coming weeks/months but ultimately I think we will correct this Summer... maybe not as seriously as 2011, but it's worth keeping an eye on.

My system is on a sell based on the PPO cross a few weeks ago. I am thinking we could bounce up and down in the coming weeks/months but ultimately I think we will correct this Summer... maybe not as seriously as 2011, but it's worth keeping an eye on.

craigerv

Market Tracker

- Reaction score

- 3

I'm a little nervous that we're going to pull a 2011 this Summer but if that's the case, we still have some time to bounce around before the big drop. So far we're on track in that regard, breaking out to new highs, perhaps to sucker in some buyers. My system is flipping back to a buy this week as long as we stay above 1675 by cob Thursday so it appears I may be one of the suckers. I'll likely only put in 50% this week because we're still straddling that line between buy/sell and I may choose to go in with the rest before the end of the month to save myself a trade in August.

craigerv

Market Tracker

- Reaction score

- 3

Well, we stayed put around 1690 today so I'm putting my IFT in for 50% S. My system is on a buy but I'm being a bit cautious as I'm still seeing signs of 2011. If early next week we stay put above 1675, I'll likely put in the rest.

What gives me pause, is the last few times the MACD weekly signal line crossed over, prices fell to the 52 week EMA. In 2011 that didn't happen right away though, so there could be some time to push a little higher.

What gives me pause, is the last few times the MACD weekly signal line crossed over, prices fell to the 52 week EMA. In 2011 that didn't happen right away though, so there could be some time to push a little higher.

Similar threads

- Replies

- 0

- Views

- 83

- Replies

- 0

- Views

- 127