It's OPEX if you're not already aware, and that means there's probably a floor under the market. At least for now.

This morning, retail sales for August came in at 0.4%, a bit better than the anticipated 0.3% increase. But strip out autos and August sales were up 0.6%, double the expected 0.3% increase.

Business inventories for July were up 1.0%, which was above the anticipated 0.7% increase.

Something to take note of is that fact that the S&P failed to break through 1128 (that's the flash crash close level). But I doubt the market is done testing that level. In fact, I'm expecting us to close above it in the next few trading days, if not tomorrow.

If you haven't heard, gold prices set a new all-time high of $1274.60 per ounce today.

The dollar meanwhile, dropped sharply, which helped the I fund tack on more gains.

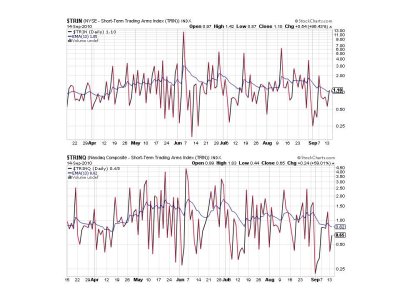

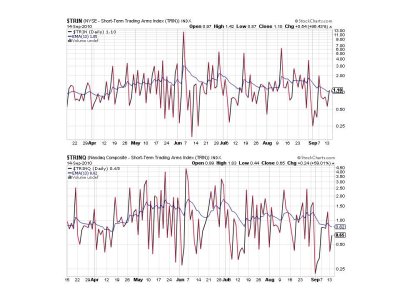

I'm looking for this market to chop along for now, with an upward bias. Here's the charts:

We're leveling off a bit here, but we can move higher and sideways for some time yet before another decline begins.

NAHL and NYHL continue to post healthy numbers. NYHL did flip to a sell barely, but that's not particularly notable.

TRIN flipped to a sell, but remains very close to it's 13 day EMA, while TRINQ remains on a buy.

It's not moving quickly, but it does have an upward bias. BPCOMPQ remains on a buy.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy. I'm looking for higher prices yet, but I suspect the bulk of gains have already passed by. Still, we could get a few more percent out of this up-leg before any meaningful pullback takes hold. I just don't think they'll come as quickly as the first few percent did.

This morning, retail sales for August came in at 0.4%, a bit better than the anticipated 0.3% increase. But strip out autos and August sales were up 0.6%, double the expected 0.3% increase.

Business inventories for July were up 1.0%, which was above the anticipated 0.7% increase.

Something to take note of is that fact that the S&P failed to break through 1128 (that's the flash crash close level). But I doubt the market is done testing that level. In fact, I'm expecting us to close above it in the next few trading days, if not tomorrow.

If you haven't heard, gold prices set a new all-time high of $1274.60 per ounce today.

The dollar meanwhile, dropped sharply, which helped the I fund tack on more gains.

I'm looking for this market to chop along for now, with an upward bias. Here's the charts:

We're leveling off a bit here, but we can move higher and sideways for some time yet before another decline begins.

NAHL and NYHL continue to post healthy numbers. NYHL did flip to a sell barely, but that's not particularly notable.

TRIN flipped to a sell, but remains very close to it's 13 day EMA, while TRINQ remains on a buy.

It's not moving quickly, but it does have an upward bias. BPCOMPQ remains on a buy.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy. I'm looking for higher prices yet, but I suspect the bulk of gains have already passed by. Still, we could get a few more percent out of this up-leg before any meaningful pullback takes hold. I just don't think they'll come as quickly as the first few percent did.