The market took some time to digest yesterday's gains, finishing modestly lower on the day as a result.

Perhaps the tone was set by the initial jobless claims data, which came in at 445,000, which was above expectations. Continuing claims fell to 3.88 million, which was a 2 year low, but the market recognized that this reduction was most likely a result of expiring unemployment benefits and not due to job creation. The December Producer Price Index for December raised a few eyebrows as it came it a bit hot at 1.1%, but the core number was a more modest 0.2%. Our November trade deficit was $38.3 Billion, which was a relative non-event.

The debt auctions continued over in the EU as Italy and Spain's auctions showed continued interest in these debt offerings.

The euro rallied strongly while the dollar was trounced in currency action today, which is the main reason for the I fund's positive close.

So the market continues to look resilient and the downside very limited as a result. Here's this evening's charts:

NAMO and NYMO remain on buys.

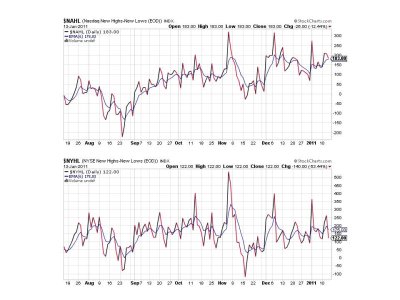

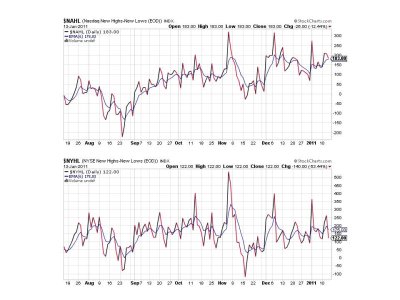

NAHL remains on a buy, but NYHL flipped to a sell.

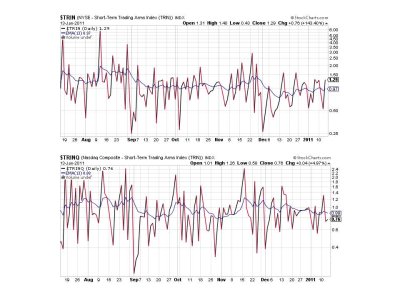

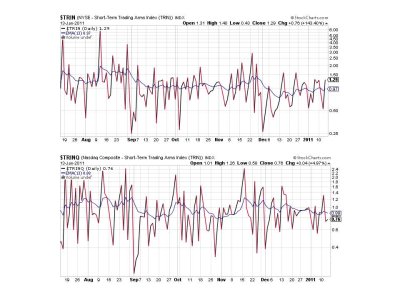

TRIN is a buy, while TRINQ is a sell.

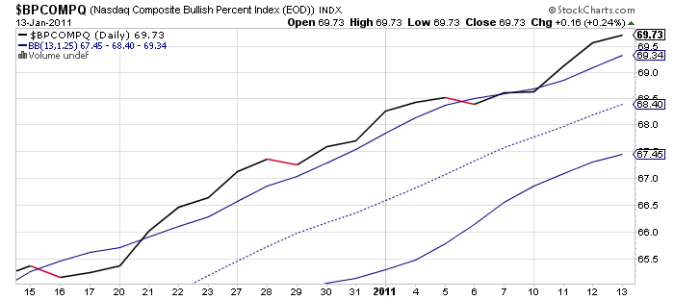

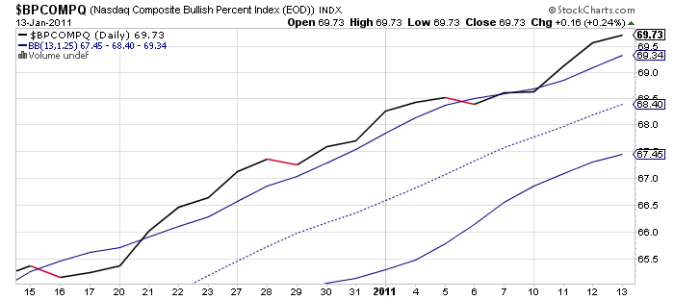

BPCOMPQ ebbed a bit higher today and remains in a bullish posture.

So 5 of 7 signals remain on a buy, which keeps the system on a buy. Earnings season is going to start picking up, especially next week, so there will be move information for the market to digest as a we move forward.

Perhaps the tone was set by the initial jobless claims data, which came in at 445,000, which was above expectations. Continuing claims fell to 3.88 million, which was a 2 year low, but the market recognized that this reduction was most likely a result of expiring unemployment benefits and not due to job creation. The December Producer Price Index for December raised a few eyebrows as it came it a bit hot at 1.1%, but the core number was a more modest 0.2%. Our November trade deficit was $38.3 Billion, which was a relative non-event.

The debt auctions continued over in the EU as Italy and Spain's auctions showed continued interest in these debt offerings.

The euro rallied strongly while the dollar was trounced in currency action today, which is the main reason for the I fund's positive close.

So the market continues to look resilient and the downside very limited as a result. Here's this evening's charts:

NAMO and NYMO remain on buys.

NAHL remains on a buy, but NYHL flipped to a sell.

TRIN is a buy, while TRINQ is a sell.

BPCOMPQ ebbed a bit higher today and remains in a bullish posture.

So 5 of 7 signals remain on a buy, which keeps the system on a buy. Earnings season is going to start picking up, especially next week, so there will be move information for the market to digest as a we move forward.