I'm going to go straight the charts tonight. Here they are:

No change, but today's action may be interpreted as at least a short term bottom being put in. Still on sells here though.

NAHL and NYHL also remain on sells

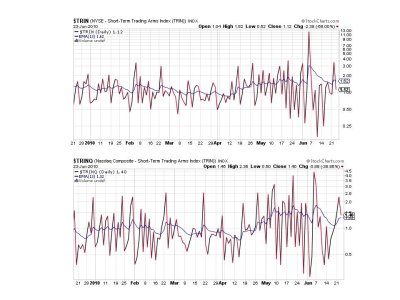

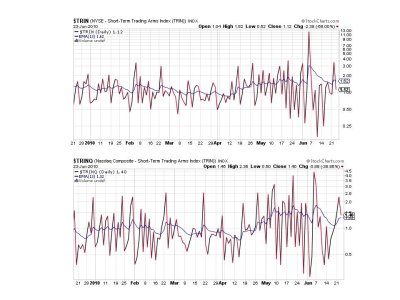

TRIN flipped to a buy while TRINQ remained on a sell.

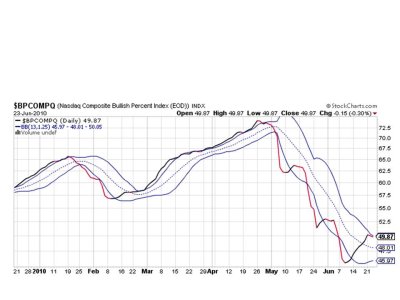

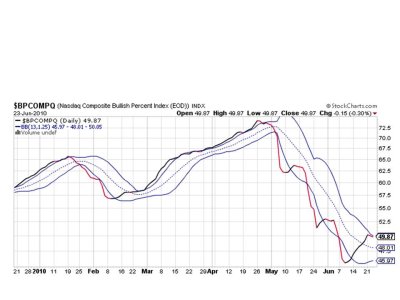

BPCOMPQ moved sideways today, but remains solidly in buy territory.

So we have 5 of 7 signals flashing sells, but the system remains on a buy. Today's action was healthy for the market. If today's housing numbers couldn't drive the market down (aside from the initial reaction) then it would appear the downside is indeed limited at this point.

I moved to a 100% S fund allocation today. I anticipate this buy signal will have legs and should take us into July at the very least. But that's just my expectation given we are winding down the quarter and window dressing may be part of the action for the next week or so.

See you tomorrow.

No change, but today's action may be interpreted as at least a short term bottom being put in. Still on sells here though.

NAHL and NYHL also remain on sells

TRIN flipped to a buy while TRINQ remained on a sell.

BPCOMPQ moved sideways today, but remains solidly in buy territory.

So we have 5 of 7 signals flashing sells, but the system remains on a buy. Today's action was healthy for the market. If today's housing numbers couldn't drive the market down (aside from the initial reaction) then it would appear the downside is indeed limited at this point.

I moved to a 100% S fund allocation today. I anticipate this buy signal will have legs and should take us into July at the very least. But that's just my expectation given we are winding down the quarter and window dressing may be part of the action for the next week or so.

See you tomorrow.