Jason here: I would like to preface, any projections listed in AI blog-output below do not factor in seasonal bias, the best 2-Month performer of the year is Nov-Dec.

In addition, with next week's holiday, we might expect lighter than average volume to float prices higher, (this is my perception).

The S&P 500's Current 9-Session performance is -2.13% (the worst within our last 142 sessions.

● The last time our 9-Session performance was this bad was during the Tariff-Crash

● Going forward 9 sessions from this point, statistically we've fared well

What does it mean?

● Unless we think we are in a Crash-Type event, historical patterns favor higher prices 9-Sessions from now.

Blog: Time for a Breadth Mint

♗ Weekly Recap

● WTD Overview: Risk-off: SPX slipped −1.63% as megacaps lagged while mid and lower tiers held steadier.

● Flows showed heavy equity fund outflows offset by strong ETF buying while money funds swelled, the dollar dipped and VIX rose +9.40%.

● Key Takeaway: The regime stays cautious until long yields stabilise, DXY softens further, and VIX settles back toward recent ranges.

$↗︎ Net Flows $↘︎ - Wednesday Series

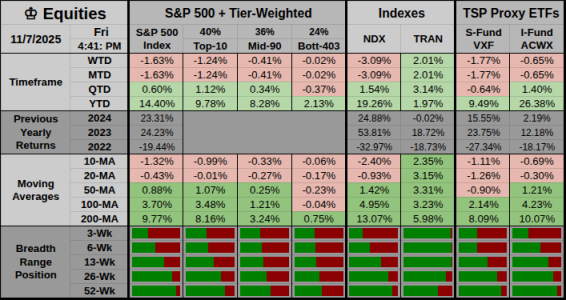

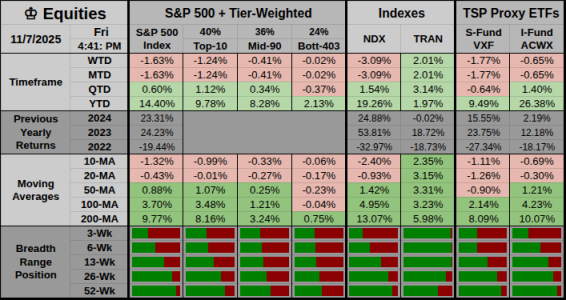

♔ Equities

WTD Overview: Risk-off week: SPX fell −1.63% while NDX dropped −3.09%, but TRAN gained +2.01%, so breadth was uneven.

● Key Takeaway: Equity tone stays cautious until volatility cools and global breadth improves, especially if transports keep outperforming growth heavy indexes.

Leaders & Relative Holds

● Risk Bias: Risk-off. Mid and lower tiers outperformed the Top-10, with small losses in the Mid-90 and almost flat Bott-403.

● Breadth: Participation was mixed. Large tech dragged while transports and some cyclical value pockets cushioned index declines.

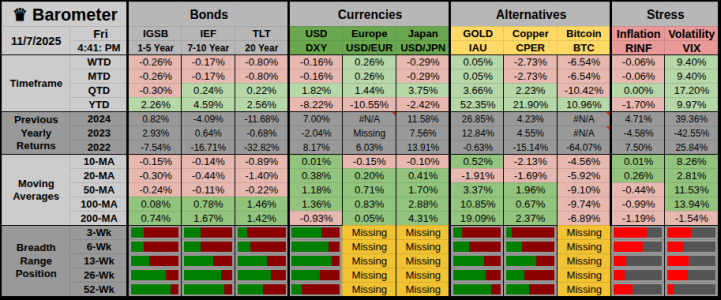

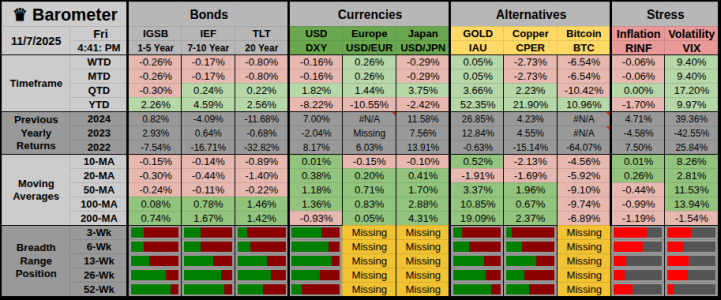

♛ Barometer

WTD Overview: Short and long Treasuries slipped as IGSB and IEF fell modestly, the dollar eased, gold was steady, and volatility jumped.

