Yesterday, the S&P managed to close above its 50 day MA, even though it was broken during intraday trade. I had said that given the sell signal issued by the seven sentinels that the 50 day MA probably wouldn't hold. It didn't.

Fiscal concerns surrounding Greece, Portugal, Ireland, Italy, and Spain continued to draw market selling interest throughout the day, although the major averages did manage to retrace significant early morning losses before succumbing to selling pressure later in the day.

The Euro is going down about as fast as the dollar is going up. In fact the dollar saw an 11-month high against a collection of competing currencies early on and closed with a 1.0% gain.

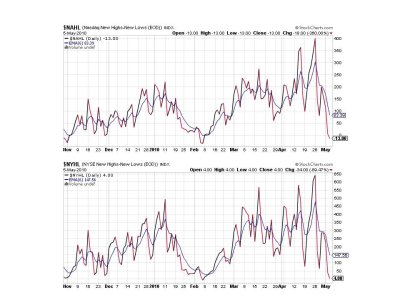

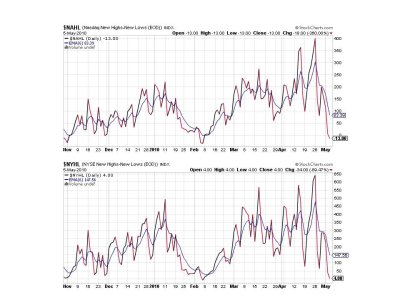

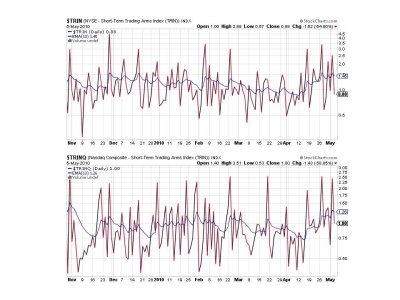

Been a while since we've seen these levels, and the sell signal is only 3 days old.

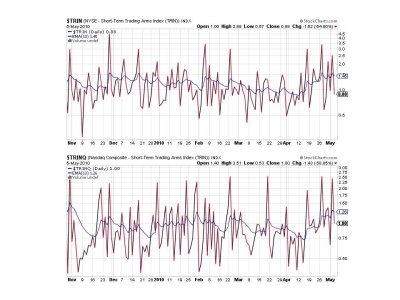

Same here. Not a pretty picture.

We did manage to flip these two signals to buys today.

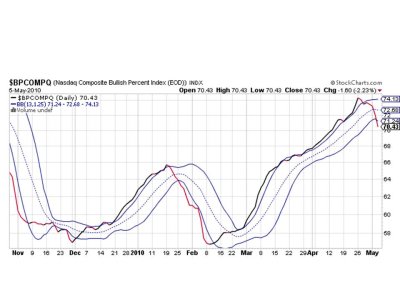

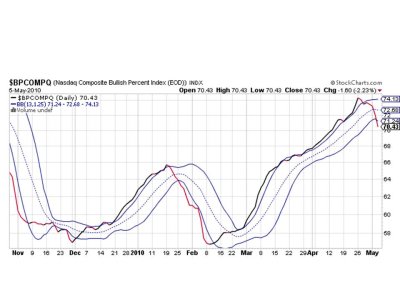

Cliff diving? Remember, anything over 70 is overbought and you have to get to 30 to get to oversold. That leaves a lot of room for further weakness if the strength we've come to expect for so long disappears.

So we have 5 of 7 signals on a sell, which leaves the system on a sell. Not much else to add expect to say be careful and good luck. See you tomorrow.

Fiscal concerns surrounding Greece, Portugal, Ireland, Italy, and Spain continued to draw market selling interest throughout the day, although the major averages did manage to retrace significant early morning losses before succumbing to selling pressure later in the day.

The Euro is going down about as fast as the dollar is going up. In fact the dollar saw an 11-month high against a collection of competing currencies early on and closed with a 1.0% gain.

Been a while since we've seen these levels, and the sell signal is only 3 days old.

Same here. Not a pretty picture.

We did manage to flip these two signals to buys today.

Cliff diving? Remember, anything over 70 is overbought and you have to get to 30 to get to oversold. That leaves a lot of room for further weakness if the strength we've come to expect for so long disappears.

So we have 5 of 7 signals on a sell, which leaves the system on a sell. Not much else to add expect to say be careful and good luck. See you tomorrow.