I haven't spent much time in stats lately, too many spreadsheets and projects to keep track of everything.

Each of the S&P 500's last 6-Months have closed positive, with the last Seven 6-Month-Candlesticks also positive.

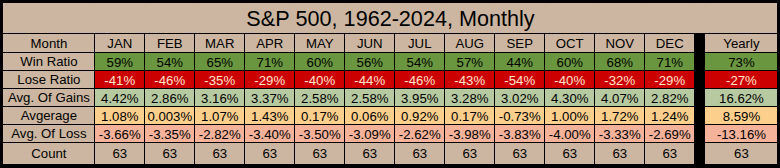

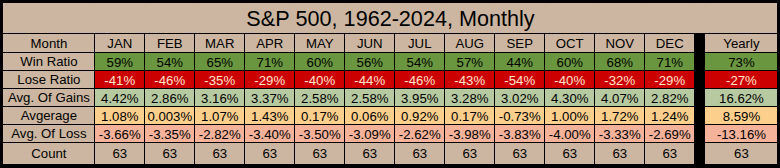

With Sep/Oct behind us, we have statistically the the best 2-Months of the year ahead of us.

It could be a tricky week. At some point the markets may start pricing in real frustration with the federal shutdown: We'll tie the record on Mon, Nov 4, the previous record was 35 days (Dec 22 2018 → Jan 25 2019). During this time Oct-Dec 2018 dropped -20.18% with December alone closing with a -9.18% loss. But... the Jan-Apr 2019 recovery was strong and steady.

Here's a side-by-side table illustrating a comparison of 2018 with 2025

Straight-Six Still Running: Fall-Back Edition

Note: Time change in the U.S. takes place this week (clocks “fall back” one hour on Sunday, Nov 2 at 2 a.m.).

♗ Weekly Recap

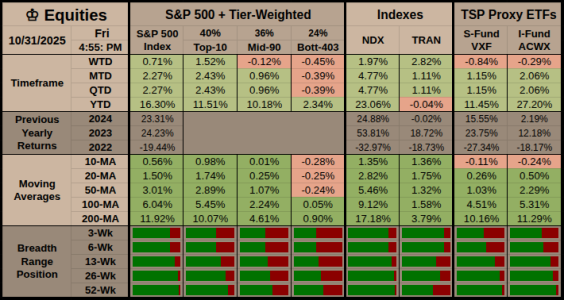

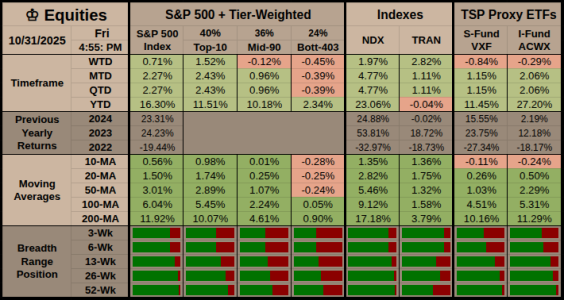

● WTD Overview: Risk-on but narrow: SPX +0.71% on megacap tech; VXF −0.84% and ACWX −0.29% slipped as dollar and vol rose.

● Key Takeaway: A softer dollar or calmer VIX would confirm the move; without that, treat it as an ETF-and-megacap pop.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series[/b] (ici.org)

● Equity (mutual funds): Below vs 4-wk median: −$19.53B (week ended Oct 22, 2025). ICI

● Bonds (mutual funds): Below vs 4-wk median: +$4.02B total; +$2.39B taxable; +$1.62B muni (week ended Oct 22, 2025). ICI

● ETFs (net issuance): Near: +$43.53B (week ended Oct 22, 2025). ICI

● Combined (MF + ETF): Net inflows: +$22.87B (week ended Oct 22, 2025). ICI

● Money Market Funds: Up w/w: +$20.60B to $7.42T (week ended Oct 29, 2025). ICI

● ● Key Takeaway: Equity MF outflows, bond MF inflows, ETF tone firm, cash balances up. ICI×3

● ● ● Compared to last week: equity MF outflows worsened; bond MF inflows strengthened; ETF inflows strengthened; cash inflows accelerated.

