The bears crawled out of the woodwork today thinking they could seize control of this market, but instead were punished yet again. Between the liquidity pump and bearish sentiment, downside action can continue to be a tricky proposition for the bears in spite of many technical indicators turning down in recent trading.

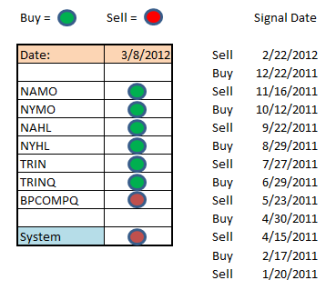

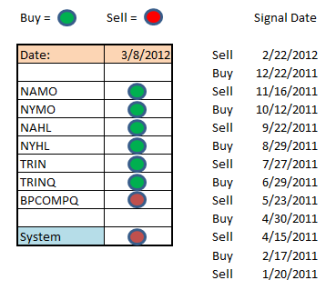

Today's action was bullish from the get go with the major averages all posting significant gains. As a result, the Seven Sentinels moved closer to a buy condition, but BPCOMPQ remains a hold out. That keeps the system in an intermediate term sell condition.

I'd like to tell you that we're heading lower again and that the current sell signal will continue to prevail, but I don't see that as a slam dunk. I do think volatility may pick up as a result of the short term overbought condition, but with the bears all too willing to short en mass, I don't know how deep any correction can go. Also, throw in the fact that this is tax season (many folks are trying to max out their IRAs for 2011 before the deadline) and that we're approaching the end of the quarter (window dressing time), we can see that the bulls still have much in their favor.

Today's action was bullish from the get go with the major averages all posting significant gains. As a result, the Seven Sentinels moved closer to a buy condition, but BPCOMPQ remains a hold out. That keeps the system in an intermediate term sell condition.

I'd like to tell you that we're heading lower again and that the current sell signal will continue to prevail, but I don't see that as a slam dunk. I do think volatility may pick up as a result of the short term overbought condition, but with the bears all too willing to short en mass, I don't know how deep any correction can go. Also, throw in the fact that this is tax season (many folks are trying to max out their IRAs for 2011 before the deadline) and that we're approaching the end of the quarter (window dressing time), we can see that the bulls still have much in their favor.