Key Takeaway: Rates and the dollar are only mildly supportive; conviction improves if DXY drifts lower and VIX retreats from its spike.

Key Takeaway: Rates and the dollar are only mildly supportive; conviction improves if DXY drifts lower and VIX retreats from its spike.

Hedges & Risk Bias

● Risk Bias: Risk-off. Long Treasuries via TLT fell −0.80% while DXY slipped −0.16% and IAU was flat.

● Breadth: Safety trades were broad as gold held, Bitcoin via BTC dropped −6.54%, and volatility through VIX surged +9.40%.

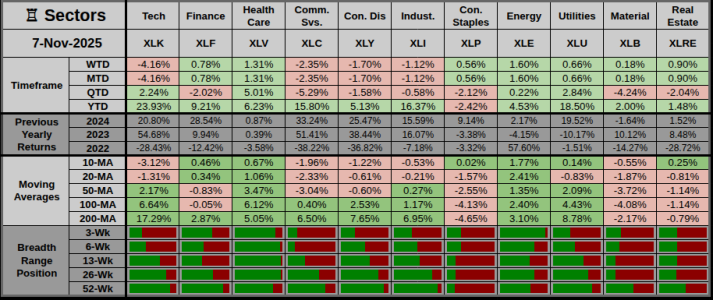

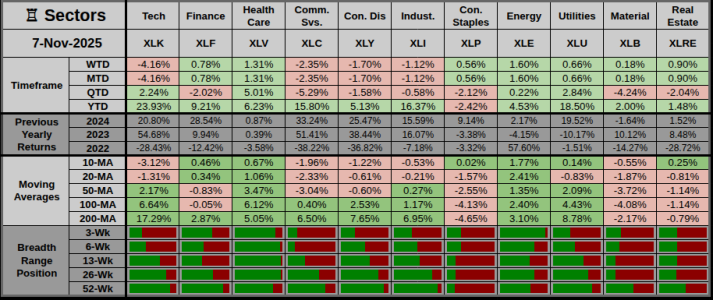

♖ Sectors & Rotation

Weekly Sector Overview: Defensives led; leadership narrow as XLE gained +1.60% and XLV rose +1.31% while XLK dropped −4.16%.

• Key Takeaway: Result: Defensives > Cyclicals (breadth: defensive), and follow-through depends on whether tech stabilises or yields back off for a spell.

Offensive Assets

● Top WTD gainers: XLE +1.60%, XLV +1.31%, XLRE +0.90% as energy and health care drew selective buying.

● Breadth/outperformance: Cyclicals lagged SPX as XLK −4.16% and XLC −2.35% slid, so offensive breadth was narrow.

Defensive Assets

● Standout hedge/defense: XLU +0.66% and XLP +0.56% outperformed as investors leaned into yield and stability.

● Safety tone or drag: Utilities, staples, and real estate cushioned the tape, so the sector message stayed late-cycle and yield-sensitive.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● ● Alternate: Mid: mixed spread, trend mixed, breadth neutral across 6–13 week gauges.

● ● ● Confidence: Medium: Timeframe lens disagrees while Trend leans contraction and Breadth sits neutral.

