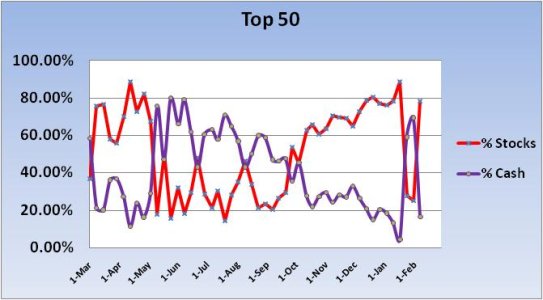

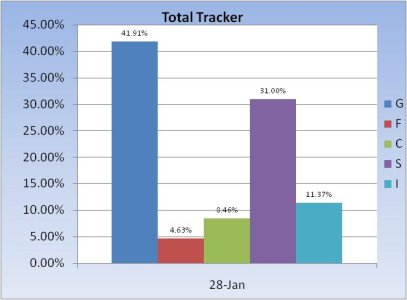

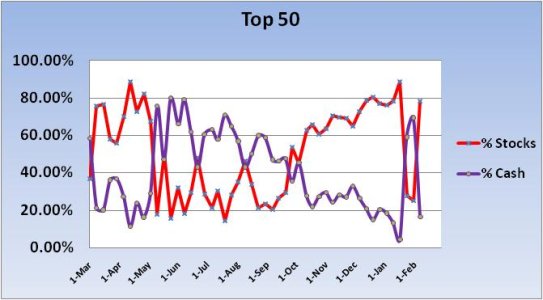

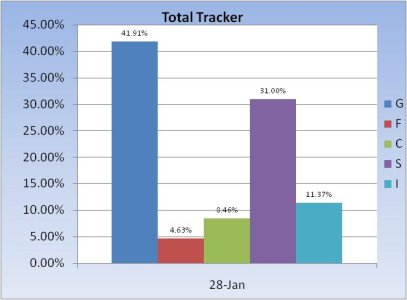

Sure, the Top 50 are sporting a stock allocation of over 78%, but the total tracker showed we raised cash for the 4th week in a row.

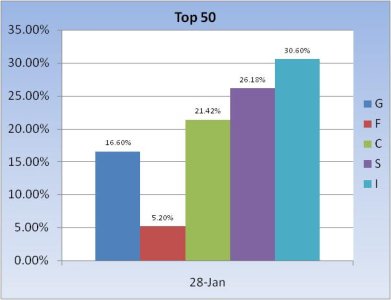

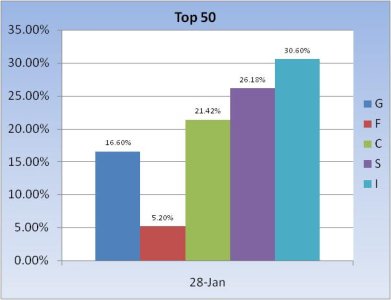

The I fund now leads the S fund in largest allocation among the Top 50.

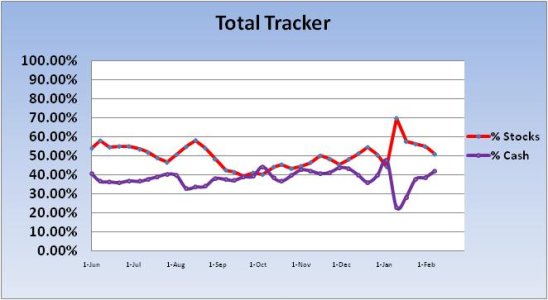

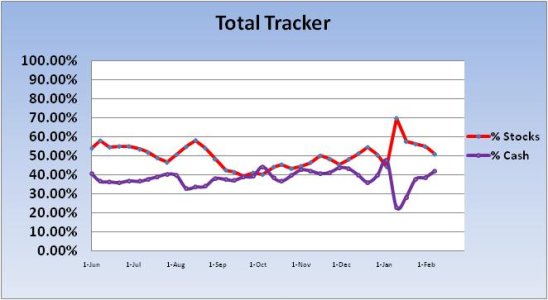

Here we can see we're getting more conservative even as this bull has been hitting fresh 2-year highs. I doubt those cash levels will drop too much more unless the bottom falls out of this market as many of our participants maintain some stock exposure at all times.

I'd have to say though, that these charts make it easy to see why our sentiment survey has been on a buy as much as it has.

The I fund now leads the S fund in largest allocation among the Top 50.

Here we can see we're getting more conservative even as this bull has been hitting fresh 2-year highs. I doubt those cash levels will drop too much more unless the bottom falls out of this market as many of our participants maintain some stock exposure at all times.

I'd have to say though, that these charts make it easy to see why our sentiment survey has been on a buy as much as it has.