The first post OPEX trading day started out with an S&P gap up of about 0.5%, and it continued climbing in choppy fashion until it reached its intraday peak around 1000. It was a slow grind lower the rest of the day reaching the unchanged mark around 3:00 before pushing into negative territory and reversing once more after hitting about a -0.8% loss to close the day just under -0.4% lower.

The broader market fared worse with a decline of -0.82%. The I fund closed out trading just about even.

The main catalyst for today's early gains was news that China would let its yuan move more freely, but that news wasn't nearly enough to maintain an upward bias for long.

The market has come a long way in a short amount of time, so perhaps some consolidation should be expected.

Let's take a look at today's charts:

Both NAMO and NYMO flipped to sells today as each dropped below their 6 day EMAs.

NAHL and NYHL remained on a buy.

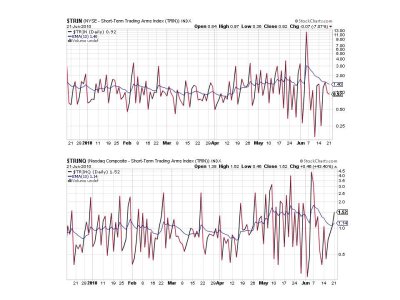

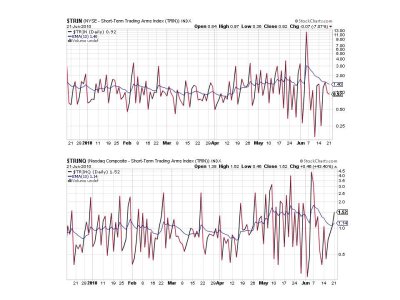

TRIN also remained on a buy, but TRINQ flipped to a sell.

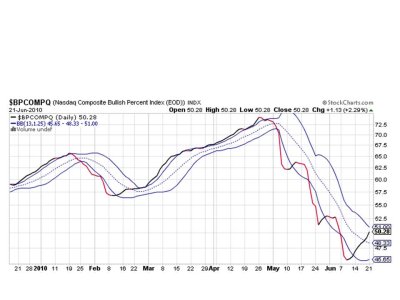

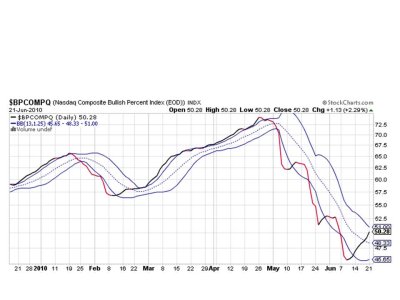

BPCOMPQ marched higher in spite of today's weakness.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy.

More weakness may be in store in the short term, but the signals do not suggest it would be anything more than modest to moderate profit taking. A continuation higher should be expected once this weakness passes.

The broader market fared worse with a decline of -0.82%. The I fund closed out trading just about even.

The main catalyst for today's early gains was news that China would let its yuan move more freely, but that news wasn't nearly enough to maintain an upward bias for long.

The market has come a long way in a short amount of time, so perhaps some consolidation should be expected.

Let's take a look at today's charts:

Both NAMO and NYMO flipped to sells today as each dropped below their 6 day EMAs.

NAHL and NYHL remained on a buy.

TRIN also remained on a buy, but TRINQ flipped to a sell.

BPCOMPQ marched higher in spite of today's weakness.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy.

More weakness may be in store in the short term, but the signals do not suggest it would be anything more than modest to moderate profit taking. A continuation higher should be expected once this weakness passes.