Tomorrow is the last trading day of August and we have one week to go before we get past Labor Day weekend. We saw some very tentative trading action in the stock market the previous week, which has me wondering if change is coming. Do we stick with what is working or is it time to get defensive?

I'm seeing a subtle sign from our top 25% that seems to suggest caution is seeping into the game plan. We do have two new IFTs coming very soon, so some flexibility has been restored to our account mobility. Since this is in fact the case I won't read too much into any small shift in the charts.

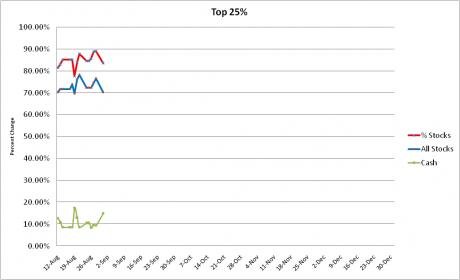

Having said that let's look at how our top 25% is positioned to end the month.

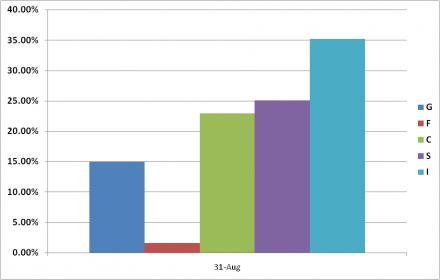

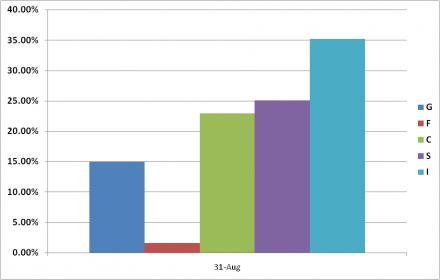

Here we can see how our best performers are allocated across the funds. The "F" fund has seen some recent profit taking and the "G" fund has increased a few percentage points. Total stock exposure has decreased as well, but so far the differences between the funds have been modest since I began collecting this data on August 12th.

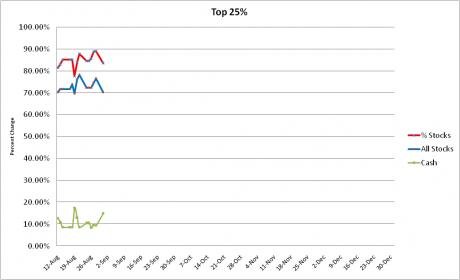

I have added a new data point to this chart. It's the blue line, which denotes the percent of top performers who have a 100% stock allocation. We can see from this chart that stock exposure has dropped and cash levels have risen, both relatively modestly. This is consistent with the first chart.

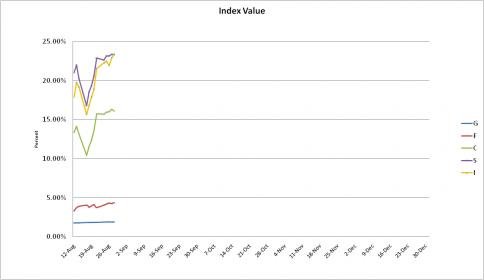

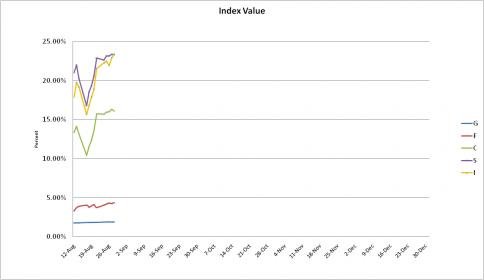

This is a chart I have not posted before. It simply shows Index values over time. We can see how much the dollar is influencing price in the past few trading days, as its performance has exceeded either C or S.

So the last day of August still shows a strong stock allocation and our top performers seem to be saying that we should be following the trend, which has obviously been up. But the market is hitting some resistance. Is it another set-up for a leg higher? For awhile now, when caution has been elevated we've cut through resistance. Are we in for more of the same? Or is change coming?

I still have a Seven Sentinels sell signal, but if that system manages to flip back to a buy, I'll be back to a 100% stock allocation. Should that happen with no real damage to the downside, that'll be BT's cue to let me know he told me so.

But let's see how it plays out first.

I'm seeing a subtle sign from our top 25% that seems to suggest caution is seeping into the game plan. We do have two new IFTs coming very soon, so some flexibility has been restored to our account mobility. Since this is in fact the case I won't read too much into any small shift in the charts.

Having said that let's look at how our top 25% is positioned to end the month.

Here we can see how our best performers are allocated across the funds. The "F" fund has seen some recent profit taking and the "G" fund has increased a few percentage points. Total stock exposure has decreased as well, but so far the differences between the funds have been modest since I began collecting this data on August 12th.

I have added a new data point to this chart. It's the blue line, which denotes the percent of top performers who have a 100% stock allocation. We can see from this chart that stock exposure has dropped and cash levels have risen, both relatively modestly. This is consistent with the first chart.

This is a chart I have not posted before. It simply shows Index values over time. We can see how much the dollar is influencing price in the past few trading days, as its performance has exceeded either C or S.

So the last day of August still shows a strong stock allocation and our top performers seem to be saying that we should be following the trend, which has obviously been up. But the market is hitting some resistance. Is it another set-up for a leg higher? For awhile now, when caution has been elevated we've cut through resistance. Are we in for more of the same? Or is change coming?

I still have a Seven Sentinels sell signal, but if that system manages to flip back to a buy, I'll be back to a 100% stock allocation. Should that happen with no real damage to the downside, that'll be BT's cue to let me know he told me so.

But let's see how it plays out first.