♟ The Phantom Of The Rally

● Intela’s Read: A phantom rally: index up, breadth soft; Mid-90 led; Top-10 and Bott-403 even; defensives led, energy trailed.

• Key Takeaway: Modest broadening beyond mega-caps, but sector tone reads defensive.

• Base case: Maintain Mid-90 bias unless Bott-403 strengthens; phantom breadth fades the edge.

● Fund Inflows — Wednesday Series

• Key Takeaway: Stocks saw a small bid, bonds drew more money, and cash balances kept climbing.

• Equity: Higher vs 4-wk median — +$4.0B (week ended Sep 24, 2025).

• Bonds: Higher vs 4-wk median — +$22.0B (week ended Sep 24, 2025).

• Money Market: Up w/w — +$50.6B to $7.37T (week ended Oct 1, 2025).

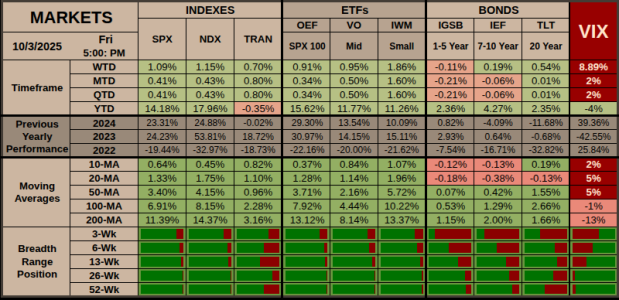

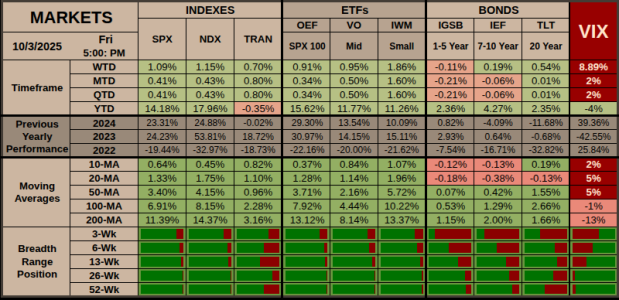

♔ Markets - Weekend Recap

● Overview: Equities edged higher with small-caps leading. VIX popped and breadth sits near cycle highs—risk-on with a caution tag.

• Key Takeaway: Respect the uptrend, but a rising VIX with overbought breadth argues for tighter risk and quick exits on stalls.

● Offensive Assets

• Small-caps led the week (IWM WTD +1.86%), outpacing SPX (+1.09%) and NDX (+1.15%), a classic risk-on tilt.

• Breadth strong: 26-week range positions sit ~97–98% for SPX/NDX/OEF/VO/IWM, signaling a crowded push toward upper bands.

• Mid-caps (VO +0.95% WTD) and transports (+0.70% WTD) confirmed participation, supporting a broad advance.

● Defensive Assets

• VIX jumped 8.89% WTD even as stocks rose—an embedded bid for hedges.

• Duration was mixed: TLT (+0.54%) and IEF (+0.19%) saw mild gains while short credit (IGSB −0.11%) lagged.

• No strong safe-haven follow-through yet; the volatility bid is the primary caution flag.

