Stocks managed yet another reversal after a bout of moderate selling pressure in the morning session.

Market data seemed to little to influence the action either. Jobs data showed that initial jobless claims dropped to 415,000 from the prior week's total of 457,000, but the market didn't rally on the news.

Fourth quarter nonfarm productivity came in much better than expected too. It was up 2.6% overall. Labor cost fell 0.6%, which was also a surprise as economists were looking lower.

The January ISM non-manufacturing composite hit 59.4, which was well above expectations.

December factory orders were up 0.2%, which was much better than a forecasted 0.6% decline.

The dollar hit the I fund hard today as it gained 0.9% overall.

The Seven Sentinels didn't change too much over the past two trading days, and I am of the opinion that this action suggests another up-leg is coming in the days ahead. Liquidity is largely seen as providing continuing support for this market in spite of attempts to take the averages lower. And there doesn't seem to be any end in sight for that kind of support.

Here's today's charts:

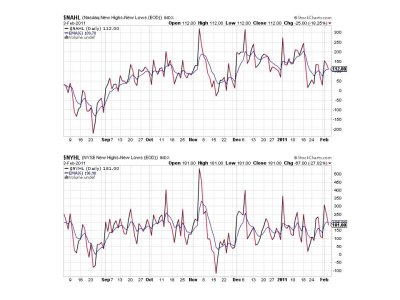

Both NAMO and NYMO remain on buys.

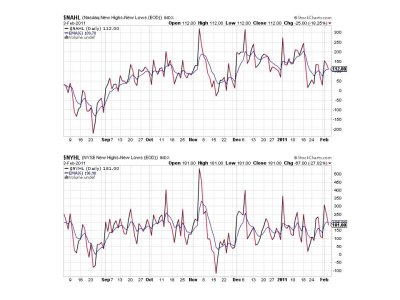

NAHL is flashing a buy while NYHL is a sell.

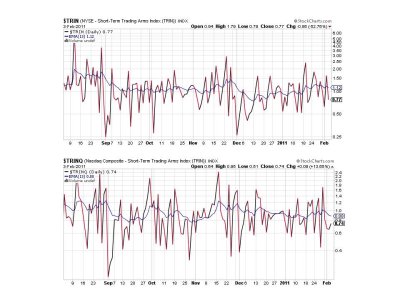

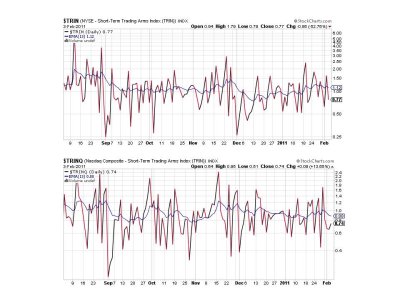

TRIN and TRINQ are both flashing buys.

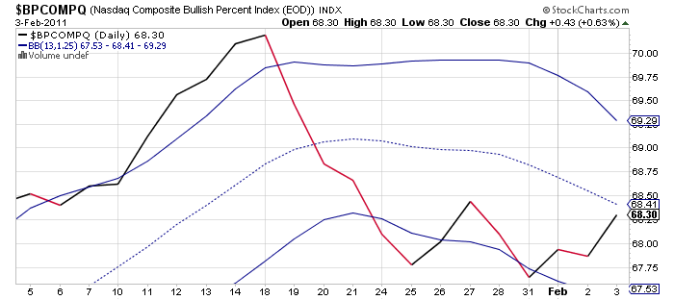

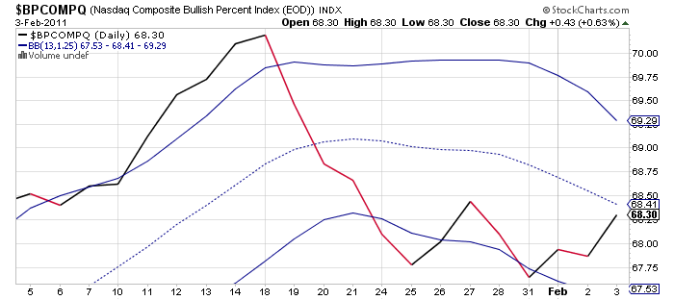

BPCOMPQ is beginning to look a bit bullish again and also remains on a buy.

So all buy one signal are flashing buys, but the system remains on a sell until NYMO can achieve a 28 day trading high. And as I alluded to in my earlier comments, I suspect we'll get there, but that's based solely on continuing liquidity injections, otherwise I'd be looking lower.

Market data seemed to little to influence the action either. Jobs data showed that initial jobless claims dropped to 415,000 from the prior week's total of 457,000, but the market didn't rally on the news.

Fourth quarter nonfarm productivity came in much better than expected too. It was up 2.6% overall. Labor cost fell 0.6%, which was also a surprise as economists were looking lower.

The January ISM non-manufacturing composite hit 59.4, which was well above expectations.

December factory orders were up 0.2%, which was much better than a forecasted 0.6% decline.

The dollar hit the I fund hard today as it gained 0.9% overall.

The Seven Sentinels didn't change too much over the past two trading days, and I am of the opinion that this action suggests another up-leg is coming in the days ahead. Liquidity is largely seen as providing continuing support for this market in spite of attempts to take the averages lower. And there doesn't seem to be any end in sight for that kind of support.

Here's today's charts:

Both NAMO and NYMO remain on buys.

NAHL is flashing a buy while NYHL is a sell.

TRIN and TRINQ are both flashing buys.

BPCOMPQ is beginning to look a bit bullish again and also remains on a buy.

So all buy one signal are flashing buys, but the system remains on a sell until NYMO can achieve a 28 day trading high. And as I alluded to in my earlier comments, I suspect we'll get there, but that's based solely on continuing liquidity injections, otherwise I'd be looking lower.