There wasn't any particularly good news today, but a dip is a dip and once again buyers piled in quickly in fear of missing out on the next wave higher. Even a stronger dollar is being dismissed as a reason to sell as the market finished as strong as it began.

Last time the Seven Sentinels flipped from a sell to a buy in two trading days. This time it took just one day.

Yes, the Seven Sentinels flipped back to a buy today, which is consistent with market character.

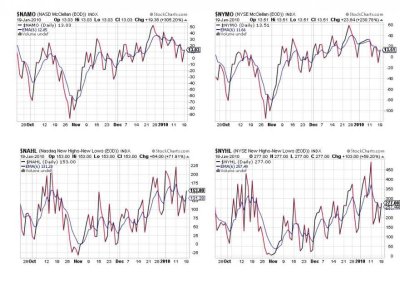

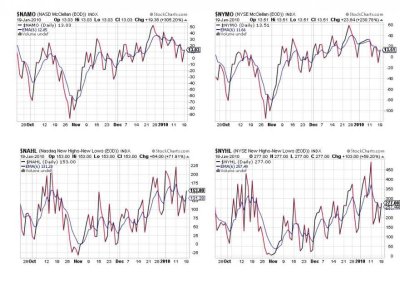

Here's the charts:

Now while NAMO and NYMO technically managed to flip back to a buy today, they did so right at their 6 day EMA, which is the minimum requirement to trigger a buy signal. But looking at those two signals it seems they are oscillating in a modestly declining slope. So I think caution is still warranted. NAHL and NYHL also flipped back to a buy today.

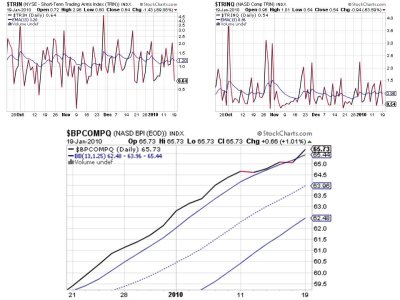

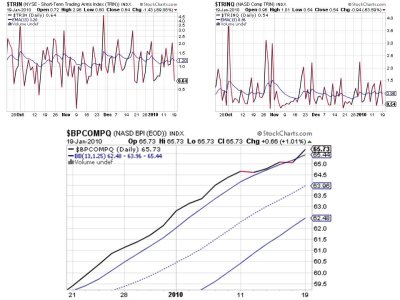

All three signals here are back to a buy as well.

Our Top 25 made no changes today, so they collectively continue to be evenly split in their stock/cash allocation.

So "technically" the Seven Sentinels are back in buy mode. I was/am looking for more pullback than the 1% we saw on Friday and I certainly wasn't expecting another whipsaw performance just one trading later, but I can't say I'm surprised. I don't know if I'll follow this signal or not yet as I'm not the only one looking for a bigger pullback. If we aren't down tomorrow morning I may move some cash into equities. This should get the pullback started. Da Boyz just want to see me capitulate first.

See you tomorrow.

Last time the Seven Sentinels flipped from a sell to a buy in two trading days. This time it took just one day.

Yes, the Seven Sentinels flipped back to a buy today, which is consistent with market character.

Here's the charts:

Now while NAMO and NYMO technically managed to flip back to a buy today, they did so right at their 6 day EMA, which is the minimum requirement to trigger a buy signal. But looking at those two signals it seems they are oscillating in a modestly declining slope. So I think caution is still warranted. NAHL and NYHL also flipped back to a buy today.

All three signals here are back to a buy as well.

Our Top 25 made no changes today, so they collectively continue to be evenly split in their stock/cash allocation.

So "technically" the Seven Sentinels are back in buy mode. I was/am looking for more pullback than the 1% we saw on Friday and I certainly wasn't expecting another whipsaw performance just one trading later, but I can't say I'm surprised. I don't know if I'll follow this signal or not yet as I'm not the only one looking for a bigger pullback. If we aren't down tomorrow morning I may move some cash into equities. This should get the pullback started. Da Boyz just want to see me capitulate first.

See you tomorrow.