♗ Weekly Recap

● WTD Overview: Risk-off: SPX finished flat while small caps and transports slipped and defensive sectors did most of the work. Flows favored health care, energy, gold, and copper over crypto as volatility and long yields moved higher.

● Key Takeaway: A softer dollar, calmer VIX and easier long yields are needed to unlock a cleaner risk-on turn.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

● Weekly flows leaned risk-on in equity and bond funds while money market assets still crept higher, so cash caution stayed in place.

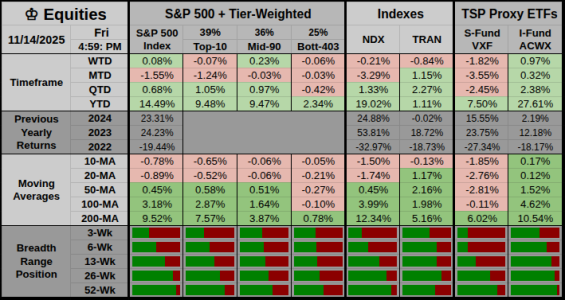

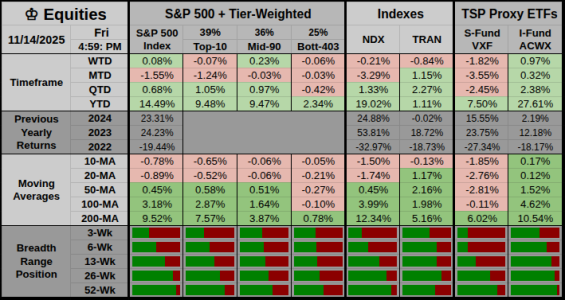

♔ Equities

WTD Overview: SPX was flat while mid-tier names rose and small caps and transports stayed under pressure.

● Key Takeaway: Modest losses in VXF and TRAN keep risk skewed cautious until small caps can confirm any rally.

Leaders & Relative Holds

● Risk Bias: Mild risk-off. Mid-90 stocks outpaced the Top-10, and global stocks via ACWX beat US small caps.

● Breadth: Participation was respectable in the middle of the index, but tail names and small caps carried most of the drag.

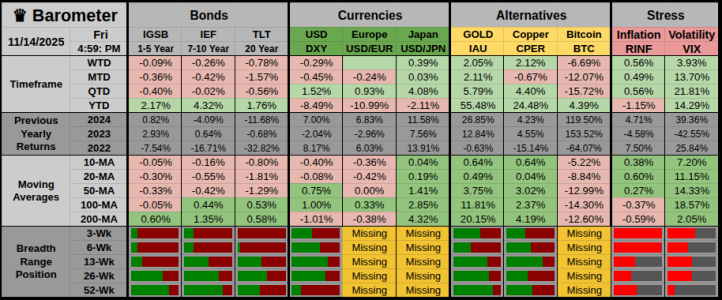

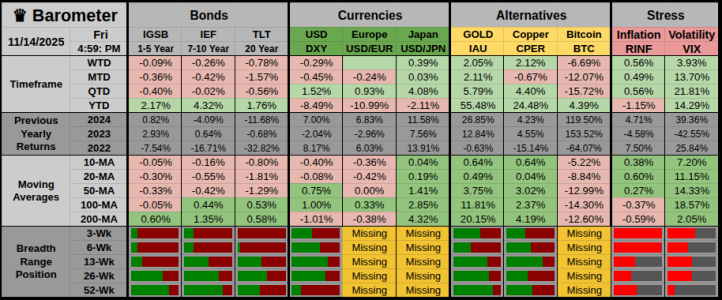

♛ Barometer

WTD Overview: Short and long Treasuries in IGSB, IEF, and TLT slipped as DXY eased. Gold and copper rallied while BTC sank and VIX jumped.

Key Takeaway: Rates and volatility still lean risk-off; a calmer VIX with softer real yields would improve confidence in any equity rebound.

Key Takeaway: Rates and volatility still lean risk-off; a calmer VIX with softer real yields would improve confidence in any equity rebound.

Hedges & Risk Bias

● Risk Bias: Cautious. Long Treasuries weakened, gold in IAU and copper in CPER held firm, and inflation expectations via RINF edged higher.

● Breadth: Safety trades were broad, cyclical proxies were mixed, and the participation tilt still favors defense over growth and crypto.

