Well, I should have remembered that holiday trading usually means thin markets and thin markets move easily. And since there's still so much shorting going on, which direction was the most likely for the market to follow. Yep...up.

Of course main stream media would have us believe today's rally was in response to a European commitment to recapitalize their struggling financial institutions, but I think today was simply a continuation of last week's short squeeze. The European news was coincidental. And that news came with no specifics either. Remember that phrase "Where's the beef?"

And we're starting to see headlines that the low is in too. After all, the S&P 500 just closed above its 50 day moving average. So come on in, the water's fine.

If I sound just a tad cynical, I am. We're back at the top of the channel again and many are ready to claim the worst is over. But after a 10% rally, what's left in the tank?

Here's today's charts:

NAMO and NYMO are now well within positive territory and remain on buys. Of note, NYMO is still well away from hitting a new 28 day trading high. It currently sits at 51.57, but it would need to extend past 85.54 to trigger an official buy signal for the Seven Sentinels. However, in two more trading days it need only hit above 52 and it's just about there now. So any more follow through and it's possible the buy signal gets triggered.

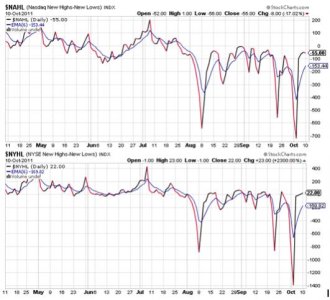

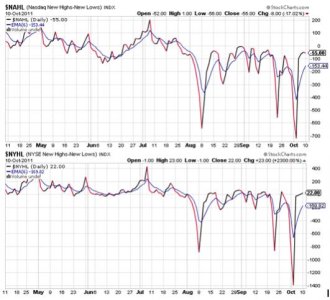

As impressive as a 10% rally can be, neither NAHL nor NYHL are indicating healthy internals. There just isn't many stocks making fresh 52 week trading highs. And NAHL actually went lower today in spite of the huge spike higher by the broader market. And NYHL didn't move much higher than its -1 from Friday.

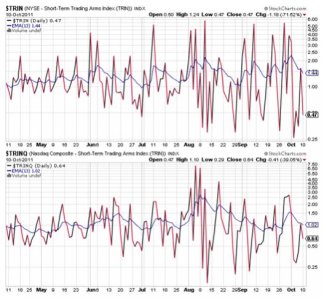

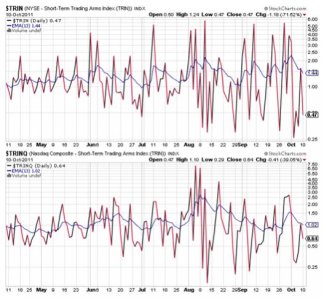

TRIN and TRINQ are both on buys, but TRIN is suggesting a moderately overbought market, while TRINQ on modestly so.

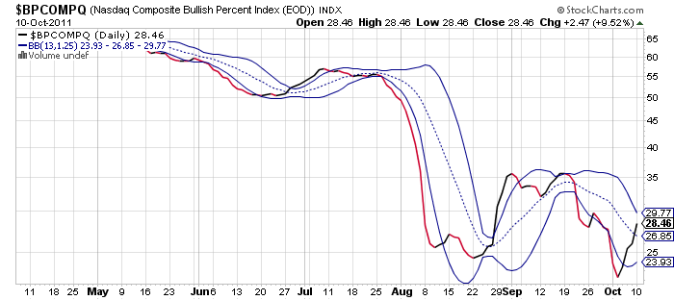

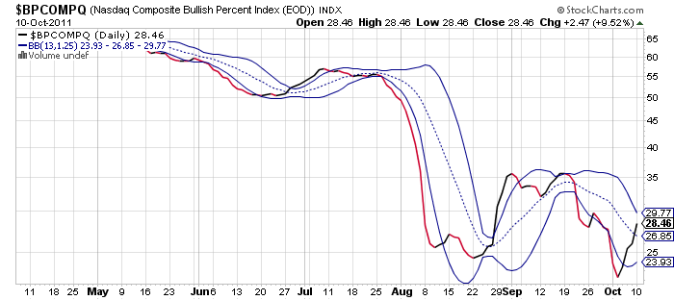

BPCOMPQ spiked higher on today's action and really looks bullish now. But it was only a few trading days ago it spiked lower in like fashion and appeared to be ready to fall off a cliff.

So all seven sentinels are back to buy conditions, which is the second unconfirmed buy signal in a week. Is it time to get invested?

I think it primarily depends on much the bears have backed off on all the shorting. If they haven't, it could be look out above. And interestingly, our sentiment survey flipped to a sell for this week as the number of bulls equaled the numbers of bears. That signal by itself should mean that there will be some measure of selling pressure this week, even if it doesn't match the intensity we've seen from the upside pressure.

I have been holding my bond position now for seven weeks. I am currently sporting a modest loss, but bonds have been volatile and are currently on a downward trend (yields rising). AGG broke below its 50 day moving average Friday and dropped even lower today. So with the S&P 500 closing above its 50 day moving average, the market may be signaling a trend change. But I'd prefer to see both averages hold those levels another couple of days before I'd be willing to make any adjustments.

Of course main stream media would have us believe today's rally was in response to a European commitment to recapitalize their struggling financial institutions, but I think today was simply a continuation of last week's short squeeze. The European news was coincidental. And that news came with no specifics either. Remember that phrase "Where's the beef?"

And we're starting to see headlines that the low is in too. After all, the S&P 500 just closed above its 50 day moving average. So come on in, the water's fine.

If I sound just a tad cynical, I am. We're back at the top of the channel again and many are ready to claim the worst is over. But after a 10% rally, what's left in the tank?

Here's today's charts:

NAMO and NYMO are now well within positive territory and remain on buys. Of note, NYMO is still well away from hitting a new 28 day trading high. It currently sits at 51.57, but it would need to extend past 85.54 to trigger an official buy signal for the Seven Sentinels. However, in two more trading days it need only hit above 52 and it's just about there now. So any more follow through and it's possible the buy signal gets triggered.

As impressive as a 10% rally can be, neither NAHL nor NYHL are indicating healthy internals. There just isn't many stocks making fresh 52 week trading highs. And NAHL actually went lower today in spite of the huge spike higher by the broader market. And NYHL didn't move much higher than its -1 from Friday.

TRIN and TRINQ are both on buys, but TRIN is suggesting a moderately overbought market, while TRINQ on modestly so.

BPCOMPQ spiked higher on today's action and really looks bullish now. But it was only a few trading days ago it spiked lower in like fashion and appeared to be ready to fall off a cliff.

So all seven sentinels are back to buy conditions, which is the second unconfirmed buy signal in a week. Is it time to get invested?

I think it primarily depends on much the bears have backed off on all the shorting. If they haven't, it could be look out above. And interestingly, our sentiment survey flipped to a sell for this week as the number of bulls equaled the numbers of bears. That signal by itself should mean that there will be some measure of selling pressure this week, even if it doesn't match the intensity we've seen from the upside pressure.

I have been holding my bond position now for seven weeks. I am currently sporting a modest loss, but bonds have been volatile and are currently on a downward trend (yields rising). AGG broke below its 50 day moving average Friday and dropped even lower today. So with the S&P 500 closing above its 50 day moving average, the market may be signaling a trend change. But I'd prefer to see both averages hold those levels another couple of days before I'd be willing to make any adjustments.