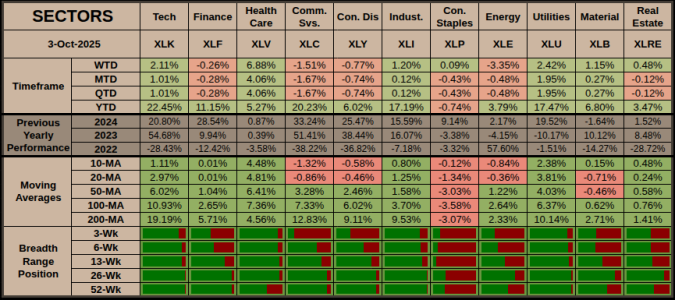

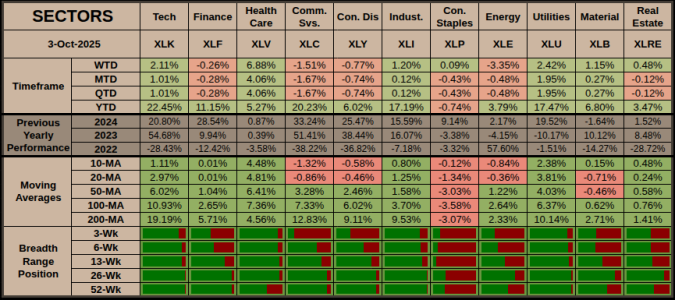

♝ Sectors & Rotation

● Overview: Late-cycle tone with defensive tilt; health care and utilities outpaced while energy and communications lagged.

• Key Takeaway: If defensives keep leading and energy stays weak, risk fades; a cyclicals push above stacked MAs would flip risk-on.

● Leaders

• XLV +6.88%, XLU +2.42% — rates eased; quality & income drew bids.

• Breadth: wider, but confirmation still needs Mid-90 follow-through.

● Laggards

• Energy, Communication Services — rotation hinted, not confirmed.

• Read: defensive > cyclical = “phantom” feel persists.

● Market Cycle — Where We Are

• Diagnosis: Late-cycle quality-led.

• Timeframe: Rolling 4–8 weeks, cross-checked vs 13–26-week breadth and 20/50/200-MA state.

• Why it fits: Defensive participation high, mega/quality steady, cyclicals mixed with energy weak and industrials firming.

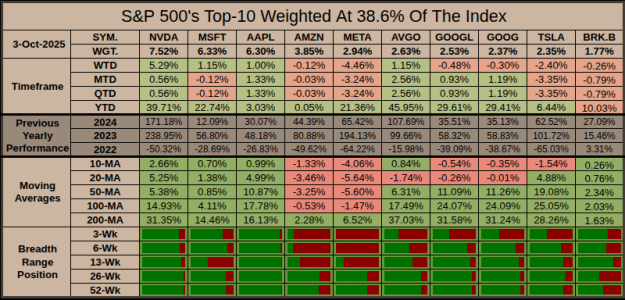

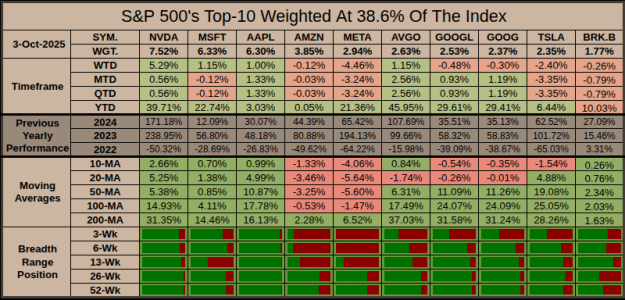

♕ S&P 500's Top-10 Weekly Moves

● Overview: Mixed: more decliners than advancers inside the Top-10; leadership was narrow.

• Key Takeaway: Concentration risk rose—leadership leaned on one heavyweight; watch for breadth to stabilize or broaden.

● Offensive Standouts

• NVDA +5.29% led decisively, driving most of the group’s positive impulse.

• Secondary gains were modest: MSFT +1.15%, AVGO +1.15%, AAPL +1.00%.

● Defensive or Laggards

• META −4.46% was the weakest; TSLA −2.40% added drag.

• AMZN −0.12%, GOOGL −0.48%, GOOG −0.30%, BRK.B −0.26% kept Top-10 breadth negative.

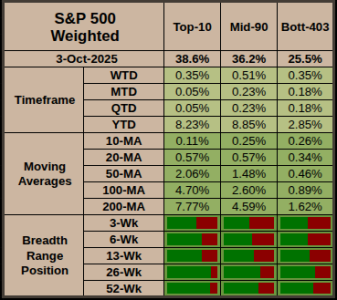

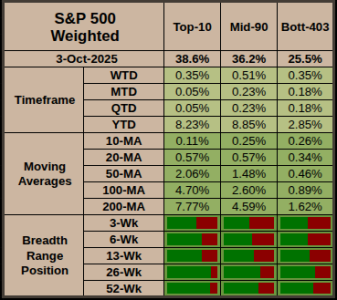

♜ S&P 500's Weighted Rotation

● Overview: Mid-90 led WTD (+0.51%) while Top-10 and Bott-403 matched (+0.35%)—a slight broadening beyond mega-caps.

