Once again the market has taken us to the brink. A point at which it seems bad news will finally overwhelm prices and push the indicies to levels not seen in many months.

A contrarian will tell you this is the best time to buy stocks; when things look their worst. And we can certainly point to not only market fundamentals, but technicals as well to make that case. The economy doesn't look good from either perspective.

This morning we saw a disappointing ADP Employment Change Report that revealed private June payrolls increased by 13,000. Problem is 61,000 had been expected. The report everyone is talking about however, is the non-farm payroll number being released at the end of the week. Given today's ADP report why would anyone expect non-farm payrolls to shine? That report is expected to shock the market. We're being set-up for it. Check it out:

http://www.reuters.com/article/idUSN3020704920100630

http://www.businessweek.com/investor/content/jun2010/pi20100629_309715.htm

http://www.marketwatch.com/story/do...ts-boost-euro-2010-06-30?reflink=MW_news_stmp

The question now is how will the market react? We've already seen a down close 7 of the last 8 trading days. Is this news already priced in?

Volume today was actually a little on the light side until that late slide hit this afternoon. That gave today's bout of selling more weight and certainly casts a bearish pall going into end of the week trading.

Of course I can't be sure what's going to happen, but I'm thinking we're setting up for yet another big reveral. So many mechanical trading systems have turned down (the Sentinels are not far from it either) that a bottom would seem to be close at hand.

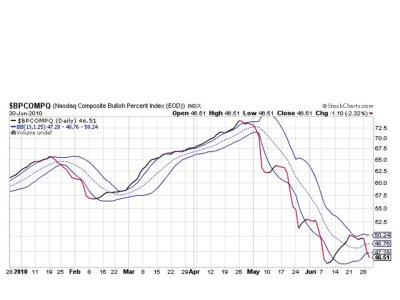

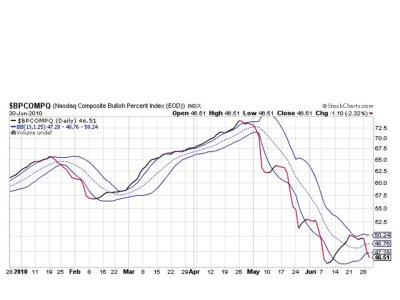

Yesterday, BPCOMPQ was the only signal still on a buy. But it too rolled over after today's late day selling pressure. But the system did not flip to a sell. Not yet anyway. Here's the charts:

Still flashing sells here.

NAHL and NYHL are also flashing sells, but did turn up just a bit today.

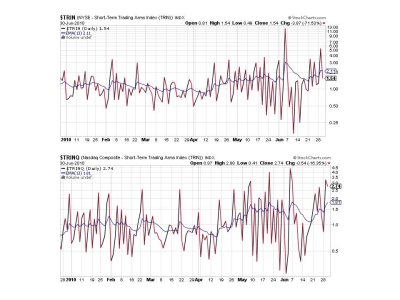

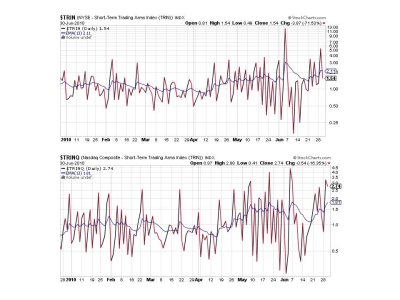

TRIN flipped back to a buy today, while TRINQ remained on a sell.

As you can see in this chart, BPCOMPQ penetrated the lower bollinger band and that triggers a sell for this signal.

But TRIN keeps the system on a buy as I still do not have all seven signals on sells simultaneously.

I will not be surprised if the Sentinels finally issue a sell by the end of this week. What bothers me though, is that this market is showing a propensity of triggering as many sell signals as possible before turning back up again. It's called whipsaw action. It's usually seen in shorter time frames, but longer term systems (like the SS) appear to be a target right now.

Again, I don't know what's going to happen, but I don't trust this market one way or the other. Other traders and systems that I watch are also seeing mixed signals. I am currently 100% S, but I don't see myself selling my position if the Sentinels roll over again. Those whipsaws are much more common than market crashes and it's the whipsaw that I'm more worried about. That makes me a buy and holder in this fast-paced market environment since this isn't a private trading account I'm working with.

That's it for this evening. See you tomorrow.

A contrarian will tell you this is the best time to buy stocks; when things look their worst. And we can certainly point to not only market fundamentals, but technicals as well to make that case. The economy doesn't look good from either perspective.

This morning we saw a disappointing ADP Employment Change Report that revealed private June payrolls increased by 13,000. Problem is 61,000 had been expected. The report everyone is talking about however, is the non-farm payroll number being released at the end of the week. Given today's ADP report why would anyone expect non-farm payrolls to shine? That report is expected to shock the market. We're being set-up for it. Check it out:

http://www.reuters.com/article/idUSN3020704920100630

http://www.businessweek.com/investor/content/jun2010/pi20100629_309715.htm

http://www.marketwatch.com/story/do...ts-boost-euro-2010-06-30?reflink=MW_news_stmp

The question now is how will the market react? We've already seen a down close 7 of the last 8 trading days. Is this news already priced in?

Volume today was actually a little on the light side until that late slide hit this afternoon. That gave today's bout of selling more weight and certainly casts a bearish pall going into end of the week trading.

Of course I can't be sure what's going to happen, but I'm thinking we're setting up for yet another big reveral. So many mechanical trading systems have turned down (the Sentinels are not far from it either) that a bottom would seem to be close at hand.

Yesterday, BPCOMPQ was the only signal still on a buy. But it too rolled over after today's late day selling pressure. But the system did not flip to a sell. Not yet anyway. Here's the charts:

Still flashing sells here.

NAHL and NYHL are also flashing sells, but did turn up just a bit today.

TRIN flipped back to a buy today, while TRINQ remained on a sell.

As you can see in this chart, BPCOMPQ penetrated the lower bollinger band and that triggers a sell for this signal.

But TRIN keeps the system on a buy as I still do not have all seven signals on sells simultaneously.

I will not be surprised if the Sentinels finally issue a sell by the end of this week. What bothers me though, is that this market is showing a propensity of triggering as many sell signals as possible before turning back up again. It's called whipsaw action. It's usually seen in shorter time frames, but longer term systems (like the SS) appear to be a target right now.

Again, I don't know what's going to happen, but I don't trust this market one way or the other. Other traders and systems that I watch are also seeing mixed signals. I am currently 100% S, but I don't see myself selling my position if the Sentinels roll over again. Those whipsaws are much more common than market crashes and it's the whipsaw that I'm more worried about. That makes me a buy and holder in this fast-paced market environment since this isn't a private trading account I'm working with.

That's it for this evening. See you tomorrow.