Anxiety gave way to a bit of fear today as the major averages fell hard under significant selling pressure. On the day, the S&P 500 dropped 2.03% to close at 1304.89, while the DOW dropped 1.59% and the Nasdaq a hefty 2.65%. Of particular note was that the S&P 500 closed under its 50-day moving average, but remains well above its 200-day moving average.

Earnings continue to impress overall, but the big concern for the market is the stalemate over the debt ceiling limit, which was blamed for today's very negative tone.

Not helping matters was a disappointing durable goods order, which showed a 2.1% drop for June. Estimates had called for about a 0.5% rise. Also weighing heavily on the market was the Fed's Beige Book, which revealed a slowing economy.

I had mentioned in yesterday's blog that one more day of moderate selling pressure would probably flip the Seven Sentinels to a confirmed sell signal. And that's what happened today. Let's look at the charts:

NAMO and NYMO plunged today and fell much deeper into negative territory. Both are firmly in sell conditions. NYMO easily tagged a new 28-day trading low, which is key to confirming a sell signal.

NAHL and NYHL also fell lower and remain on sells.

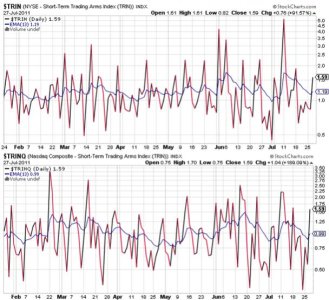

TRIN and TRINQ both spike higher and flipped to sells in the process. They are only suggesting a modestly oversold market so a bounce tomorrow is hardly a given.

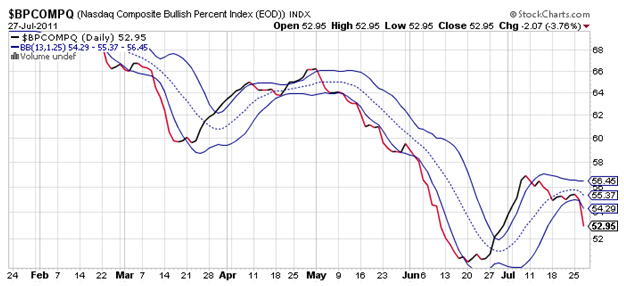

BPCOMPQ took a plunge today and looks very bearish. It too remains in a sell condition.

So all signals are now flashing sells with NYMO hitting a 28-day trading low in the process. That officially flips the Seven Sentinels to an intermediate term sell condition.

It's very difficult to take positions on these signals after such large market movements as technical conditions tend to get somewhat extreme. That's often when reversals happen, which is partly why I went from a 100% G fund position to a 100% S fund position today. I may be early, but the S&P 500 fell back to a level I felt was a reasonable entry point. I also note the rising anxiety and bearishness among traders, which also influenced my decision. Of course the wild card continues to be the debt talks, which could lead to a credit rating adjustment depending on how the situation plays out.

It may not have been a comfortable decision to go all-in today, but I have to take my buy signals when I can and not let fear leave me on the sidelines. It won't take long before I'll know whether it was a good decision or not.