There really wasn't much news or catalysts to move this market today, and maybe that's why the indicies had their worst trading day in several weeks. It wasn't an ugly day by any stretch of the imagination, but traders found reasons to take profits none-the-less.

One bit of news that's been blamed for the intensified selling this afternoon was a report that consumer credit in February fell by $11.5 billion vice an expected $0.7 billion.

But in other news a senior Fed official warned that Wall Street needed to start managing risk instead of leaving it up to the Fed to bail them out. Kansas City Federal Reserve Bank President Thomas Hoenig said on Wednesday the Fed could raise rates to around 1 percent, which would keep borrowing costs at historically low levels while sending a signal that easy money policies put in place during the crisis are steadily being pulled back.

"The time is right to put the market on notice that it must again manage its risk, be accountable for its actions, and cease its reliance on assurances that the Federal Reserve, not they, will manage the risks they must deal with in a market economy", said Hoenig.

I don't think the selling will last long, but those comments by the KC Fed President probably

contributed to some profit taking.

The Seven Sentinels did not maintain an across-the-board buy signal today, but not much damage was done either. Here's the charts:

One buy and one sell. Both are near their respective 6 day EMA and the zero line. Pretty neutral actually.

One buy and one sell here too.

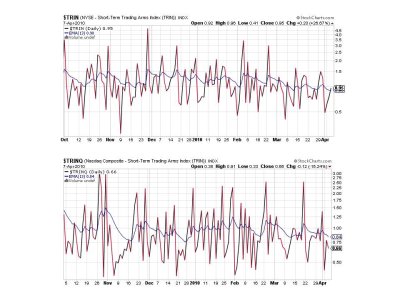

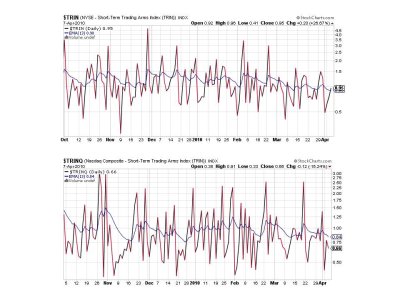

TRIN and TRINQ are flashing one buy and one sell as well.

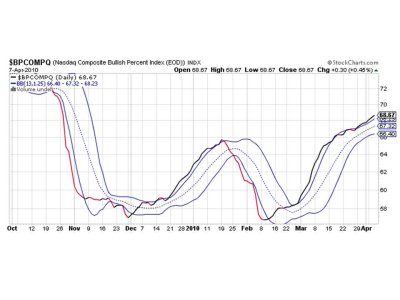

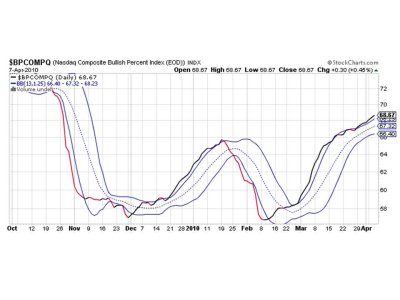

BPCOMPQ also remains on a buy and is ever so slowly climbing higher.

So we now have 4 of 7 signals on a buy, which keeps the system on a buy. I do not believe the uptrend is over. In fact, I think a buying opportunity is probably in progress or maybe even missed if we get no follow-through to the downside by Friday. I have no reason to be too bearish in the short term given the underlying strength in this market. That doesn't mean risk is not an issue, but the market is not behaving in a manner that suggests any serious selling pressure is imminent. And with a SS buy signal in force, I am looking very carefully for an entry point right now. That's it for this evening, see you tomorrow.

One bit of news that's been blamed for the intensified selling this afternoon was a report that consumer credit in February fell by $11.5 billion vice an expected $0.7 billion.

But in other news a senior Fed official warned that Wall Street needed to start managing risk instead of leaving it up to the Fed to bail them out. Kansas City Federal Reserve Bank President Thomas Hoenig said on Wednesday the Fed could raise rates to around 1 percent, which would keep borrowing costs at historically low levels while sending a signal that easy money policies put in place during the crisis are steadily being pulled back.

"The time is right to put the market on notice that it must again manage its risk, be accountable for its actions, and cease its reliance on assurances that the Federal Reserve, not they, will manage the risks they must deal with in a market economy", said Hoenig.

I don't think the selling will last long, but those comments by the KC Fed President probably

contributed to some profit taking.

The Seven Sentinels did not maintain an across-the-board buy signal today, but not much damage was done either. Here's the charts:

One buy and one sell. Both are near their respective 6 day EMA and the zero line. Pretty neutral actually.

One buy and one sell here too.

TRIN and TRINQ are flashing one buy and one sell as well.

BPCOMPQ also remains on a buy and is ever so slowly climbing higher.

So we now have 4 of 7 signals on a buy, which keeps the system on a buy. I do not believe the uptrend is over. In fact, I think a buying opportunity is probably in progress or maybe even missed if we get no follow-through to the downside by Friday. I have no reason to be too bearish in the short term given the underlying strength in this market. That doesn't mean risk is not an issue, but the market is not behaving in a manner that suggests any serious selling pressure is imminent. And with a SS buy signal in force, I am looking very carefully for an entry point right now. That's it for this evening, see you tomorrow.