The powers that be are doing a fine job of shaking loose bulls and bears alike right now. I saw some folks IFT yesterday thinking they were buying back into another big rally, only to take a big left hook the very next day. We've been trained to expect large moves in each direction in short time frames for a few months now.

Don't hesitate, or you'll miss the boat. Ooops, not this time. This time it was a big bull trap.

This is not bullish action. Over-confidence can lead to mistakes...and losses. I got lucky yesterday with a gift rally that I sold into. I didn't trust that rally either. Not completely anyway. I left myself with a 30% hedge in case I was wrong, but for the moment it looks like I wasn't wrong. But the main thing was raising cash in the event of a large correction, as well as following the seven sentinels sell signal to a large extent.

So far this market appears to be headed for lower lows. The technical damage is mounting and a fast reversal to new heights is not likely in the very short term. That's my opinion anyway. I believe the market makers are going to throttle the bulls to the point where complacency all but disappears.

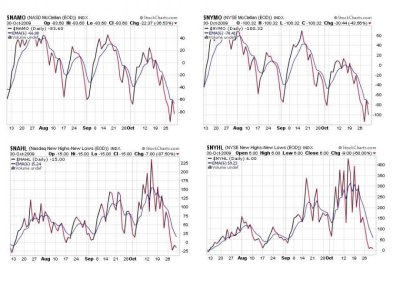

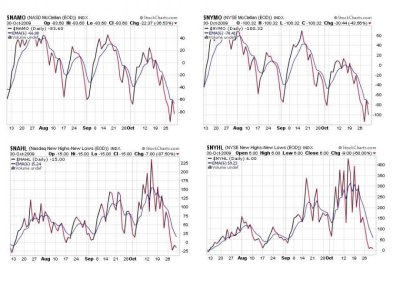

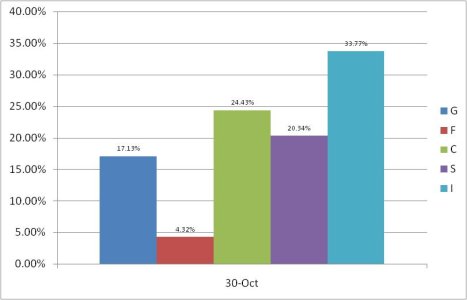

No surprises in the charts today:

All four are on sells here.

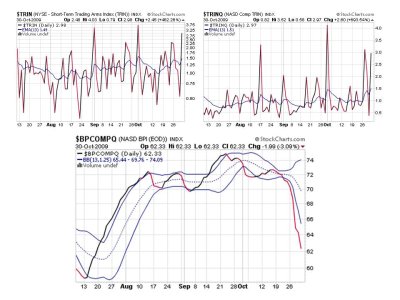

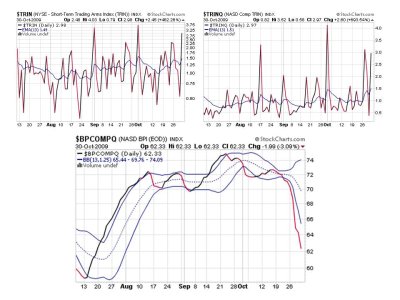

And all three are on sells here. That's 7 for 7, but we remain on a sell anyway.

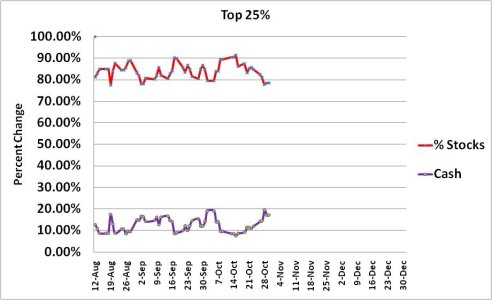

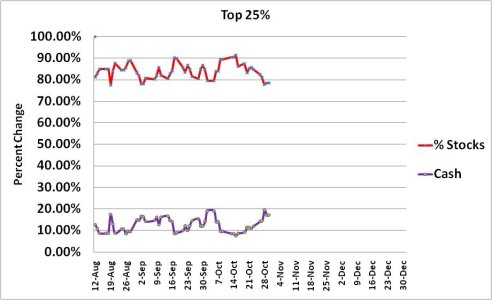

Looking at the allocation of our top 25% we can see that some cash was put to work yesterday in an attempt to catch a rally in the making, but as we know now that was not how it played out this time. And the longs are giving up a lot of ground. The question is, how much more ground might the market give up?

I can only muse that until more hard core bulls are shaken loose, that the decline will continue. I think that's the intent of this weakness. And I'm not at all sure that we will make new highs this year either. But a decent rally off this correction is certainly a possiblity, new highs or not. But we need to see the seven sentinels turn first. And that may be just as tricky as the upside was these past few months if volatility remains the same.

Don't hesitate, or you'll miss the boat. Ooops, not this time. This time it was a big bull trap.

This is not bullish action. Over-confidence can lead to mistakes...and losses. I got lucky yesterday with a gift rally that I sold into. I didn't trust that rally either. Not completely anyway. I left myself with a 30% hedge in case I was wrong, but for the moment it looks like I wasn't wrong. But the main thing was raising cash in the event of a large correction, as well as following the seven sentinels sell signal to a large extent.

So far this market appears to be headed for lower lows. The technical damage is mounting and a fast reversal to new heights is not likely in the very short term. That's my opinion anyway. I believe the market makers are going to throttle the bulls to the point where complacency all but disappears.

No surprises in the charts today:

All four are on sells here.

And all three are on sells here. That's 7 for 7, but we remain on a sell anyway.

Looking at the allocation of our top 25% we can see that some cash was put to work yesterday in an attempt to catch a rally in the making, but as we know now that was not how it played out this time. And the longs are giving up a lot of ground. The question is, how much more ground might the market give up?

I can only muse that until more hard core bulls are shaken loose, that the decline will continue. I think that's the intent of this weakness. And I'm not at all sure that we will make new highs this year either. But a decent rally off this correction is certainly a possiblity, new highs or not. But we need to see the seven sentinels turn first. And that may be just as tricky as the upside was these past few months if volatility remains the same.