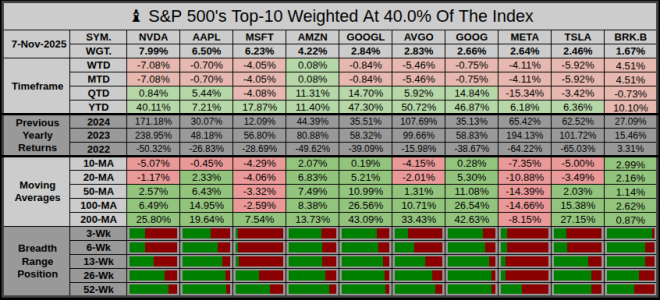

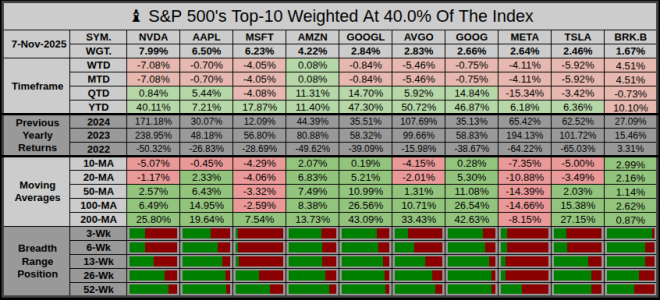

♗ S&P 500’s Weighted Top-10

Overview: Broadly weak: seven of the Top-10 were red as BRK.B rose +4.51% and AMZN barely gained +0.08%.

● Key Takeaway: Leadership stayed concentrated, and weakness in semis and high multiple names kept the index from shrugging off sector rotation.

Offensive Leaders

● Relative winners: AMZN +0.08% and BRK.B +4.51% provided ballast despite broader megacap weakness.

● Secondary theme: Semis and growth lagged as NVDA dropped −7.08% and AVGO slid −5.46%, pressuring index momentum.

Defensive Laggards

● Biggest decliners: TSLA fell −5.92%, NVDA −7.08%, and META −4.11%, underscoring how growth heavy names drove the pullback.

● Drag theme: Large drops in semis and autos kept Top-10 breadth narrow even as the overall index loss stayed moderate.

Next Week’s Projection

Next Week’s Projection

Have a great week...Jason

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

In addition, with next week's holiday, we might expect lighter than average volume to float prices higher, (this is my perception).

The S&P 500's Current 9-Session performance is -2.13% (the worst within our last 142 sessions.

● The last time our 9-Session performance was this bad was during the Tariff-Crash

● Going forward 9 sessions from this point, statistically we've fared well

| Condition | Sessions (N) | Avg Fwd 9-Session Return | Notes |

|---|---|---|---|

| All sessions (benchmark) | 10,000 | 0.35% | ≈ 9.8% average yearly return |

| Prior 9-session return < -2.00% | 1,661 | 0.52% | 977 up (avg +3.16%), 684 down (avg -3.25%) |

| < -2.00% and price > 50/100/200 MA | 181 | 0.40% | 105 up (avg +2.37%), 76 down (avg -2.32%) |

What does it mean?

● Unless we think we are in a Crash-Type event, historical patterns favor higher prices 9-Sessions from now.

Blog: Time for a Breadth Mint

♗ Weekly Recap

● WTD Overview: Risk-off: SPX slipped −1.63% as megacaps lagged while mid and lower tiers held steadier.

● Flows showed heavy equity fund outflows offset by strong ETF buying while money funds swelled, the dollar dipped and VIX rose +9.40%.

● Key Takeaway: The regime stays cautious until long yields stabilise, DXY softens further, and VIX settles back toward recent ranges.

$↗︎ Net Flows $↘︎ - Wednesday Series

| Box | Category | Weekly Flow | 4-wk Median Read | Risk Tone |

|---|---|---|---|---|

| Equity mutual funds | −$39.12B | Above | Risk-off/de-risking | |

| Bond mutual funds | −$0.76B | Below | Mixed/neutral | |

| ETFs (net issuance) | +$44.02B | Near | Risk-on/supportive | |

| Combined funds + ETFs | +$7.94B | Below | Mixed: ETF strength vs mutual outflows | |

| Money market funds | +$116.36B to $7.53T | Above | Risk-off/de-risking (cash build) |

♔ Equities

WTD Overview: Risk-off week: SPX fell −1.63% while NDX dropped −3.09%, but TRAN gained +2.01%, so breadth was uneven.

● Key Takeaway: Equity tone stays cautious until volatility cools and global breadth improves, especially if transports keep outperforming growth heavy indexes.