♔ Equities

WTD Overview: SPX +0.71% (the top of the index worked).

● NDX +1.97% and TRAN +2.82% pulled higher, while VXF −0.84% and ACWX −0.29% showed the move was not broad.

● Key Takeaway: Watch VIX +6.54% and DXY +0.79% for a retrace; breadth will not improve until at least one cools.

Leaders & Relative Holds

● Risk Bias: Risk-on headline, risk-off underneath. Top-10 tier +1.52% cushioned; Mid-90 −0.12% and Bott-403 −0.45% lagged.

● Breadth: Participation narrowed; cyclicals and small caps bore the brunt; transports stayed constructive which helps the narrative for now.

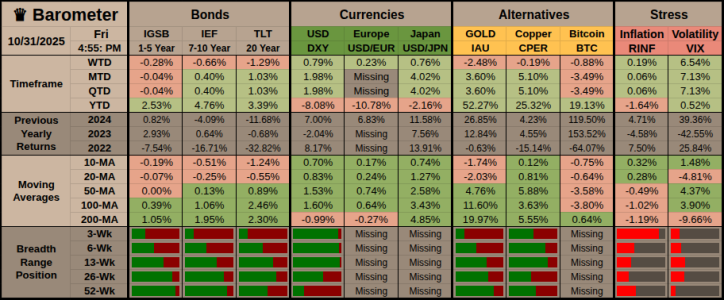

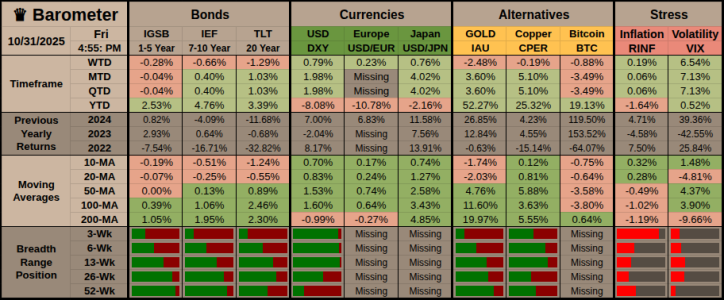

♛ Barometer

WTD Overview: Bonds fell (IGSB −0.28%, IEF −0.66%, TLT −1.29%); DXY +0.79% held firm, IAU −2.48% slipped, and VIX +6.54% spiked.

● Key Takeaway: This was a risk-off read from rates, dollar, and volatility; conviction improves if the dollar fades or long bonds stabilize.

Hedges & Risk Bias

● Risk Bias: Risk-off. Curve pain hit long duration; gold lost its hedge slot; inflation gauge RINF +0.19% and firm USD made life harder for global risk.

● Breadth: Safety trades were mixed, cyclic proxies were weak (CPER −0.19%, Bitcoin −0.84%), and participation tilted to defense instead of offense.

