Once again, technology led stocks, but it was a mixed day among the major averages overall as the DOW fell 0.35%, the S&P was down 0.3% and the Nasdaq was up 0.6%. Banks and financial services saw significant selling pressure and where the main reason some of the averages couldn't stay in positive territory.

Among the headlines regarding banks today are these articles:

Fitch Downgrades UBS, Puts BofA, Others on Watch

BofA, Morgan and Goldman on Negative Credit Watch

Bank Layoffs Exceed 100,000: Where the Cuts Are

We did have some data released this morning. Initial jobless claims were down by 1,000 to 404,000, which was very close to estimates calling for 406,000 initial claims.

The August the trade deficit came in at $45.6 billion, which was a bit under estimates of $46.1 billion.

Here's today's charts:

NAMO and NYMO dipped just a bit today, but remain on buys.

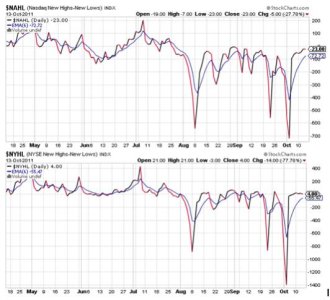

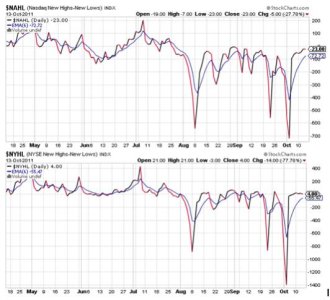

NAHL and NYHL continue to track sideways, but also remain on buys.

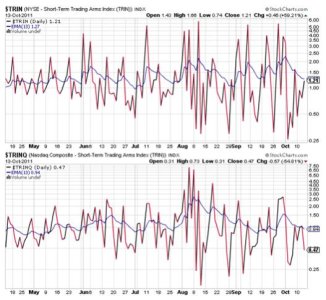

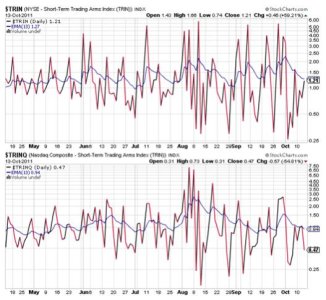

TRIN moved up to its neutral line and remained on a buy, while TRINQ dropped back into buy territory from a sell. Neither signal are very telling in the immediate term.

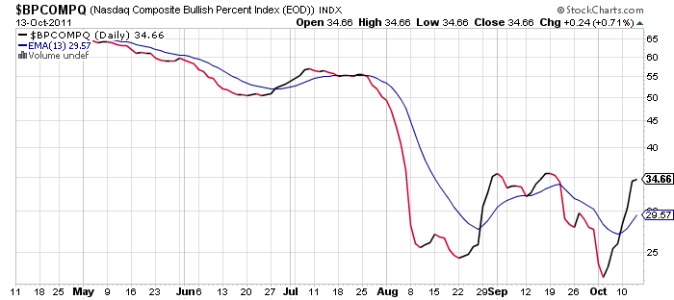

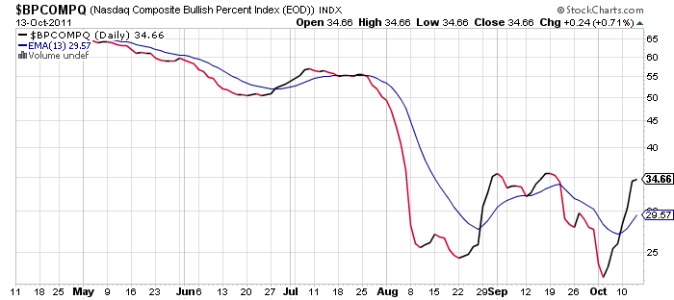

BPCOMPQ ebbed just a tad higher and remains firmly in buy territory.

So all signals remain in buy conditions, which keeps the system on a buy.

I remain 100% F fund, but I am not particularly bearish, although I do remain wary. Be aware though, that the low may be in for the time being and that we could see higher prices in the weeks ahead. At the same time though, global economic challenges have not gone away. But it's bearish sentiment that's driving this market right now and that's largely driven by bearish headlines. If and when the bears finally capitulate, we could head back down the ladder in a hurry.

It's no secret that this market has been challenging for even the most seasoned trader. And the media has been talking about that very thing for some time now. Everything from High Frequency Trading to Risk on - Risk off trading, European debt worries, joblessness, and housing market blues are some of the more notable reasons for the volatility and have made for hazardous trading conditions.

How long will this environment be with us? I see no end in sight myself. And for that reason, it may not be a bad idea to accumulate some stock funds over time on severe down legs and play this market from a longer term perspective. That's one option. There are many others. Each of us has to determine an individual investing plan, which can change over time as market conditions change. I have two ROTH IRAs that are very diversified, so I always have some measure of exposure to stocks and bonds and I make both regular monthly contributions and timed contributions (on severe down-legs). However, TSP is much, much more limiting in what they offer and I take a different approach to that account than I do the ROTHs. So think about what kind of investor you want to be and develop a keen understanding of how to execute your plan. It does takes time and energy, but your retirement deserves some measure of planning and execution.

Among the headlines regarding banks today are these articles:

Fitch Downgrades UBS, Puts BofA, Others on Watch

BofA, Morgan and Goldman on Negative Credit Watch

Bank Layoffs Exceed 100,000: Where the Cuts Are

We did have some data released this morning. Initial jobless claims were down by 1,000 to 404,000, which was very close to estimates calling for 406,000 initial claims.

The August the trade deficit came in at $45.6 billion, which was a bit under estimates of $46.1 billion.

Here's today's charts:

NAMO and NYMO dipped just a bit today, but remain on buys.

NAHL and NYHL continue to track sideways, but also remain on buys.

TRIN moved up to its neutral line and remained on a buy, while TRINQ dropped back into buy territory from a sell. Neither signal are very telling in the immediate term.

BPCOMPQ ebbed just a tad higher and remains firmly in buy territory.

So all signals remain in buy conditions, which keeps the system on a buy.

I remain 100% F fund, but I am not particularly bearish, although I do remain wary. Be aware though, that the low may be in for the time being and that we could see higher prices in the weeks ahead. At the same time though, global economic challenges have not gone away. But it's bearish sentiment that's driving this market right now and that's largely driven by bearish headlines. If and when the bears finally capitulate, we could head back down the ladder in a hurry.

It's no secret that this market has been challenging for even the most seasoned trader. And the media has been talking about that very thing for some time now. Everything from High Frequency Trading to Risk on - Risk off trading, European debt worries, joblessness, and housing market blues are some of the more notable reasons for the volatility and have made for hazardous trading conditions.

How long will this environment be with us? I see no end in sight myself. And for that reason, it may not be a bad idea to accumulate some stock funds over time on severe down legs and play this market from a longer term perspective. That's one option. There are many others. Each of us has to determine an individual investing plan, which can change over time as market conditions change. I have two ROTH IRAs that are very diversified, so I always have some measure of exposure to stocks and bonds and I make both regular monthly contributions and timed contributions (on severe down-legs). However, TSP is much, much more limiting in what they offer and I take a different approach to that account than I do the ROTHs. So think about what kind of investor you want to be and develop a keen understanding of how to execute your plan. It does takes time and energy, but your retirement deserves some measure of planning and execution.