clester

Market Veteran

- Reaction score

- 37

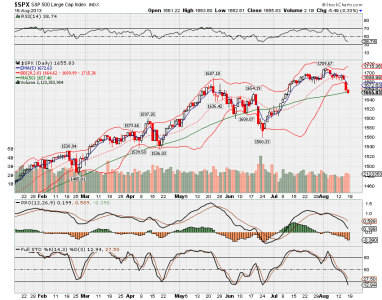

All I have is my phone. What Is the value of the 50dma?

Looks like 1657

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

All I have is my phone. What Is the value of the 50dma?

Looks like 1657

We hit 1659 and bounced but I need a coupke days bounce

On my longer term view, I think we test the June lows by sometime in October but we have time for a bounce before then.My system did sell yesterday so it is now 100% G. What the system looks for now is a 2 day bounce near the 50dma (or between 50 and 200 dma) for a 50% buy and and regaining the 50dma to signal a 100% buy. I also use an oversold RSI (below 30) but we are still a good way from there.

If we could get another 1% on the S&P down the RSI would be close to 30 and a buy signal.

I like to see a bounce first as well. You never know when it will stop but we should see a short term bounce maybe next week if the selling continues. There is usually a bounce near the 50dma. That and an RSI of 30 or lower would be a nice setup.It's been a long time since the daily RSI has seen 30. However, I would need to see some technical upside action before buying. Stoch and PPO are falling like a rock. This market could keep dropping a while longer, IMHO.

I like to see a bounce first as well. You never know when it will stop but we should see a short term bounce maybe next week if the selling continues. There is usually a bounce near the 50dma. That and an RSI of 30 or lower would be a nice setup.

That RSI is dropping slowly. I do believe in gap filling especially in S&P because it rarely has gaps. Usually they get filled within a month or so but sometimes its much longer. There is a gap around 1630 that would get us close to the 30 reading on RSI. That confluence might be a good spot to buy. At some point we need to test the June low around 1560 area before we can resume the rally IMO but that may take some time.Looking for a buying opportunity this week. If we can get some more selling and the RSI down to 30 I may buy in especially if we can get a bounce started. The bigger drop is coming next month IMO and we have time for a nice rally and a lower high before then.

That RSI is dropping slowly. I do believe in gap filling especially in S&P because it rarely has gaps. Usually they get filled within a month or so but sometimes its much longer. There is a gap around 1630 that would get us close to the 30 reading on RSI. That confluence might be a good spot to buy. At some point we need to test the June low around 1560 area before we can resume the rally IMO but that may take some time.

Interesting bounce today. S fund bounced off its 50 dma and S&P is trying to regain its 50. If we can close above it I'll have a buy signal. Although the RSI hasn't made it to 30 but in this setup I don't need it.

I have this feeling today is a sucker rally. I could be wrong but I feel like folks waiting to buy the dip are going to bite and the pros will be waiting to sell. Hope I'm wrong because I would like to buy in. I want to buy today! That's what scares me.

Follow the system not your feelings.

That's the way I felt about the July rally and it cost me dearly.I have this feeling today is a sucker rally. I could be wrong but I feel like folks waiting to buy the dip are going to bite and the pros will be waiting to sell.

You don't think the gap at 1680 improves the chances of it not being a bull trap?I have this feeling today is a sucker rally. I could be wrong but I feel like folks waiting to buy the dip are going to bite and the pros will be waiting to sell. Hope I'm wrong because I would like to buy in. I want to buy today! That's what scares me.

That gap also needs to be filled. Which one gets filled first is the question I guess. Yesterday was puzzling since the S fund had such a big pop and held it into the close while the C fund sold off into the close. Also, the S fund bounced off its 50 dma and C fund tested and failed at regaining its 50 dma. Which is right? the S fund is usually the leader but with such a divergence I don't know.You don't think the gap at 1680 improves the chances of it not being a bull trap?

That gap also needs to be filled. Which one gets filled first is the question I guess. Yesterday was puzzling since the S fund had such a big pop and held it into the close while the C fund sold off into the close. Also, the S fund bounced off its 50 dma and C fund tested and failed at regaining its 50 dma. Which is right? the S fund is usually the leader but with such a divergence I don't know.

Yes. No clear buy signal yet. I would love to see the RSI drop.U staying in the G?