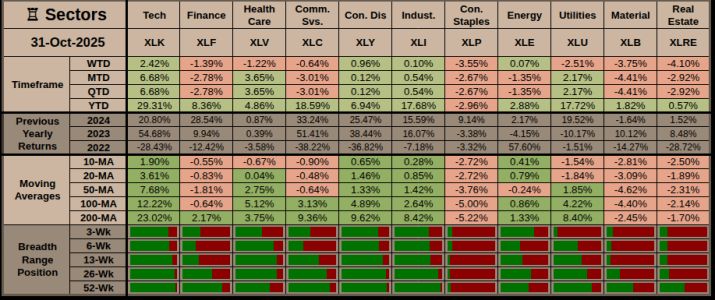

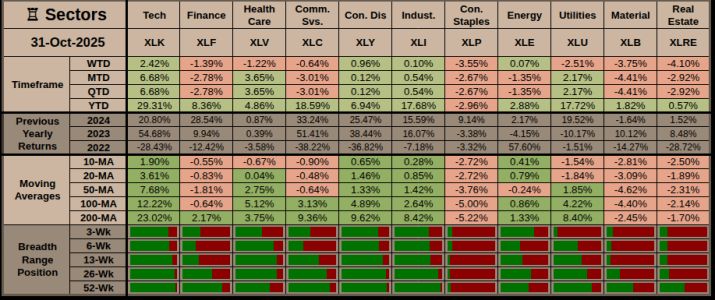

♖ Sectors & Rotation

Weekly Sector Overview: Tech won: XLK +2.42%. Most other groups were flat to red and defensives were sold so leadership was narrow.

● Key Takeaway: This was growth over value; rotation improves only if yields calm and buyers rotate into the losers.

Offensive Assets

● Top WTD gainers: XLK +2.42%, XLY +0.96%: megacap tech and consumer names got the AI-and-holiday story.

● Breadth/outperformance: Cyclicals > Defensives (breadth: defensive).

Defensive Assets

● Standout drag: XLRE −4.10%, XLB −3.75%, XLP −3.55%: higher-rate tone hurt plays tied to yield.

● Safety tone: Utilities XLU −2.51% could not catch a bid so defense did not lead.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● ● Alternate: Mid: mixed spread; trend mixed; breadth neutral.

● ● ● Confidence: Low: time lens was neutral, trend lens disagreed, breadth lens was early.

63%: Up: tech-and-cyclicals carry for several weeks if dollar cools.

63%: Up: tech-and-cyclicals carry for several weeks if dollar cools.

● ● ● 20%: Down: defensive slump becomes broader de-risking if yields pop again.

20%: Down: defensive slump becomes broader de-risking if yields pop again.

● ● ● 17%: Sideways: index chops while tech protects recent gains.

17%: Sideways: index chops while tech protects recent gains.

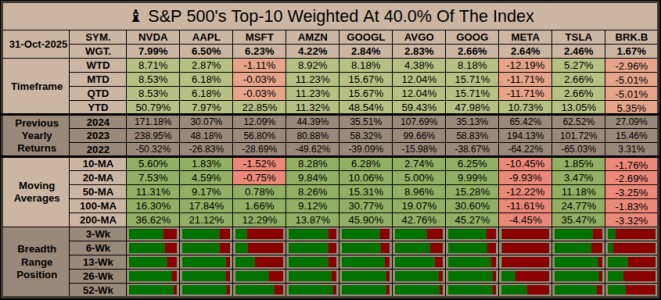

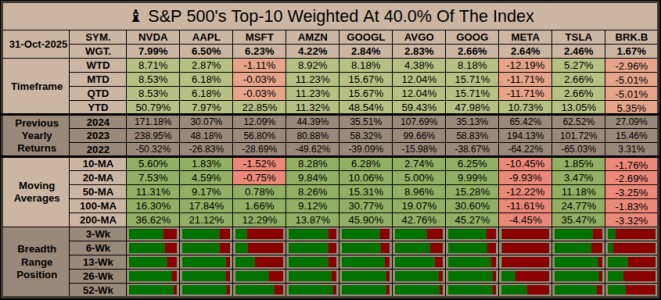

♗ S&P 500’s Weighted Top-10

Overview: Tone was broadly strong: 7 of 10 Top-10 names gained, led by mega-tech and ecommerce. The basket rose +1.52%, handily beating the index.

● Key Takeaway: With Apple steady and most peers firm, the index still rides high concentration but on broader footing than earlier in the month.

Offensive Leaders

● NVDA +8.71%, AMZN +8.92%, GOOGL +8.18%, and GOOG +8.18% drove the move; AVGO +4.38% and TSLA +5.27% added depth.

