That late day short covering probably pushed the Seven Sentinels back to the brink of another buy signal. In fact, you may want to consider it a valid buy right now, it's that close.

I said I was concerned that end of quarter window dressing might make any serious selling pressure difficult, and so far that's been the case. The question in the short term is whether we're really going to begin another up-leg or are traders just trying to maximize gains knowing the quarter is coming to an end. If this is about maximizing gains given the strong trend and end of quarter bias, then we could see another reversal as traders may decide to get conservative and lock in gains at some point. I am not suggesting the market "will" do anything, only what might occur. Here's today's charts:

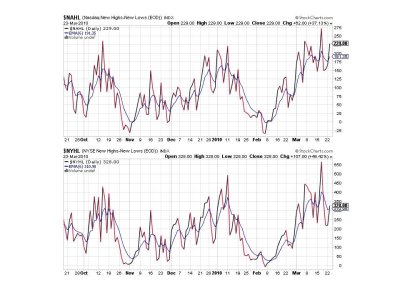

NAMO flipped back to a buy, and NYMO is the one borderline signal. It's sitting right at the 6 day EMA.

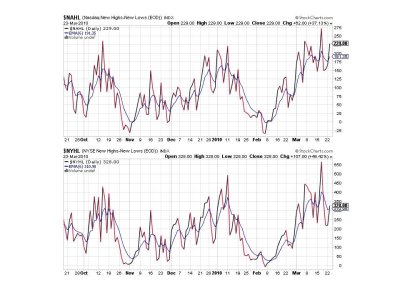

NAHL and NYHL have flipped back to buys.

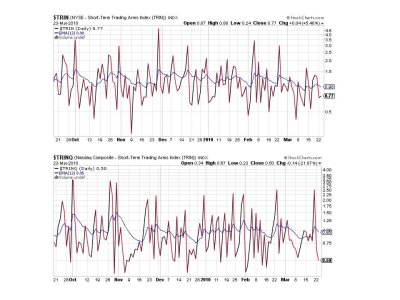

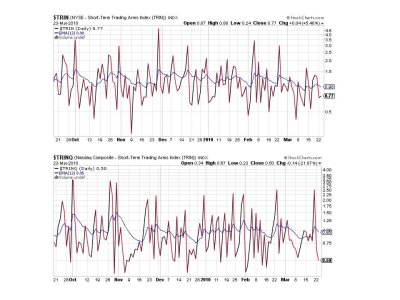

TRIN and TRINQ remain on a buy.

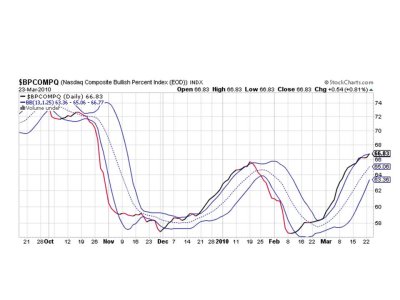

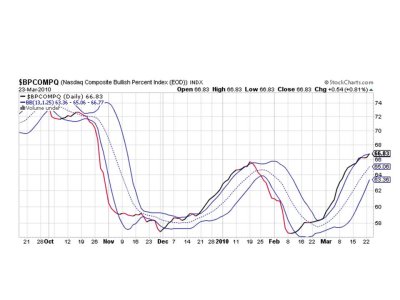

BPCOMPQ pushed a bit higher today and recrossed the upper bollinger band, triggering a buy signal.

So if you want to consider NYMO a buy, then the Sentinels are back in buy mode. But I'm not willing to consider it a buy myself until it pokes above that 6 day EMA. It might do it tomorrow if the market is up again. If not, then some signals may flip back to sells. I can tell you one thing, it's obvious the Healthcare Reform legislation drove fear back up again, because that's what holding up the market in my opinion. Too much fear. Or at least perceived fear.

Not much has changed with the Top 15 or Top 50 so I'm not going to post a chart of either.

I said I was concerned that end of quarter window dressing might make any serious selling pressure difficult, and so far that's been the case. The question in the short term is whether we're really going to begin another up-leg or are traders just trying to maximize gains knowing the quarter is coming to an end. If this is about maximizing gains given the strong trend and end of quarter bias, then we could see another reversal as traders may decide to get conservative and lock in gains at some point. I am not suggesting the market "will" do anything, only what might occur. Here's today's charts:

NAMO flipped back to a buy, and NYMO is the one borderline signal. It's sitting right at the 6 day EMA.

NAHL and NYHL have flipped back to buys.

TRIN and TRINQ remain on a buy.

BPCOMPQ pushed a bit higher today and recrossed the upper bollinger band, triggering a buy signal.

So if you want to consider NYMO a buy, then the Sentinels are back in buy mode. But I'm not willing to consider it a buy myself until it pokes above that 6 day EMA. It might do it tomorrow if the market is up again. If not, then some signals may flip back to sells. I can tell you one thing, it's obvious the Healthcare Reform legislation drove fear back up again, because that's what holding up the market in my opinion. Too much fear. Or at least perceived fear.

Not much has changed with the Top 15 or Top 50 so I'm not going to post a chart of either.