More choppy trade, but that's what happens in a period of consolidation.

The September Consumer Confidence Index surprised to the downside this morning by coming in at 48.5. Small wonder given economic fundamentals.

If you hadn't noticed, bonds have had a strong come-back after a recent bout of moderate weakness. The 30-year note was up a full point, while the 10 and 5-year were up 16 and 8 ticks respectively. Our F fund has had a nice run the past week or so as a result of the buying pressure.

Apparently, the dollar's recent break below a major support line is the real deal as it dropped to a seven-month low, while the euro rallied 1.0% against it. This is another indication that the current upward trend in stocks could push higher in the weeks ahead. The I fund could be the place to be if this market grinds higher and the dollar continues its descent.

Let's look at the charts:

NAMO and NYMO continue to hug their respective 6 day EMAs and flipped to buys today.

NAHL remained on a buy, while NYHL flipped to a sell.

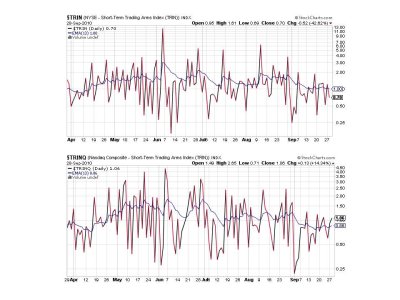

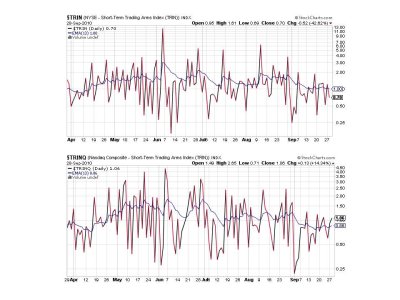

TRIN is on a buy, while TRINQ is flashing a sell.

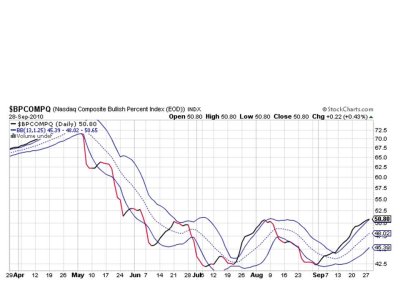

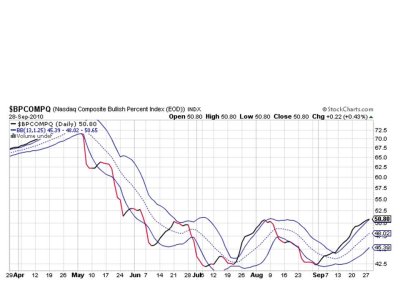

That upper bollinger band is now touching the signal on the BPCOMPQ chart. As long as that signal remains on an upward bias I will consider it a buy even if it penetrates that bollinger band. But if it turns down it'll be a sell. For now though, it's a buy.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

The charts are not revealing much. We had to expect some consolidation given how strong the month of September was, but I'm hardly complacent about this market. I went in 100% to the S fund today as I thought I might be buying weakness above the key technical level on the S&P (1030), but instead we rallied to close near the highs of the day. But that's a reflection of the strength in the market right now. Both my short and intermediate term systems are on buys so I'm taking a shot at some gains here.

But like I said, I'm not complacent at all. I fully expect volatility to kick back in and keep everyone guessing the market's next move. I'm also watching sentiment carefully to give me a better clue and right now it's somewhat mixed, but hardly bullish.

The September Consumer Confidence Index surprised to the downside this morning by coming in at 48.5. Small wonder given economic fundamentals.

If you hadn't noticed, bonds have had a strong come-back after a recent bout of moderate weakness. The 30-year note was up a full point, while the 10 and 5-year were up 16 and 8 ticks respectively. Our F fund has had a nice run the past week or so as a result of the buying pressure.

Apparently, the dollar's recent break below a major support line is the real deal as it dropped to a seven-month low, while the euro rallied 1.0% against it. This is another indication that the current upward trend in stocks could push higher in the weeks ahead. The I fund could be the place to be if this market grinds higher and the dollar continues its descent.

Let's look at the charts:

NAMO and NYMO continue to hug their respective 6 day EMAs and flipped to buys today.

NAHL remained on a buy, while NYHL flipped to a sell.

TRIN is on a buy, while TRINQ is flashing a sell.

That upper bollinger band is now touching the signal on the BPCOMPQ chart. As long as that signal remains on an upward bias I will consider it a buy even if it penetrates that bollinger band. But if it turns down it'll be a sell. For now though, it's a buy.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

The charts are not revealing much. We had to expect some consolidation given how strong the month of September was, but I'm hardly complacent about this market. I went in 100% to the S fund today as I thought I might be buying weakness above the key technical level on the S&P (1030), but instead we rallied to close near the highs of the day. But that's a reflection of the strength in the market right now. Both my short and intermediate term systems are on buys so I'm taking a shot at some gains here.

But like I said, I'm not complacent at all. I fully expect volatility to kick back in and keep everyone guessing the market's next move. I'm also watching sentiment carefully to give me a better clue and right now it's somewhat mixed, but hardly bullish.