● Theme: AI, cloud, and consumer-discretionary strength kept growth firmly in charge despite the shutdown noise.

Defensive Laggards

● META −12.19%, BRK.B −2.96%, and MSFT −1.11% lagged on rotation and earnings drag.

● Even with those declines, internal breadth inside the Top-10 improved versus the prior week — a genuine follow-through rather than a narrow lift.

Have a great week.... Jason

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Each of the S&P 500's last 6-Months have closed positive, with the last Seven 6-Month-Candlesticks also positive.

With Sep/Oct behind us, we have statistically the the best 2-Months of the year ahead of us.

It could be a tricky week. At some point the markets may start pricing in real frustration with the federal shutdown: We'll tie the record on Mon, Nov 4, the previous record was 35 days (Dec 22 2018 → Jan 25 2019). During this time Oct-Dec 2018 dropped -20.18% with December alone closing with a -9.18% loss. But... the Jan-Apr 2019 recovery was strong and steady.

Here's a side-by-side table illustrating a comparison of 2018 with 2025

| Factor | % Similar | Oct 2018 Peak Setup | Now (Oct–Nov 2025) |

|---|---|---|---|

| Market structure (narrow leadership) | 90% | Crowded in growth/momentum; selloff hit the same winners. | Megacap/AI and transports pulling; small caps and ex-US lag, so shocks travel fast. |

| Dollar as a headwind | 90% | Tightening + firm USD, pressured multinationals. | Shutdown + safe-haven tone keep USD firm, crimping ex-US risk. |

| Rates “high enough to bite” | 60% | 10y jumped over ~3.2%, fast move was the shock. | 10y around 4% and sticky; level, not the speed, is the problem. |

| Policy overhang | 70% | Fed tightening + QT on autopilot; market feared “too tight.” | Live federal shutdown with day-count risk; December cut now ‘data-permitting’ because the Fed said another move isn’t a sure thing.” |

| Volatility readiness | 80% | Vol picked up right after the rates shock. | VIX already off the floor while SPX is up; risk budgets sensitive. |

| Macro narrative | 50% | “Peak earnings” after tax-cut boom; room to disappoint. | “Growth drag” from shutdown + firm USD; room to disappoint, different cause. |

Straight-Six Still Running: Fall-Back Edition

Note: Time change in the U.S. takes place this week (clocks “fall back” one hour on Sunday, Nov 2 at 2 a.m.).

♗ Weekly Recap

● WTD Overview: Risk-on but narrow: SPX +0.71% on megacap tech; VXF −0.84% and ACWX −0.29% slipped as dollar and vol rose.

● Key Takeaway: A softer dollar or calmer VIX would confirm the move; without that, treat it as an ETF-and-megacap pop.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series[/b] (ici.org)

● Equity (mutual funds): Below vs 4-wk median: −$19.53B (week ended Oct 22, 2025). ICI

● Bonds (mutual funds): Below vs 4-wk median: +$4.02B total; +$2.39B taxable; +$1.62B muni (week ended Oct 22, 2025). ICI

● ETFs (net issuance): Near: +$43.53B (week ended Oct 22, 2025). ICI

● Combined (MF + ETF): Net inflows: +$22.87B (week ended Oct 22, 2025). ICI

● Money Market Funds: Up w/w: +$20.60B to $7.42T (week ended Oct 29, 2025). ICI

● ● Key Takeaway: Equity MF outflows, bond MF inflows, ETF tone firm, cash balances up. ICI×3

● ● ● Compared to last week: equity MF outflows worsened; bond MF inflows strengthened; ETF inflows strengthened; cash inflows accelerated.

♔ Equities

WTD Overview: SPX +0.71% (the top of the index worked).

● NDX +1.97% and TRAN +2.82% pulled higher, while VXF −0.84% and ACWX −0.29% showed the move was not broad.

● Key Takeaway: Watch VIX +6.54% and DXY +0.79% for a retrace; breadth will not improve until at least one cools.

