Birchtree

TSP Talk Royalty

- Reaction score

- 143

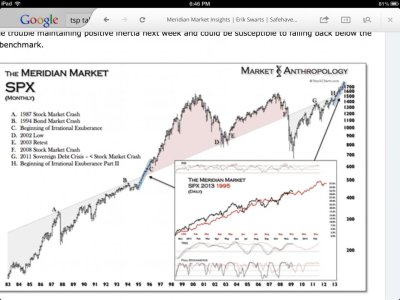

Hedge fund manager Tepper says he's worried (fear) that he's not long enough in the market. There is probably a lot of thinking like that going on - I know my anxiety levels would be increasing like JTHs and would have to think damn I'm missing this train. But I've been long for so long I'm just resting on my base as gains are built. If you read my Merrill post there is a guy in comments that thinks the S&P 500 will get near 8000 by the end of this secular bull. I'll take it one year at a time but I do plan to make several more $Ms in the next few years.