The market didn't gap lower at the open this morning, but it sure didn't take long before another steep decline took hold to take the broader market down well over 1% in the first hour of trading. The S&P 500 fell as low as 1234.56 before sharply reversing those losses in large measure over the following hour. It continued to look dicey for the bulls for another couple of hours, but eventually stocks chopped their way back to the neutral line before staging a final rally in the last hour of trade to close with moderate gains.

Once again, economic data failed to impress even as the July ADP Employment Report showed private payrolls were up by 114,000, which was better than estimates. The July ISM Services Index dipped to 52.7, which was lower than estimates that called for it to improve to 53.7. June factory orders fell 0.8%, which was actually "good" news as estimates called for a 1% drop.

The dollar continued its fall with a loss of 0.7% against a basket of currencies, while market share volume was relatively high for the fourth session in a row.

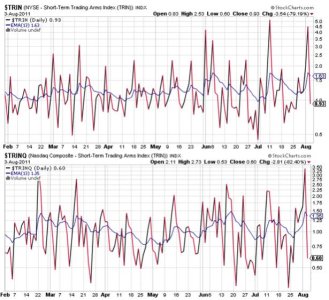

Yesterday I had pointed out that TRIN and TRINQ were highly suggestive of a bounce, and while we didn't retrace much of the previous losses, we did have a healthy intra-day rally off the early lows, and that counts for something. But this market still has a lot to prove, because the S&P remains below the its 200 day moving average and much technical damage has been done.

Let's take a look at the charts:

NAMO and NYMO bounced a bit of their lows today, but are still deep in negative territory. This is an area that I would expect to see some measure of a rally, but if the game has really changed we may not see a lot of traction and may actually see continued selling pressure instead.

Internals continued to fall as shown by NAHL and NYHL. That's not an encouraging sign.

TRIN and TRINQ fell back to buy conditions.

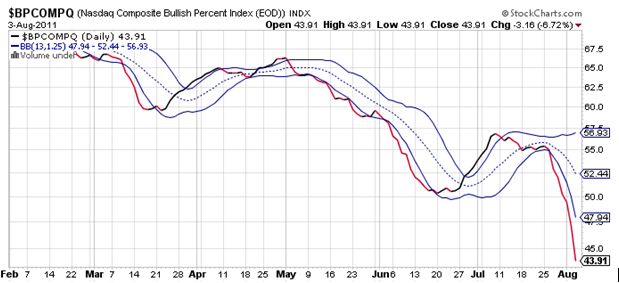

No relief from BPCOMPQ. It continued its plunge and that's not good news for bulls.

So while some signals flipped back to buys, the system remains in an official sell condition.

Believe it or not, I am neutral here. Not comfortably neutral, just neutral. The market is ripe for a sustained move higher off today's lows, but there's little technical evidence as of yet that might happen. I would think bullish sentiment took a hit today and I'd like to believe that the powers that be will try to keep this market from plunging much further, but economically things really aren't good on a global scale. And that reality may finally be catching up with prices. The Seven Sentinels did flip to an official sell signal back on 27 July, and that signal was certainly a good one. I tend to think that while we may see some buying interest here and there, this sell signal may be around for a bit.