It's been awhile since we've seen some serious selling pressure, but we got some today as the S&P 500 and Nasdaq posted their worst losses since November. And if it wasn't for IBM's solid performance today, the DOW may have closed much lower than it's modest 0.11% too.

During the morning session, losses were not severe enough for me to consider lightening up as we've seen weakness yield to strength so many times in the past few weeks. But after our noon deadline passed it became more obvious that today's selling pressure might very well be enough to flip the Seven Sentinels to a sell condition. And after reviewing this evening's charts, that outcome was confirmed.

Market data did little to inspire the market either. December housing starts were down 4.3% to an annual rate of 529,000, a bit lower than the 550,000 that were expected. Building permits jumped 16.7% to an annual rate of 635,000, which was much higher than the anticipated 560,000.

Further weakness in the dollar kept the I fund from seeing a lower close as the greenback fell 0.5%.

Overall, it appears that profit taking is finally kicking in in earnest. Here's today's charts:

Both NAMO and NYMO spiked lower today, flipping both signals to sells as they penetrated back below the zero line into negative territory.

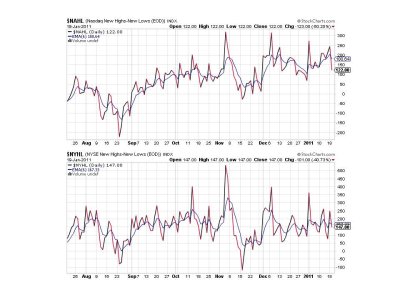

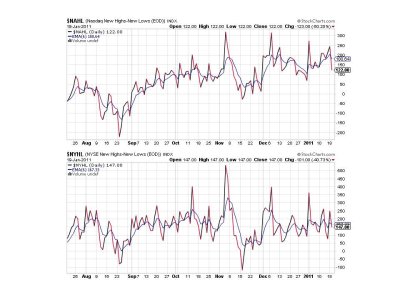

NAHL and NYHL don't look as bad, but they still both flipped to sells themselves.

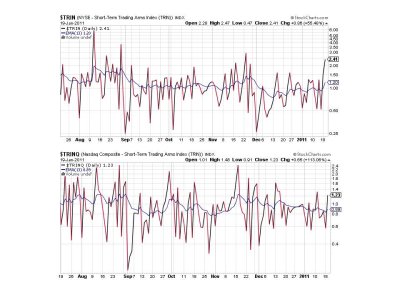

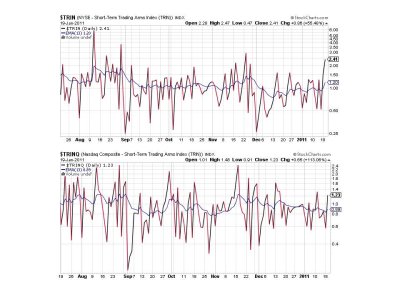

TRIN and TRINQ both spiked higher and flipped to sell conditions.

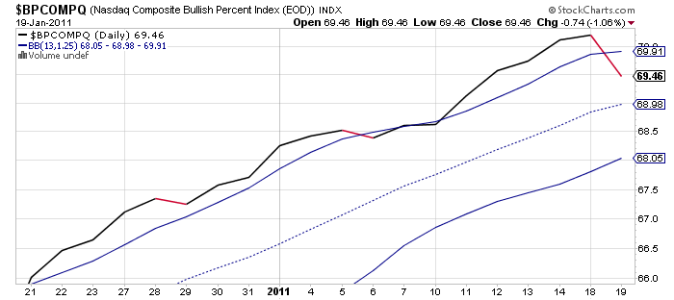

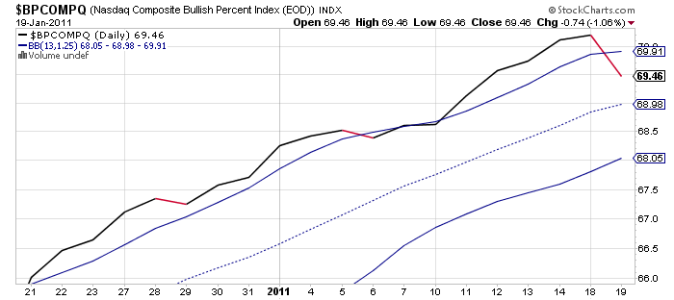

BPCOMPQ was the one signal that early on in the trading day I couldn't be sure would flip to a sell. But significant weakness in the Nasdaq continued to put pressure on this signal until it too rolled over.

So all signals are now flashing sells, which flips the system from a buy to a sell condition. As a result, I will be changing the 7-Sentinels on the tracker to an allocation of all G fund by the close of business tomorrow.

Generally speaking, I do not compare my system to anyone else's, but since Intrepid Timer got a buy signal today I would like to take this time to make sure my readers understand that the seven sentinels are designed as an intermediate term system, which typically means each signal should last between a couple weeks to several months. Intrepid Timer's system looks at shorter time frames. I don't want this to confuse anyone because we may very well bounce for a day or two before possibly turning back down again. In other words, depending on how the market unfolds both of our systems "may" be correct.

I cannot pretend to know what the market will do however. I can only read the tea leaves as the seven sentinels dictate. And right now they are telling me to get defensive.

During the morning session, losses were not severe enough for me to consider lightening up as we've seen weakness yield to strength so many times in the past few weeks. But after our noon deadline passed it became more obvious that today's selling pressure might very well be enough to flip the Seven Sentinels to a sell condition. And after reviewing this evening's charts, that outcome was confirmed.

Market data did little to inspire the market either. December housing starts were down 4.3% to an annual rate of 529,000, a bit lower than the 550,000 that were expected. Building permits jumped 16.7% to an annual rate of 635,000, which was much higher than the anticipated 560,000.

Further weakness in the dollar kept the I fund from seeing a lower close as the greenback fell 0.5%.

Overall, it appears that profit taking is finally kicking in in earnest. Here's today's charts:

Both NAMO and NYMO spiked lower today, flipping both signals to sells as they penetrated back below the zero line into negative territory.

NAHL and NYHL don't look as bad, but they still both flipped to sells themselves.

TRIN and TRINQ both spiked higher and flipped to sell conditions.

BPCOMPQ was the one signal that early on in the trading day I couldn't be sure would flip to a sell. But significant weakness in the Nasdaq continued to put pressure on this signal until it too rolled over.

So all signals are now flashing sells, which flips the system from a buy to a sell condition. As a result, I will be changing the 7-Sentinels on the tracker to an allocation of all G fund by the close of business tomorrow.

Generally speaking, I do not compare my system to anyone else's, but since Intrepid Timer got a buy signal today I would like to take this time to make sure my readers understand that the seven sentinels are designed as an intermediate term system, which typically means each signal should last between a couple weeks to several months. Intrepid Timer's system looks at shorter time frames. I don't want this to confuse anyone because we may very well bounce for a day or two before possibly turning back down again. In other words, depending on how the market unfolds both of our systems "may" be correct.

I cannot pretend to know what the market will do however. I can only read the tea leaves as the seven sentinels dictate. And right now they are telling me to get defensive.