The dollar began the morning moving higher, which seemed to drag down the markets early on, but strength among the financials kept the market afloat.

But the underlying internals may be telling us to get ready for a big move. I expect it to be down, but this market is not staying down easy. The fact is six of ten sectors were in negative territory today, so breadth was not very good.

Tomorrow morning we have four reports coming before the opening bell, but two of them the market is particularly interested in; Nonfarm payrolls (Consensus -35K) and Unemployment rate (Consensus 10%). I'm looking for this data to provide a catalyst to move the market. As I mentioned, I think it will be down, mainly because we are due and the charts look tired. But the prevailing trend is up, and the Seven Sentinels have been on a buy since 21 Dec. I suspect any weakness will be bought.

Keep this in mind too...Monday's have been green the vast majority of the time over the past several months.

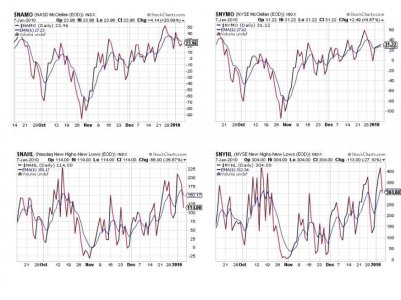

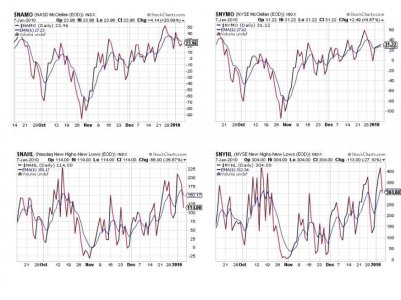

Here's today's charts:

We can see weakness keeps creeping back into these charts, but the system has remained on a buy for over two weeks as the upward momentum has offset any weakness we've had since last SS buy signal.

NAMO is on a sell, while NYMO remains on a buy (but not by much). But we can see where today's breadth took its toll today by looking at NAHL and NYHL. Both flipped to sells today. Of note is that the NAZ has been especially weak the past couple of days.

TRIN remained on a buy, but TRINQ remained on a sell. BPCOMPQ inched a bit higher today and has been on a buy since 21 Dec.

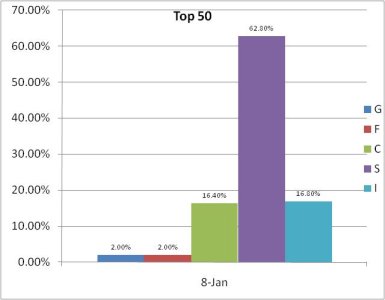

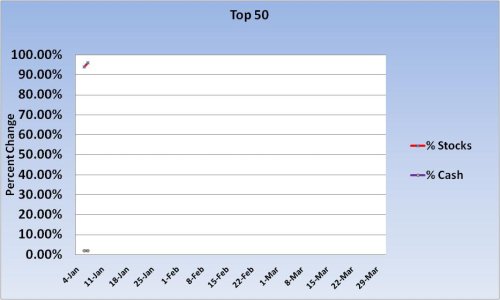

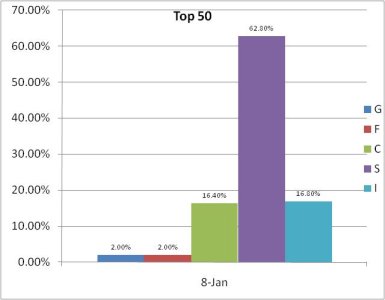

The Top 15 remained the same from yesterday, so I won't post that today, but the Top 50 changed as the S fund is proving to be the fund to own right now as noted in these two charts.

So the Seven Sentinels remain on a buy with 3 of 7 signals still in buy territory. Until all seven go to a sell condition simultaneously it will remain on a buy. I think BPCOMPQ will be a tough signal to roll over to a sell and my thought is that weakness should be bought short term. Sooner or later though we'll get a bigger correction, but I don't think we're there yet. See you tomorrow.

But the underlying internals may be telling us to get ready for a big move. I expect it to be down, but this market is not staying down easy. The fact is six of ten sectors were in negative territory today, so breadth was not very good.

Tomorrow morning we have four reports coming before the opening bell, but two of them the market is particularly interested in; Nonfarm payrolls (Consensus -35K) and Unemployment rate (Consensus 10%). I'm looking for this data to provide a catalyst to move the market. As I mentioned, I think it will be down, mainly because we are due and the charts look tired. But the prevailing trend is up, and the Seven Sentinels have been on a buy since 21 Dec. I suspect any weakness will be bought.

Keep this in mind too...Monday's have been green the vast majority of the time over the past several months.

Here's today's charts:

We can see weakness keeps creeping back into these charts, but the system has remained on a buy for over two weeks as the upward momentum has offset any weakness we've had since last SS buy signal.

NAMO is on a sell, while NYMO remains on a buy (but not by much). But we can see where today's breadth took its toll today by looking at NAHL and NYHL. Both flipped to sells today. Of note is that the NAZ has been especially weak the past couple of days.

TRIN remained on a buy, but TRINQ remained on a sell. BPCOMPQ inched a bit higher today and has been on a buy since 21 Dec.

The Top 15 remained the same from yesterday, so I won't post that today, but the Top 50 changed as the S fund is proving to be the fund to own right now as noted in these two charts.

So the Seven Sentinels remain on a buy with 3 of 7 signals still in buy territory. Until all seven go to a sell condition simultaneously it will remain on a buy. I think BPCOMPQ will be a tough signal to roll over to a sell and my thought is that weakness should be bought short term. Sooner or later though we'll get a bigger correction, but I don't think we're there yet. See you tomorrow.