It was due after last week's run-up, but was today's action confirmation that last week's rally was nothing more than a counter-trend rally? It's too early to say, but volume was light today and being this was post holiday action it certainly leaves room for bullish arguments.

Here's the charts:

No real technical damage here and both signals remain on buys.

NAHL remains on a buy, but NYHL just did flip to a sell. Still, it's just one day of selling on light volume so I won't read too much it.

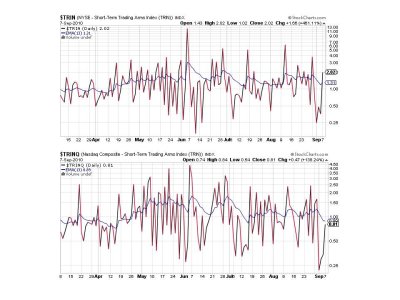

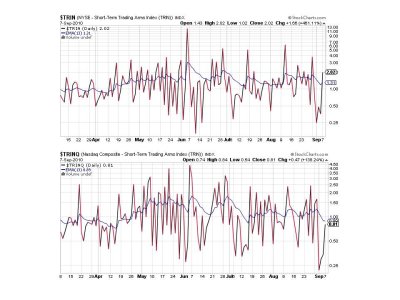

TRIN flipped to a sell while TRINQ remained on a buy.

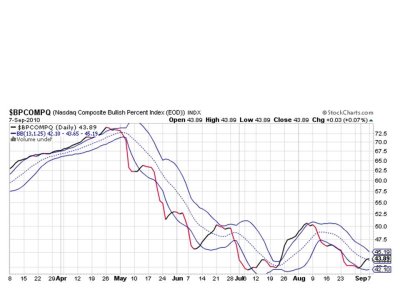

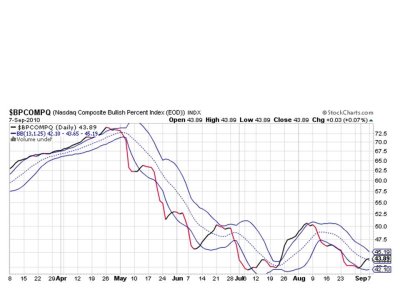

BPCOMPQ took a breather today, but remained on a buy.

So we have 5 of 7 signals on buys, but the system remains on a sell.

I am going to be on travel the next couple of days so my posting may be limited, but I should be able to update the charts as long as I have an internet connection available.

Still holding 100% G fund.

Here's the charts:

No real technical damage here and both signals remain on buys.

NAHL remains on a buy, but NYHL just did flip to a sell. Still, it's just one day of selling on light volume so I won't read too much it.

TRIN flipped to a sell while TRINQ remained on a buy.

BPCOMPQ took a breather today, but remained on a buy.

So we have 5 of 7 signals on buys, but the system remains on a sell.

I am going to be on travel the next couple of days so my posting may be limited, but I should be able to update the charts as long as I have an internet connection available.

Still holding 100% G fund.