• Key Takeaway: Leadership tilted toward the core; watch if the base (Bott-403) extends this bid or the tape snaps back to Top-10.

• 3-Wk: Top soft (~23%) vs. base firmer (~33%)—rotation under the surface.

• 6-Wk: Similar tilt (Top-10 ~27%, Mid-90 ~20%, Bott-403 ~34%)—strength down-cap.

• 13-Wk: Medium-term participation stronger in Bott-403 (~35%) than Top/Mid (~26/22%)—constructive breadth.

• 26-Wk: Base leads (~42%) with Top/Mid in low-30s/high-20s—broader foundation.

• 52-Wk: Same pattern persists (Bott-403 ~40% vs. ~33/25)—less top-heavy than earlier in the year.

♞ YTD Breadth Rotation

● Overview: Top-10 leadership is intact; churn is concentrated in the Mid-90 as several names rotate in from Bott-403 and out toward it.

• Key Takeaway: Mid-90 is where the action is; concentration at the top persists.

● Top-10 Group

• Promoted: None

• Demoted: None

● Mid-90 Group • Promoted: • INTC (62↑ from 105) • APH (75↑ from 110) • KLAC (79↑ from 108)

• COF (87↑ from 142) • CRWD (93↑ from 118) • WELL (98↑ from 133)

● Mid-90 Group • Demoted: • KKR (101↓ from 95) • CB (102↓ from 92) • PLD (105↓ from 97)

• VRTX (108↓ from 89) • MMC (110↓ from 90) • SBUX (112↓ from 91) • BMY (122↓ from 83) • UPS (151↓ from 99) • FI (159↓ from 81)

● Index Membership Changes

• Added: APP, COIN, DASH, DDOG, EME, EXE, HOOD, IBKR, PSKY, TKO, TTD, WSM, XYZ

• Removed: ANSS, BWA, CE, CZR, DFS, ENPH, FMC, HES, JNPR, MKTX, PARA, TFX, WBA

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Powered by AI-Intela v2.91 — Sometimes thinking hard, sometimes hardly thinking.

● Intela’s Read: A phantom rally: index up, breadth soft; Mid-90 led; Top-10 and Bott-403 even; defensives led, energy trailed.

• Key Takeaway: Modest broadening beyond mega-caps, but sector tone reads defensive.

• Base case: Maintain Mid-90 bias unless Bott-403 strengthens; phantom breadth fades the edge.

● Fund Inflows — Wednesday Series

• Key Takeaway: Stocks saw a small bid, bonds drew more money, and cash balances kept climbing.

• Equity: Higher vs 4-wk median — +$4.0B (week ended Sep 24, 2025).

• Bonds: Higher vs 4-wk median — +$22.0B (week ended Sep 24, 2025).

• Money Market: Up w/w — +$50.6B to $7.37T (week ended Oct 1, 2025).

♔ Markets - Weekend Recap

● Overview: Equities edged higher with small-caps leading. VIX popped and breadth sits near cycle highs—risk-on with a caution tag.

• Key Takeaway: Respect the uptrend, but a rising VIX with overbought breadth argues for tighter risk and quick exits on stalls.

● Offensive Assets

• Small-caps led the week (IWM WTD +1.86%), outpacing SPX (+1.09%) and NDX (+1.15%), a classic risk-on tilt.

• Breadth strong: 26-week range positions sit ~97–98% for SPX/NDX/OEF/VO/IWM, signaling a crowded push toward upper bands.

• Mid-caps (VO +0.95% WTD) and transports (+0.70% WTD) confirmed participation, supporting a broad advance.

● Defensive Assets

• VIX jumped 8.89% WTD even as stocks rose—an embedded bid for hedges.

• Duration was mixed: TLT (+0.54%) and IEF (+0.19%) saw mild gains while short credit (IGSB −0.11%) lagged.

• No strong safe-haven follow-through yet; the volatility bid is the primary caution flag.

♝ Sectors & Rotation

● Overview: Late-cycle tone with defensive tilt; health care and utilities outpaced while energy and communications lagged.

• Key Takeaway: If defensives keep leading and energy stays weak, risk fades; a cyclicals push above stacked MAs would flip risk-on.

● Leaders

• XLV +6.88%, XLU +2.42% — rates eased; quality & income drew bids.

• Breadth: wider, but confirmation still needs Mid-90 follow-through.

● Laggards

• Energy, Communication Services — rotation hinted, not confirmed.

• Read: defensive > cyclical = “phantom” feel persists.

● Market Cycle — Where We Are

• Diagnosis: Late-cycle quality-led.

• Timeframe: Rolling 4–8 weeks, cross-checked vs 13–26-week breadth and 20/50/200-MA state.

• Why it fits: Defensive participation high, mega/quality steady, cyclicals mixed with energy weak and industrials firming.

♕ S&P 500's Top-10 Weekly Moves

● Overview: Mixed: more decliners than advancers inside the Top-10; leadership was narrow.

• Key Takeaway: Concentration risk rose—leadership leaned on one heavyweight; watch for breadth to stabilize or broaden.

● Offensive Standouts

• NVDA +5.29% led decisively, driving most of the group’s positive impulse.

• Secondary gains were modest: MSFT +1.15%, AVGO +1.15%, AAPL +1.00%.

● Defensive or Laggards

• META −4.46% was the weakest; TSLA −2.40% added drag.

• AMZN −0.12%, GOOGL −0.48%, GOOG −0.30%, BRK.B −0.26% kept Top-10 breadth negative.

♜ S&P 500's Weighted Rotation

● Overview: Mid-90 led WTD (+0.51%) while Top-10 and Bott-403 matched (+0.35%)—a slight broadening beyond mega-caps.

• Key Takeaway: Leadership tilted toward the core; watch if the base (Bott-403) extends this bid or the tape snaps back to Top-10.

• 3-Wk: Top soft (~23%) vs. base firmer (~33%)—rotation under the surface.

• 6-Wk: Similar tilt (Top-10 ~27%, Mid-90 ~20%, Bott-403 ~34%)—strength down-cap.

• 13-Wk: Medium-term participation stronger in Bott-403 (~35%) than Top/Mid (~26/22%)—constructive breadth.

• 26-Wk: Base leads (~42%) with Top/Mid in low-30s/high-20s—broader foundation.

• 52-Wk: Same pattern persists (Bott-403 ~40% vs. ~33/25)—less top-heavy than earlier in the year.

♞ YTD Breadth Rotation

● Overview: Top-10 leadership is intact; churn is concentrated in the Mid-90 as several names rotate in from Bott-403 and out toward it.

• Key Takeaway: Mid-90 is where the action is; concentration at the top persists.

● Top-10 Group

• Promoted: None

• Demoted: None

● Mid-90 Group • Promoted: • INTC (62↑ from 105) • APH (75↑ from 110) • KLAC (79↑ from 108)

• COF (87↑ from 142) • CRWD (93↑ from 118) • WELL (98↑ from 133)

● Mid-90 Group • Demoted: • KKR (101↓ from 95) • CB (102↓ from 92) • PLD (105↓ from 97)

• VRTX (108↓ from 89) • MMC (110↓ from 90) • SBUX (112↓ from 91) • BMY (122↓ from 83) • UPS (151↓ from 99) • FI (159↓ from 81)

● Index Membership Changes

• Added: APP, COIN, DASH, DDOG, EME, EXE, HOOD, IBKR, PSKY, TKO, TTD, WSM, XYZ

• Removed: ANSS, BWA, CE, CZR, DFS, ENPH, FMC, HES, JNPR, MKTX, PARA, TFX, WBA

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Powered by AI-Intela v2.91 — Sometimes thinking hard, sometimes hardly thinking.

Last edited: