♟ Weekly Recap

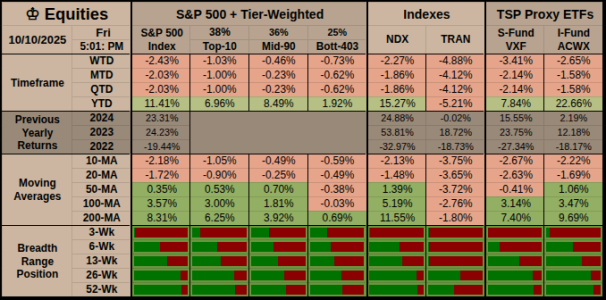

● WTD Overview: Risk-off: SPX −2.43% WTD; breadth narrowed as TRAN −4.88%, VXF −3.41%, and ACWX −3.31% lagged.

Defensives drew bids: XLU +1.45%, XLP +0.09%; cyclicals sold as DXY +1.17%, gold firmed, and VIX stayed elevated.

• • Key Takeaway: A cooler DXY and calmer VIX, plus stable long-end yields, would widen breadth and lift bounce odds.

● Fund Inflows — Wednesday Series (ici.org)

• Equity (mutual funds): Near 4-wk median — −$20.31B (week ended Oct 01, 2025).

• Bonds (mutual funds): Near 4-wk median — +$6.04B total; +$5.51B taxable; +$0.53B muni (week ended Oct 01, 2025).

• ETFs (net issuance): Strength — +$39.89B (week ended Oct 01, 2025).

• Combined (MF + ETF): Net inflows — +$19.58B (week ended Oct 01, 2025).

• Money Market Funds: Up w/w — +$19.84B to $7.39T (week ended Oct 08, 2025).

• • Key Takeaway: Equity MFs saw outflows; bond MFs modest inflows; ETF issuance was strong; cash balances rose.

• • •Compared to last week: Equity MF tone stayed weak; bond MF inflows eased; ETF inflows were firm; cash inflows continued.

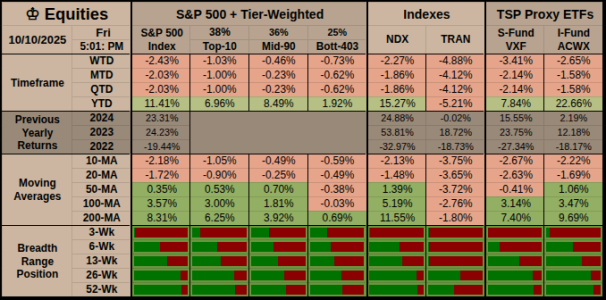

♔ Equities

● WTD Overview: Risk-off week: SPX −2.43%; NDX −2.27%; transports −4.88%; small caps −3.41%; global ex-US −3.31%.

• • Key Takeaway: A calmer VIX and softer dollar would raise odds of a tradable bounce.

● Leaders & Relative Holds

• Risk Tone: Risk-off. Defensives worked: utilities and staples cushioned; cyclicals trailed.

• Breadth: Participation narrowed; cyclicals and small caps bore the brunt.

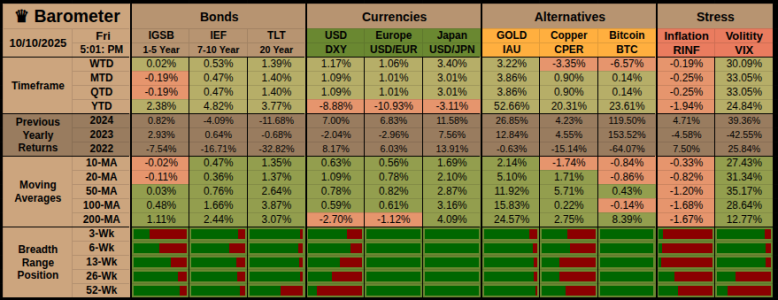

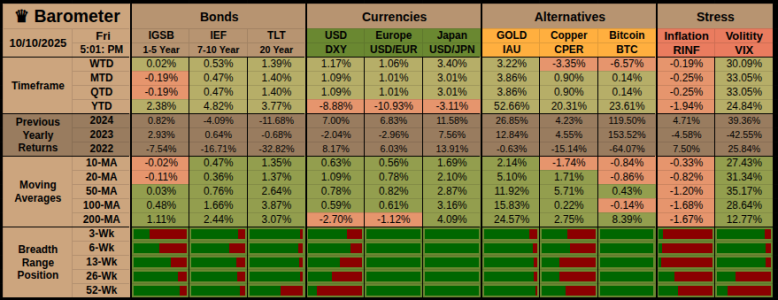

♛ Barometer

● WTD Overview: Duration rallied: IEF +0.53%, TLT +1.39%. Gold firmed; DXY +1.17%; copper and crypto slumped; VIX stayed high.

• • Key Takeaway: Rates stabilizing and a cooler dollar are needed for a cleaner risk-on read.

● Hedges & Risk Tone

• Risk Tone: Risk-off. Curve bid at the long end; gold outpaced industrials; inflation breakevens eased; strong USD weighed on global risk.

• Breadth: Safety trades broad; cyclic proxies weak; participation tilt: defense.

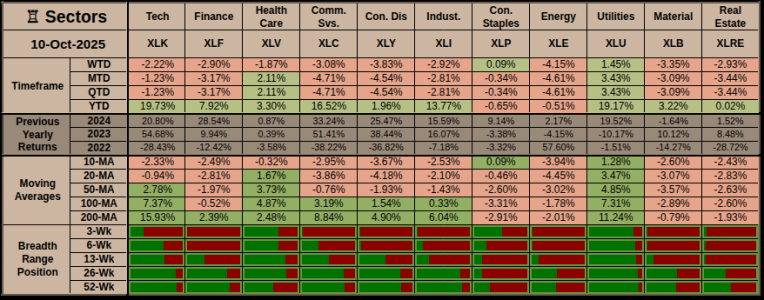

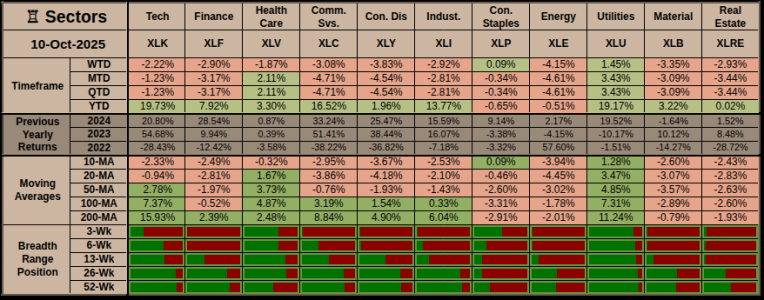

♖ Sectors & Rotation

● Weekly Sector Overview: Defensives led; leadership narrow.

• Key Takeaway: Until yields and the dollar relax, expect rallies to fade and leadership to stay tight.

● Offensive Assets (Risk-On)

• Top WTD gainers: XLU +1.45%, XLP +0.09% — yield bid and safety demand.

• Cyclicals > SPX: no; participation narrowed.

● Defensive Assets (Risk-Off)

• Standout hedge/defense: XLU +1.45% — long-end rally helped utilities.

• Safety tone or drag: XLE −4.15% and XLY −3.83% capped risk appetite.

● 4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

• Primary: Contraction — defensives led; trend mixed; breadth late tilt.

• Alternate: Late — leadership narrow; trend weakening; breadth late tilt.

• • Confidence: High — Timeframe, Trend, and Breadth lenses all Neutral.

• • • 58% — Down: Defensive leadership persists; rallies likely fade into supply.

• • • 30% — Up: A softer dollar and steadier rates lift growth and cyclicals.

• • • 12% — Sideways: Range trade with rotation inside large caps.