Leaders & Relative Holds

● Risk Bias: Risk-on headline, risk-off underneath. Top-10 tier +1.52% cushioned; Mid-90 −0.12% and Bott-403 −0.45% lagged.

● Breadth: Participation narrowed; cyclicals and small caps bore the brunt; transports stayed constructive which helps the narrative for now.

♛ Barometer

WTD Overview: Bonds fell (IGSB −0.28%, IEF −0.66%, TLT −1.29%); DXY +0.79% held firm, IAU −2.48% slipped, and VIX +6.54% spiked.

● Key Takeaway: This was a risk-off read from rates, dollar, and volatility; conviction improves if the dollar fades or long bonds stabilize.

Hedges & Risk Bias

● Risk Bias: Risk-off. Curve pain hit long duration; gold lost its hedge slot; inflation gauge RINF +0.19% and firm USD made life harder for global risk.

● Breadth: Safety trades were mixed, cyclic proxies were weak (CPER −0.19%, Bitcoin −0.84%), and participation tilted to defense instead of offense.

♖ Sectors & Rotation

Weekly Sector Overview: Tech won: XLK +2.42%. Most other groups were flat to red and defensives were sold so leadership was narrow.

● Key Takeaway: This was growth over value; rotation improves only if yields calm and buyers rotate into the losers.

Offensive Assets

● Top WTD gainers: XLK +2.42%, XLY +0.96%: megacap tech and consumer names got the AI-and-holiday story.

● Breadth/outperformance: Cyclicals > Defensives (breadth: defensive).

Defensive Assets

● Standout drag: XLRE −4.10%, XLB −3.75%, XLP −3.55%: higher-rate tone hurt plays tied to yield.

● Safety tone: Utilities XLU −2.51% could not catch a bid so defense did not lead.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Early: cyclicals led; trend firm on 10/20 day lenses; breadth had an early tilt.Early: Broad thrust - Tech, Comm, Disc lead

Mid: Consolidation - Tech steady, Industrials rotate in

Late: Narrow carry - Industrials, Materials hold trend

Contraction: Defensive turn - REITs stabilize, Tech fades

● ● Alternate: Mid: mixed spread; trend mixed; breadth neutral.

● ● ● Confidence: Low: time lens was neutral, trend lens disagreed, breadth lens was early.

● ● ●Horizon: structural 4–6 weeks (Rotation engine’s window).

● ● ●

● ● ●

♗ S&P 500’s Weighted Top-10

Overview: Tone was broadly strong: 7 of 10 Top-10 names gained, led by mega-tech and ecommerce. The basket rose +1.52%, handily beating the index.

● Key Takeaway: With Apple steady and most peers firm, the index still rides high concentration but on broader footing than earlier in the month.

Offensive Leaders

● NVDA +8.71%, AMZN +8.92%, GOOGL +8.18%, and GOOG +8.18% drove the move; AVGO +4.38% and TSLA +5.27% added depth.

● Theme: AI, cloud, and consumer-discretionary strength kept growth firmly in charge despite the shutdown noise.

Defensive Laggards

● META −12.19%, BRK.B −2.96%, and MSFT −1.11% lagged on rotation and earnings drag.

● Even with those declines, internal breadth inside the Top-10 improved versus the prior week — a genuine follow-through rather than a narrow lift.

Horizon: Scenario odds reflect the next 5–10 trading days

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 44% | If the dollar stays firm (DXY +0.79%) and VIX +6.54% holds up while megacap leadership remains narrow, the index likely chops in-range. | |

| 33% | If long-end pressure eases (TLT steadies), the dollar cools a bit, and tech keeps the baton (XLK +2.42%), dip-buyers can lift SPX again. | |

| 23% | If yields pop again, the dollar pushes higher, and vol expands from here, small caps and defensives can drag the tape lower. |

Have a great week.... Jason

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Last edited: