JamesE

TSP Strategist

- Reaction score

- 4

The VIX is still reaching for the 10 level - currently at 11.47 -0.36.

I remember when you always said when the vix hits the 14 level be ready for a blindside hit. What's your current blindside?

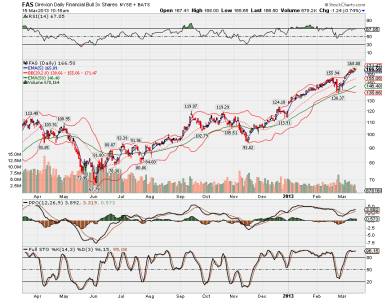

Seperately, I do believe this will run further than most think it can. Personally, I just can't jump in now. If I could just get a measley pull back that's all it would take.