I've made a very cautious pull back to the G. Things are looking odd to me, at once it looks like both a top is forming and positioning to either climb or drop. if i'm wrong, at least i didn't loose money and there will always be another entry point. i do hope the best for everyone elses trades however you decide to go.

-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bquat's Account Talk

- Thread starter Bquat

- Start date

rangerray

TSP Pro

- Reaction score

- 209

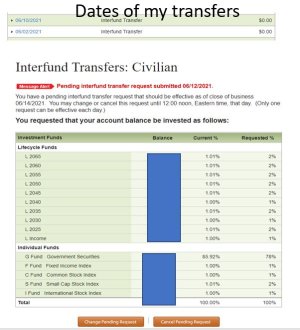

I thought after you have already made 2 trades in a month the fraction moves didn't count as trades and you could round up or rebalance. I was thinking now that they tossed in the new Lfunds you could actually drop 1% in each give you 14% invested and 86% in the G. If all those funds even moved up a fraction you could then round all of them up to 2% each thereby giving you a total of 28% invested. If the they rose again you could do the same rounding to 3% and be 42% invested. Within a couple weeks (If all the funds increased) you could be almost back to 100% invested. True some of the L funds are already toward the safer end and you may not make much but the new ones such as 2045, 2055, 2060 and 2065 seem to be fully invested so in a way you are investing in the C, S, and I. They have little to no G and F. Before they created those additional funds we were limited but now they are offered, it seems logical that you could use them along with the C, S, I, to your advantage should you be using your last trade of the month and want to leave the option to keep investing. Hopefully that makes sense. Thoughts?

I see no reason why this wouldn't work. I had not thought of it before, so glad you made this comment. And yes, you're first two moves of the month count, whether they are less than 1% or not.

quabit

Market Tracker

- Reaction score

- 24

Bquat, I apologize for hijacking your thread. I just knew you have been here for awhile so are very knowledgeable.

FYI my theory seems plausible. When I posted Thursday 10 June I made my 2nd TSP transaction of the month by leaving 1% in all funds and 86% in the G. That was Thursday so I had to wait until the close of business Friday to see if any of the funds had risen. As you can see, 8 of those funds did rise to 1.01%. For the funds that rose by .01% I am able to round them up 2% and TSP allowed me to submitted the request. As you can see in the picture, TSP did not come back and tell me I had already made 2 transactions so this trade will take place 14 June (it is the weekend). So it seems that in a couple of days I will have increased my investment by 8% even though I am out of trades this month. Come Monday COB my total investment will have risen from 14% to 22%. Had more funds went up by at least .01 my increase could have been even more however, since this is rebalancing I should be able to increase again any fraction of a percent again come Wednesday (if the market gains). I understand that there were those that did this before however there weren't as many funds so it was kind of useless. Now with the additional L funds just maybe it might be worth looking at again should you be out of trades.

Also note that the majority of the funds that increased are the new L funds because the share prices are so low right now that it doesn't take much to move them and also remember those L funds that terminate years from now, are still highly invested in the C, S, and I so they move more.

Bquat, Again I apologize for hijacking your thread I just wanted to post that the theory does seem plausible.

FYI my theory seems plausible. When I posted Thursday 10 June I made my 2nd TSP transaction of the month by leaving 1% in all funds and 86% in the G. That was Thursday so I had to wait until the close of business Friday to see if any of the funds had risen. As you can see, 8 of those funds did rise to 1.01%. For the funds that rose by .01% I am able to round them up 2% and TSP allowed me to submitted the request. As you can see in the picture, TSP did not come back and tell me I had already made 2 transactions so this trade will take place 14 June (it is the weekend). So it seems that in a couple of days I will have increased my investment by 8% even though I am out of trades this month. Come Monday COB my total investment will have risen from 14% to 22%. Had more funds went up by at least .01 my increase could have been even more however, since this is rebalancing I should be able to increase again any fraction of a percent again come Wednesday (if the market gains). I understand that there were those that did this before however there weren't as many funds so it was kind of useless. Now with the additional L funds just maybe it might be worth looking at again should you be out of trades.

Also note that the majority of the funds that increased are the new L funds because the share prices are so low right now that it doesn't take much to move them and also remember those L funds that terminate years from now, are still highly invested in the C, S, and I so they move more.

Bquat, Again I apologize for hijacking your thread I just wanted to post that the theory does seem plausible.

Attachments

Last edited:

quabit

Market Tracker

- Reaction score

- 24

Could you apply quabit's process and do this in the inverse? Could you "dollar cost average" every day by rebalancing to the same settings so that when one fund dips, you add more to it and as they increase, you sell off the increase?

I know you can rebalance to bring your totals back up to what you had them at originally. For example in my picture I could have set all the funds back to 1% and the G back to 86%. I have done that in the past. Just know that it will count as a trade if you have not already used both trades that month.

Bquat

TSP Talk Royalty

- Reaction score

- 719

Bquat

TSP Talk Royalty

- Reaction score

- 719

That's unless news changes things.:cheesy:Starting my playing with the channels. We are unembedded and can short term support hold. The odds are that we topped and proceeding downward is 60/40 at least to the bottom of my new longterm channel::worried:

Bquat

TSP Talk Royalty

- Reaction score

- 719

Stayed unembedded but the close was better than expected to get back above short term support. But didn't we actually drop below the proposed Midterm Channel which is the top half of the longterm. I don't really know if this will continue to breakdown with dip buy at the shadow line of the Midterm::blink:Starting my playing with the channels. We are unembedded and can short term support hold. The odds are that we topped and proceeding downward is 60/40 at least to the bottom of my new longterm channel::worried:

Attachments

Bquat

TSP Talk Royalty

- Reaction score

- 719

Maybe not the coin is in the air on this::blink:May have to use orange shadow line for Midterm channel:

Attachments

Bquat

TSP Talk Royalty

- Reaction score

- 719

Bquat

TSP Talk Royalty

- Reaction score

- 719

Definitely an increase in the downward movement but I opened up the channel for the three bottom tails with the good 50 Day test. Today does confirm that we exited my Longterm Channel. At least we tested the rising 50 Day this time down:Notice the change between the long bottom tails to a longer top tail to test the 18 day from below. Rate of decline seems to be the same::blink:

Attachments

Bquat

TSP Talk Royalty

- Reaction score

- 719

Yes the Midterm a bull flag but we are still near the DBA Rectangle longer term top. I won't be buying in. Maybe I should try a box between my last exit and the last top to wait and see this level is resolved one way or the other. Just my thoughts and Spidey is mute on this::cheesy:

Attachments

Similar threads

- Replies

- 2

- Views

- 539

- Replies

- 2

- Views

- 535

- Replies

- 2

- Views

- 825