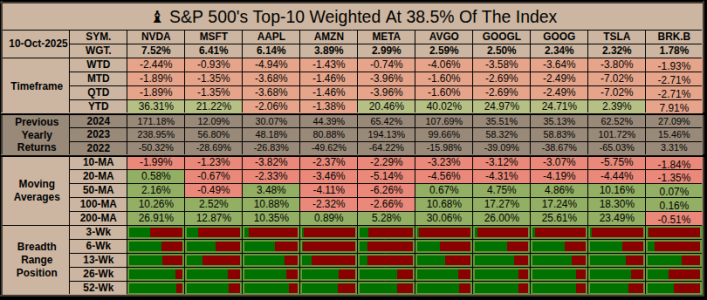

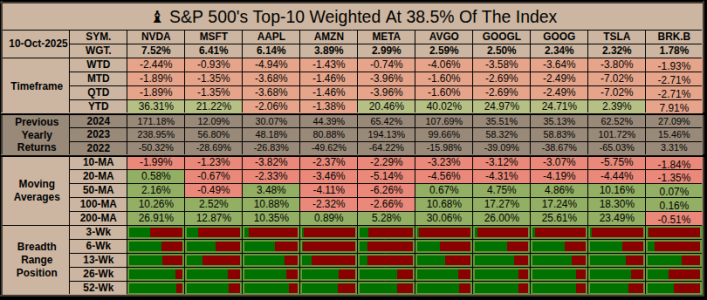

♗ S&P 500’s Weighted Top-10

● Overview: Broadly weak with pockets of resilience. None were green; dispersion moderate.

• • Key Takeaway: Concentration softened a bit as MSFT and META held up better than high-beta peers.

● Leaders & Relative Holds

• Least-negative: META −0.74%, MSFT −0.93% — quality and cash flow favored.

• Secondary: AMZN −1.43% and BRK.B −1.93% showed relative resilience.

● Defensive or Laggards

• Biggest decliners: AAPL −4.94%, AVGO −4.06%, TSLA −3.80%.

• Semis and autos faded; search twins tracked the tape; breadth at the top narrowed.

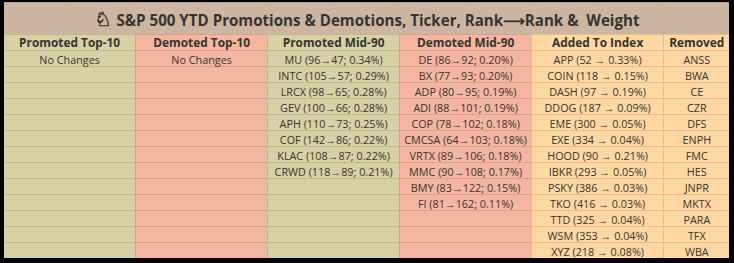

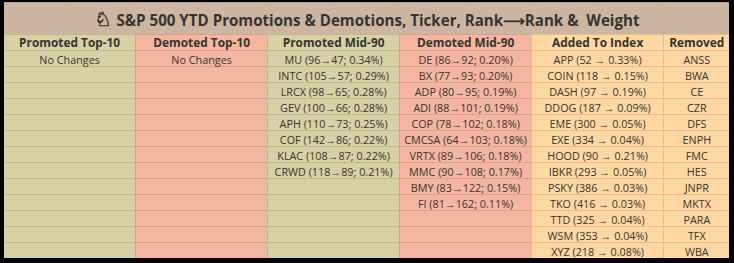

♘ S&P 500’s Tier-Weighted: YTD Rank & Weight Changes

● Overview: More promotions into the Mid-90 from semis, connectors, and security; several demotions toward the Bottom-403 from energy, health, and media.

• Key Takeaway: Participation narrowed but churn rose: quality growth advanced inside the Mid-90 while weaker cyclicals slipped.

• Breadth/outperformance: Participation narrowed.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

● WTD Overview: Risk-off: SPX −2.43% WTD; breadth narrowed as TRAN −4.88%, VXF −3.41%, and ACWX −3.31% lagged.

Defensives drew bids: XLU +1.45%, XLP +0.09%; cyclicals sold as DXY +1.17%, gold firmed, and VIX stayed elevated.

• • Key Takeaway: A cooler DXY and calmer VIX, plus stable long-end yields, would widen breadth and lift bounce odds.

● Fund Inflows — Wednesday Series (ici.org)

• Equity (mutual funds): Near 4-wk median — −$20.31B (week ended Oct 01, 2025).

• Bonds (mutual funds): Near 4-wk median — +$6.04B total; +$5.51B taxable; +$0.53B muni (week ended Oct 01, 2025).

• ETFs (net issuance): Strength — +$39.89B (week ended Oct 01, 2025).

• Combined (MF + ETF): Net inflows — +$19.58B (week ended Oct 01, 2025).

• Money Market Funds: Up w/w — +$19.84B to $7.39T (week ended Oct 08, 2025).

• • Key Takeaway: Equity MFs saw outflows; bond MFs modest inflows; ETF issuance was strong; cash balances rose.

• • •Compared to last week: Equity MF tone stayed weak; bond MF inflows eased; ETF inflows were firm; cash inflows continued.

♔ Equities

● WTD Overview: Risk-off week: SPX −2.43%; NDX −2.27%; transports −4.88%; small caps −3.41%; global ex-US −3.31%.

• • Key Takeaway: A calmer VIX and softer dollar would raise odds of a tradable bounce.

● Leaders & Relative Holds

• Risk Tone: Risk-off. Defensives worked: utilities and staples cushioned; cyclicals trailed.

• Breadth: Participation narrowed; cyclicals and small caps bore the brunt.

♛ Barometer

● WTD Overview: Duration rallied: IEF +0.53%, TLT +1.39%. Gold firmed; DXY +1.17%; copper and crypto slumped; VIX stayed high.

• • Key Takeaway: Rates stabilizing and a cooler dollar are needed for a cleaner risk-on read.

● Hedges & Risk Tone

• Risk Tone: Risk-off. Curve bid at the long end; gold outpaced industrials; inflation breakevens eased; strong USD weighed on global risk.

• Breadth: Safety trades broad; cyclic proxies weak; participation tilt: defense.

♖ Sectors & Rotation

● Weekly Sector Overview: Defensives led; leadership narrow.

• Key Takeaway: Until yields and the dollar relax, expect rallies to fade and leadership to stay tight.

● Offensive Assets (Risk-On)

• Top WTD gainers: XLU +1.45%, XLP +0.09% — yield bid and safety demand.

• Cyclicals > SPX: no; participation narrowed.

● Defensive Assets (Risk-Off)

• Standout hedge/defense: XLU +1.45% — long-end rally helped utilities.

• Safety tone or drag: XLE −4.15% and XLY −3.83% capped risk appetite.

● 4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

• Primary: Contraction — defensives led; trend mixed; breadth late tilt.

• Alternate: Late — leadership narrow; trend weakening; breadth late tilt.

• • Confidence: High — Timeframe, Trend, and Breadth lenses all Neutral.

• • • 58% — Down: Defensive leadership persists; rallies likely fade into supply.

• • • 30% — Up: A softer dollar and steadier rates lift growth and cyclicals.

• • • 12% — Sideways: Range trade with rotation inside large caps.

♗ S&P 500’s Weighted Top-10

● Overview: Broadly weak with pockets of resilience. None were green; dispersion moderate.

• • Key Takeaway: Concentration softened a bit as MSFT and META held up better than high-beta peers.

● Leaders & Relative Holds

• Least-negative: META −0.74%, MSFT −0.93% — quality and cash flow favored.

• Secondary: AMZN −1.43% and BRK.B −1.93% showed relative resilience.

● Defensive or Laggards

• Biggest decliners: AAPL −4.94%, AVGO −4.06%, TSLA −3.80%.

• Semis and autos faded; search twins tracked the tape; breadth at the top narrowed.

♘ S&P 500’s Tier-Weighted: YTD Rank & Weight Changes

● Overview: More promotions into the Mid-90 from semis, connectors, and security; several demotions toward the Bottom-403 from energy, health, and media.

• Key Takeaway: Participation narrowed but churn rose: quality growth advanced inside the Mid-90 while weaker cyclicals slipped.

• Breadth/outperformance: Participation narrowed.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.