Aside from some selling pressure that came after the existing home sales report was released, trading today was pretty listless.

The C and S funds managed to close modestly higher, while the I fund benefited from a 0.5% drop in the dollar index to close moderately higher.

Fourth quarter GDP was upwardly revised to a 5.9% annualized growth rate, but the personal consumption component of that data seemed to mute any buying interest as it increased at a lower than anticipated 1.7%.

As I mentioned earlier, the biggest market mover today was the much lower than expected reading for January existing home sales, which dropped 7.2% month-over-month to an annualized rate of 5.05 million units. A revised and final February Consumer Sentiment Survey was little changed at 73.6, which had no impact on market activity.

So we ended the week modestly lower than we began in volatile trading action. I would say that the action overall was bullish in that we appear to be consolidating gains from the previous week.

Monday we have two new IFTs so no doubt many of us are looking forward to being back in business again instead of watching from the sidelines.

Here's today's charts:

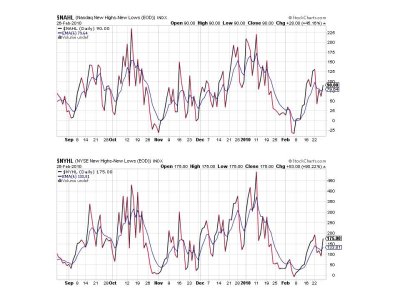

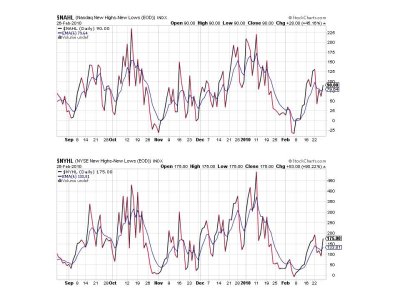

NAMO remains on a sell here, while NYMO tagged its 6 day EMA triggering a buy.

NAHL and NYHL flipped back to a buy today.

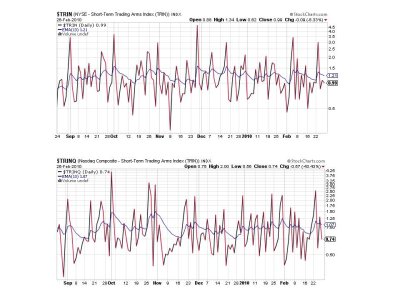

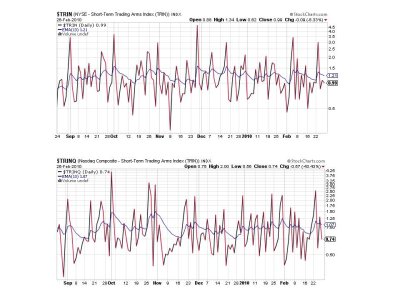

TRIN and TRINQ are both flashing buys.

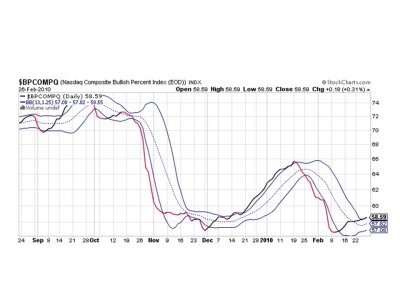

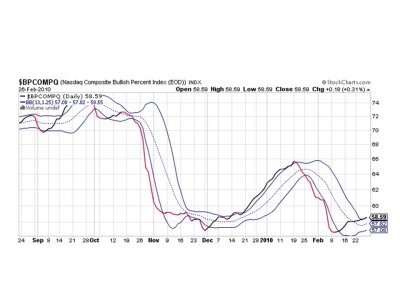

BPCOMPQ continued its slow ascent and remains on a buy.

So we have 6 of 7 sentinels flashing buys, which keeps the system on a buy. We appeared to be consolidating gains this past week, which means we could continue to see choppy action until we finally breakout (more than likely to the upside given the systems buy status). That's my take anyway, but of course the market will have the last say.

The C and S funds managed to close modestly higher, while the I fund benefited from a 0.5% drop in the dollar index to close moderately higher.

Fourth quarter GDP was upwardly revised to a 5.9% annualized growth rate, but the personal consumption component of that data seemed to mute any buying interest as it increased at a lower than anticipated 1.7%.

As I mentioned earlier, the biggest market mover today was the much lower than expected reading for January existing home sales, which dropped 7.2% month-over-month to an annualized rate of 5.05 million units. A revised and final February Consumer Sentiment Survey was little changed at 73.6, which had no impact on market activity.

So we ended the week modestly lower than we began in volatile trading action. I would say that the action overall was bullish in that we appear to be consolidating gains from the previous week.

Monday we have two new IFTs so no doubt many of us are looking forward to being back in business again instead of watching from the sidelines.

Here's today's charts:

NAMO remains on a sell here, while NYMO tagged its 6 day EMA triggering a buy.

NAHL and NYHL flipped back to a buy today.

TRIN and TRINQ are both flashing buys.

BPCOMPQ continued its slow ascent and remains on a buy.

So we have 6 of 7 sentinels flashing buys, which keeps the system on a buy. We appeared to be consolidating gains this past week, which means we could continue to see choppy action until we finally breakout (more than likely to the upside given the systems buy status). That's my take anyway, but of course the market will have the last say.