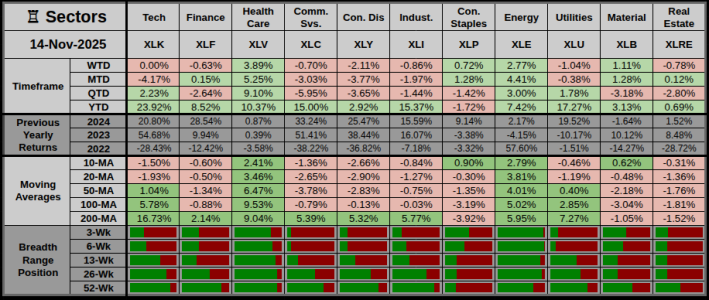

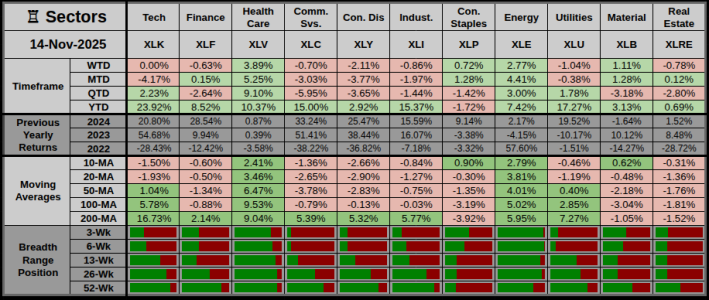

♖ Sectors & Rotation

Weekly Sector Overview: Health care and energy led while tech stalled and consumer groups lagged, a clear tilt toward defense with an energy twist.

● Key Takeaway: Until cyclicals such as XLY and XLI can retake leadership, rallies likely act more like exits than fresh entries.

Offensive Assets

● Top WTD gainers: XLV +3.89%, XLE +2.77%, XLB +1.11% as money favored earnings resilience and commodity leverage.

● Breadth/outperformance: Cyclicals underperformed, while defensives like XLP +0.72% and energy outpaced the broad SPX, signaling Defensives > Cyclicals.

Defensive Assets

● Standout defense came from XLV and XLP, which benefited from growth worries even as XLU -1.04% struggled with rate jitters.

● Safety tone: Utilities lagged, but health care, staples, and real estate kept the defensive theme intact as investors rotated out of discretionary exposure.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Contraction: defensives led, trend weakened on 10- and 20-day views, and breadth showed a late-cycle tilt across several horizons.

● ● Alternate: Late: leadership narrowed into earnings-resilient groups, trend looked tired rather than broken, and breadth hinted at crowding in safety.

● ● ● Confidence: High: trend and breadth lenses both show Contraction while the timeframe lens is neutral rather than outright supportive.

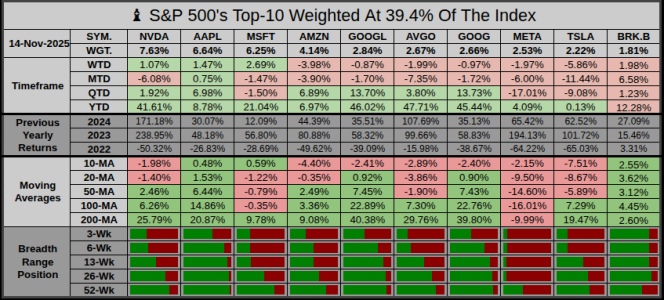

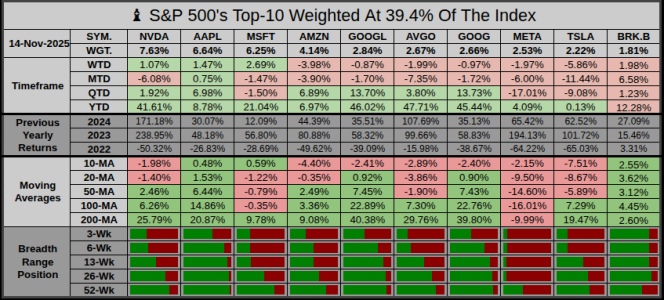

♗ S&P 500’s Weighted Top-10

Overview: Mixed week: several mega caps like software and value held up, while ecommerce and autos generated most of the drag.

● Key Takeaway: Leadership stayed concentrated, and weakness in high-beta names warns that broader upside needs help from more than a few giants.

Offensive Leaders

● Winners: MSFT +2.69%, BRK.B +1.98%, and AAPL +1.47% provided most of the positive pull inside the Top-10.

● Secondary theme: NVDA +1.07% showed buyers still support core AI and chip leadership even as broader tech cooled.

Defensive Laggards

● Biggest decliners: TSLA -5.86%, AMZN -3.98%, and AVGO -1.99% weighed on the group.

● Drag theme: ad-driven names GOOGL and GOOG slipped alongside META, hinting at some profit taking in the communication and growth complex.

