After some relatively tame action over the past two days, stocks found significant buying interest again thanks in large measure to a better-than-expected ADP Employment Report that showed private payrolls in June were up 157,000, which was well above the 60,000 increase economists were looking for. That suggests tomorrow's nonfarm payrolls report should be positive. Of course that anticipated outcome may already be priced into this market.

Weekly jobless claims were dropped to 418,000 from 432,000 in the prior week. That beat estimates by about 7,000.

So the bullish beat continues as the S&P is now up about 7% in just two weeks.

Here's today's charts:

We were due for another leg back up two weeks ago, but who expected this? NAMO and NYMO reflect a lot of momentum in this latest rally.

NAHL and NYHL are finally hitting some impress numbers again. Both are well above their respective neutral lines.

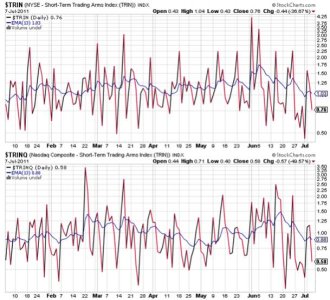

TRIN and TRINQ flipped back to buys today and suggest modestly overbought conditions.

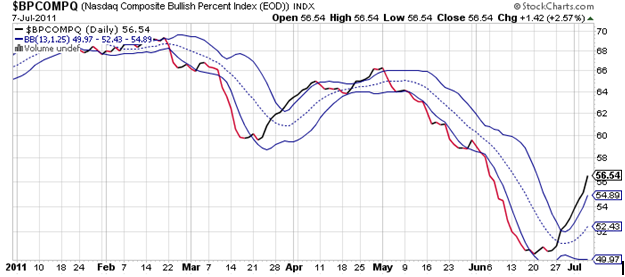

More upside for BPCOMPQ.

So all signals are back in buy conditions, which keeps the system on a buy.

These charts look quite overdone, but that's obvious to anyone who has a passing understanding of technical analysis. And that makes it unlikely we'll get any sustained selling pressure in the short term. Our sentiment survey is showing bullish levels elevated again, but it's not enough to expect a trend reversal from that indicator either. At the moment I'm thinking any dips will be bought, but because stocks are so extended I'd expect this market to begin to get choppy even if the trend remains up.