Grading the Nostradamus:

Well, so far Nostradamus is 3 of 4 - with GDP next week.

- Jobs Report - 170K private sector jobs created. Great

- GDP - Still a Mystery of the Orient, but the Administration is Cocky.

- Inflation - 2.4%, now in the FED desired zone or close enough to it for Gubmint Work. Great.

- Monthly Treasury Statement - Revenue up 12%, Spending up less than 2%, Annual Deficit down 17%. Great

Oh, heart be still !!! How could anyone prophesize with such accuracy. Folks, I am neither a prophet nor the son of a prophet - but, I do have eyes and ears. Folks who actually know what they are doing, who don't spin for a living, and who have a reputuation to uphold don't sound cocky without reason. Bessent, and others, may not have the numbers before they are posted but they know the numbers because it is their job to have a feel for them. So, when Bessent tells some financially illiterate failed lawyer politician to pound sand and that he will scoreboard them next year on job growth, dollar stength, Federal revenue, and deficit redution one should listen and act on it.

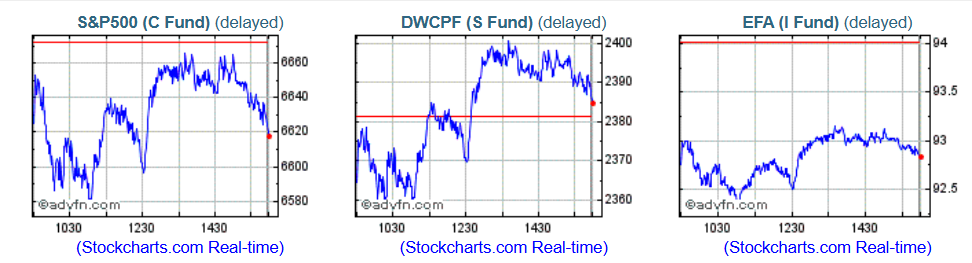

The market may panic sell (they did yesterday) because they really want that low interest high, but the economy - and, hence the underlayment of the market, will react positively. The speculators will be washed out soon and we investors will hunt the savanah.

Also, good luck with trying to get lower interest rates from either the current FED or the future FED. The economy is rolling. There is NO reason to drop interest rates - and, the guy picked by Orange Man Bad is on the record against easy money. The Trumpster will have to deal with the debt without that crutch.