Next Week’s Projection

Next Week’s Projection

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

● WTD Overview: Risk-off: SPX finished flat while small caps and transports slipped and defensive sectors did most of the work. Flows favored health care, energy, gold, and copper over crypto as volatility and long yields moved higher.

● Key Takeaway: A softer dollar, calmer VIX and easier long yields are needed to unlock a cleaner risk-on turn.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

● Weekly flows leaned risk-on in equity and bond funds while money market assets still crept higher, so cash caution stayed in place.

| Box | Category | Weekly Flow | 4-wk Median Read | Risk Tone |

|---|---|---|---|---|

| Equity mutual funds | +$13.55B | Above | Risk-on/supportive | |

| Bond mutual funds | +$15.18B | Near | Mixed/neutral | |

| ETFs (net issuance) | +$43.76B | Near | Risk-on/supportive | |

| Combined MF + ETF | +$72.58B | Above | Mixed with risk-on tilt | |

| Money market funds | +$1.82B to $7.54T | Near | Risk-off/de-risking (cash build) |

♔ Equities

WTD Overview: SPX was flat while mid-tier names rose and small caps and transports stayed under pressure.

● Key Takeaway: Modest losses in VXF and TRAN keep risk skewed cautious until small caps can confirm any rally.

Leaders & Relative Holds

● Risk Bias: Mild risk-off. Mid-90 stocks outpaced the Top-10, and global stocks via ACWX beat US small caps.

● Breadth: Participation was respectable in the middle of the index, but tail names and small caps carried most of the drag.

♛ Barometer

WTD Overview: Short and long Treasuries in IGSB, IEF, and TLT slipped as DXY eased. Gold and copper rallied while BTC sank and VIX jumped.

Hedges & Risk Bias

● Risk Bias: Cautious. Long Treasuries weakened, gold in IAU and copper in CPER held firm, and inflation expectations via RINF edged higher.

● Breadth: Safety trades were broad, cyclical proxies were mixed, and the participation tilt still favors defense over growth and crypto.

♖ Sectors & Rotation

Weekly Sector Overview: Health care and energy led while tech stalled and consumer groups lagged, a clear tilt toward defense with an energy twist.

● Key Takeaway: Until cyclicals such as XLY and XLI can retake leadership, rallies likely act more like exits than fresh entries.

Offensive Assets

● Top WTD gainers: XLV +3.89%, XLE +2.77%, XLB +1.11% as money favored earnings resilience and commodity leverage.

● Breadth/outperformance: Cyclicals underperformed, while defensives like XLP +0.72% and energy outpaced the broad SPX, signaling Defensives > Cyclicals.

Defensive Assets

● Standout defense came from XLV and XLP, which benefited from growth worries even as XLU -1.04% struggled with rate jitters.

● Safety tone: Utilities lagged, but health care, staples, and real estate kept the defensive theme intact as investors rotated out of discretionary exposure.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Contraction: defensives led, trend weakened on 10- and 20-day views, and breadth showed a late-cycle tilt across several horizons.

● ● Alternate: Late: leadership narrowed into earnings-resilient groups, trend looked tired rather than broken, and breadth hinted at crowding in safety.

● ● ● Confidence: High: trend and breadth lenses both show Contraction while the timeframe lens is neutral rather than outright supportive.

| Box | Bias | Probability | Narrative (4–6 Week Horizon) |

|---|---|---|---|

| Up | 10% | If cyclicals reassert and tech stabilizes, upside follow-through opens up. | |

| Sideways | 10% | If defensives lead and rates chop, range trading and quick fades dominate. | |

| Down | 80% | If tech stays soft and volatility firm, de-risking and failed rallies remain the base case. |

♗ S&P 500’s Weighted Top-10

Overview: Mixed week: several mega caps like software and value held up, while ecommerce and autos generated most of the drag.

● Key Takeaway: Leadership stayed concentrated, and weakness in high-beta names warns that broader upside needs help from more than a few giants.

Offensive Leaders

● Winners: MSFT +2.69%, BRK.B +1.98%, and AAPL +1.47% provided most of the positive pull inside the Top-10.

● Secondary theme: NVDA +1.07% showed buyers still support core AI and chip leadership even as broader tech cooled.

Defensive Laggards

● Biggest decliners: TSLA -5.86%, AMZN -3.98%, and AVGO -1.99% weighed on the group.

● Drag theme: ad-driven names GOOGL and GOOG slipped alongside META, hinting at some profit taking in the communication and growth complex.

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 25% | If long-end yields stay calm and the dollar eases, then dip-buyers can still lean into leaders. | |

| 30% | If the dollar chops and sector leadership stays mixed, then the index likely grinds in a range. | |

| 45% | If yields rebound and volatility rises, then recent rallies fade and de-risking resumes. |

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.