Leaders & Relative Holds

● Risk Bias: Risk-off. Mid and lower tiers outperformed the Top-10, with small losses in the Mid-90 and almost flat Bott-403.

● Breadth: Participation was mixed. Large tech dragged while transports and some cyclical value pockets cushioned index declines.

♛ Barometer

WTD Overview: Short and long Treasuries slipped as IGSB and IEF fell modestly, the dollar eased, gold was steady, and volatility jumped.

Hedges & Risk Bias

● Risk Bias: Risk-off. Long Treasuries via TLT fell −0.80% while DXY slipped −0.16% and IAU was flat.

● Breadth: Safety trades were broad as gold held, Bitcoin via BTC dropped −6.54%, and volatility through VIX surged +9.40%.

♖ Sectors & Rotation

Weekly Sector Overview: Defensives led; leadership narrow as XLE gained +1.60% and XLV rose +1.31% while XLK dropped −4.16%.

• Key Takeaway: Result: Defensives > Cyclicals (breadth: defensive), and follow-through depends on whether tech stabilises or yields back off for a spell.

Offensive Assets

● Top WTD gainers: XLE +1.60%, XLV +1.31%, XLRE +0.90% as energy and health care drew selective buying.

● Breadth/outperformance: Cyclicals lagged SPX as XLK −4.16% and XLC −2.35% slid, so offensive breadth was narrow.

Defensive Assets

● Standout hedge/defense: XLU +0.66% and XLP +0.56% outperformed as investors leaned into yield and stability.

● Safety tone or drag: Utilities, staples, and real estate cushioned the tape, so the sector message stayed late-cycle and yield-sensitive.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Contraction: defensives led, trend weakening, breadth late tilt from the Stage table.

⟳ Rotation Cycle Map Expected Perf. Leaders Rotation note Early - Broad thrust Strong gains; index, high beta up. Tech, Comm, Disc. Growth-led, breadth wide. Mid - Consolidation Moderate gains; slow grind up. Tech steady, Industrials. Broader, quality cyclicals. Late - Narrow carry Flat/mild losses; momentum fades. Industrials, Materials. Few leaders; prior winners. Contraction - Defensive turn Negative bias; drawdowns. REITs, defensives. Yield and safety bid.

● ● Alternate: Mid: mixed spread, trend mixed, breadth neutral across 6–13 week gauges.

● ● ● Confidence: Medium: Timeframe lens disagrees while Trend leans contraction and Breadth sits neutral.

| Box | Bias | Probability | Narrative (4–6 Week Horizon) |

|---|---|---|---|

| Up | 15% | If cyclicals reassert and tech stabilizes, upside follow-through opens up. | |

| Sideways | 11% | If defensives lead but rates and the dollar chop, range trading dominates. | |

| Down | 74% | If tech stays weak and volatility stays firm, de-risking and fades remain likely. |

♗ S&P 500’s Weighted Top-10

Overview: Broadly weak: seven of the Top-10 were red as BRK.B rose +4.51% and AMZN barely gained +0.08%.

● Key Takeaway: Leadership stayed concentrated, and weakness in semis and high multiple names kept the index from shrugging off sector rotation.

Offensive Leaders

● Relative winners: AMZN +0.08% and BRK.B +4.51% provided ballast despite broader megacap weakness.

● Secondary theme: Semis and growth lagged as NVDA dropped −7.08% and AVGO slid −5.46%, pressuring index momentum.

Defensive Laggards

● Biggest decliners: TSLA fell −5.92%, NVDA −7.08%, and META −4.11%, underscoring how growth heavy names drove the pullback.

● Drag theme: Large drops in semis and autos kept Top-10 breadth narrow even as the overall index loss stayed moderate.

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 20% | If long-end yields stay calm and the dollar eases, then dip-buyers retain control. | |

| 25% | If the dollar stays firm and leadership remains mixed, then the index chops in a range. | |

| 55% | If yields rebound and volatility rises, then a short-term fade becomes likely. |

Have a great week...Jason

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Last edited: