Dip buyers are finally starting to show their wariness of the stock market as an initial rally attempt at the open fizzled after the first hour of trade. The afternoon session also saw a modest attempt to take prices higher, but it too fell apart with modest losses posted by the major averages at the close.

One sector did well however, and that was energy, which saw decent gains the whole day. Oil was a big factor as crude rose close to 2% on the day, with a barrel of oil closing at $99.59 per barrel.

One economic data point of note was April new home sales, which increased to 323,000 units from 301,000 in March.

Let's go to the charts:

NAMO and NYMO remained steady today, with both remaining in a sell condition.

NAHL and NYHL both improved a bit, but also remain in a sell condition.

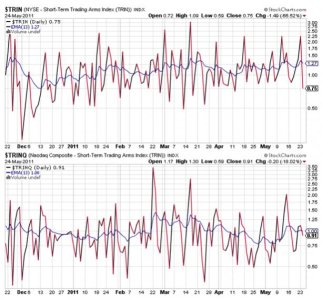

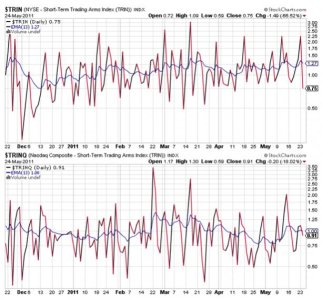

TRIN and TRINQ both dropped back down into a buy condition.

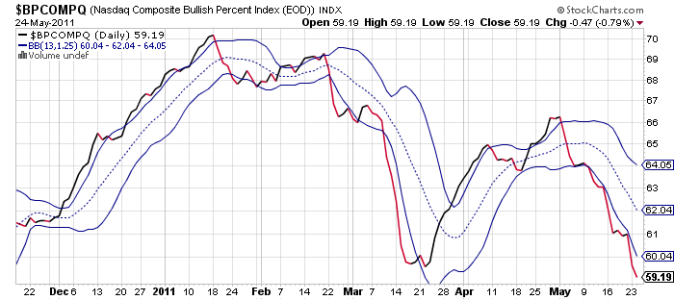

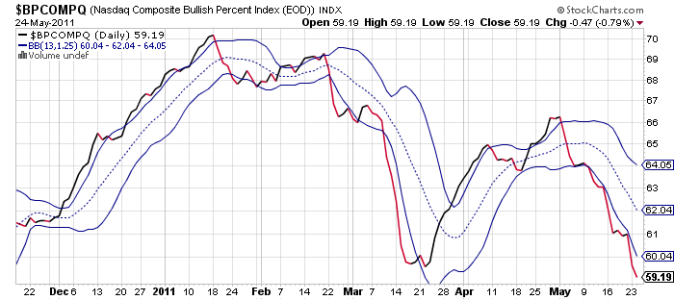

BPCOMPQ ebbed a bit lower today and remains on a sell.

So 5 of 7 signals remain on sells, which keeps the system in a sell condition.

Nothing happened today to change my outlook. The Seven Sentinels are still pointing to lower prices and I still expect this sell signal to last a bit longer than the few that were achieved during the long bull run from last September. I'm not looking for anything dramatic, but the market could potentially fall about 10% from its peak before we bottom. That's probably the worst case scenario.

One sector did well however, and that was energy, which saw decent gains the whole day. Oil was a big factor as crude rose close to 2% on the day, with a barrel of oil closing at $99.59 per barrel.

One economic data point of note was April new home sales, which increased to 323,000 units from 301,000 in March.

Let's go to the charts:

NAMO and NYMO remained steady today, with both remaining in a sell condition.

NAHL and NYHL both improved a bit, but also remain in a sell condition.

TRIN and TRINQ both dropped back down into a buy condition.

BPCOMPQ ebbed a bit lower today and remains on a sell.

So 5 of 7 signals remain on sells, which keeps the system in a sell condition.

Nothing happened today to change my outlook. The Seven Sentinels are still pointing to lower prices and I still expect this sell signal to last a bit longer than the few that were achieved during the long bull run from last September. I'm not looking for anything dramatic, but the market could potentially fall about 10% from its peak before we bottom. That's probably the worst case scenario.