Back to back rallies in as many days has sent the broader market sharply higher in spite of all the doom and gloom forecasts by the main stream press. Overly bearish sentiment is also playing a role as is the pre-holiday bias. But have we turned things up for the intermediate term? Officially, as far as the Seven Sentinels is concerned, we have. More on that in a moment. In the meantime though, as bullish as things are right now, Greece's vote on new austerity measures has yet to take place, and there is a lot of civil unrest as that vote nears. It's possible that this situation could still adversely affect global markets, and this pre-holiday bias may not hold into next week. But for now momentum is up as are prices.

Volume was very light again, which is no real surprise. Such thin trading makes it much easier for prices to move in either direction depending on who's doing the pushing.

I've been calling for higher prices by week's end and we're officially there now even before mid-week. And it might just continue.

Let's take a look at the charts:

NAMO and NYMO spiked higher today and remain well within buy territory. And NYMO hit a fresh 28 day trading too, which is one of the key criterion for changing the status of the Seven Sentinels, which have been on a sell for several weeks now.

NAHL and NYHL also moved higher and remain on buys.

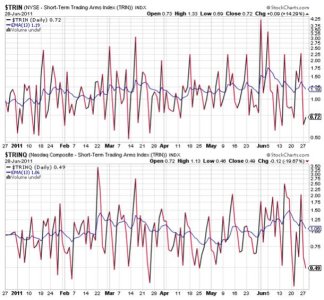

Yesterday I said that TRIN and TRINQ were suggesting a modestly overbought condition, which may bring some short term weakness. Instead, we got a bit more overbought. At least as far as TRINQ goes. Both remain in buy conditions.

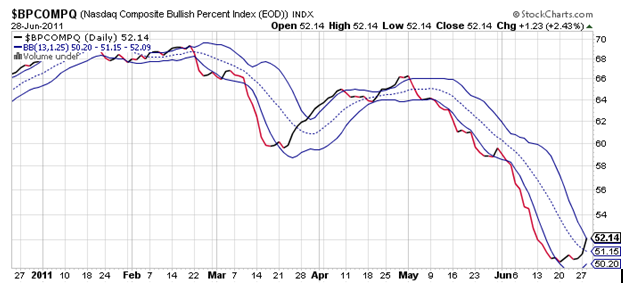

BPCOMPQ turned decidedly higher and now looks very bullish. It too remains in a buy condition.

So all Seven Sentinels are in a buy status and NYMO has hit a fresh 28 day trading high. That means the Seven Sentinels have flipped to an Official Buy status for the intermediate term.

My personal bias remains bullish through the end of this week, but this pre-holiday trading environment is not the time I'd prefer to see a buy signal triggered. I really don't think risk has dissipated and that volatility could return at any time, but I'm thinking it's more likely to return next week. For now it's time to enjoy the ride while it lasts, whether it be short-lived or not.