After three strong up days, the market reversed hard today. And chances are it won't be a one day event. Momentum seems to be swinging for several trading days at a time. First in one direction, then another.

Most of today's tone seems to be rooted in overseas data. Continued concerns involving higher interest rates and Greece's debt situation came back into focus. And in China, news that consumer prices spiked by 5.3% also didn't sit well with market forces.

And the dollar seems to be suggesting that its recent strength may not be particularly short term. Two big gains totaling about 2.4% last week were reversed during the first two trading days this week, but only by about 0.6% total. Today's reversal took that back and then some as the dollar gained 1.0% by the close.

Coinciding with a drop in the dollar was more weakness in the CRB Commodity Index, which fell 3.0%.

So now what? Here's the charts:

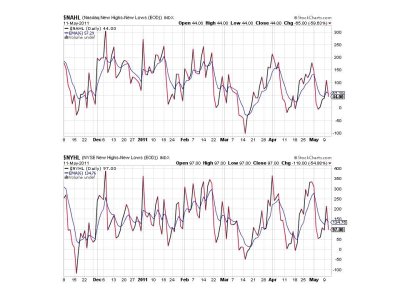

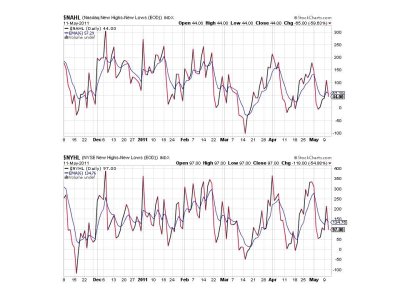

NAMO and NYMO have reversed back to a sell condition today. The question is whether downside momentum will carry them further to the downside. I can't be sure looking at these two charts, but a potential answer may be found elsewhere.

NAHL and NYHL also flipped back to sells today.

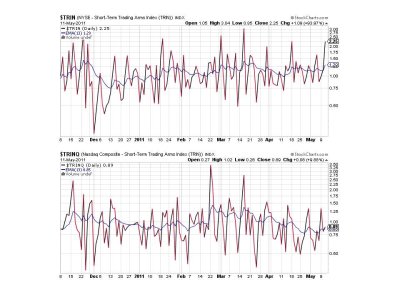

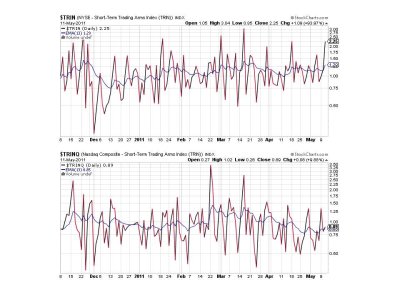

As did TRIN and TRINQ. TRIN suggests an oversold condition, but TRINQ does not.

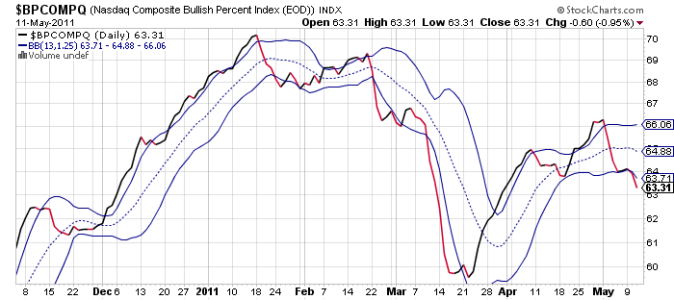

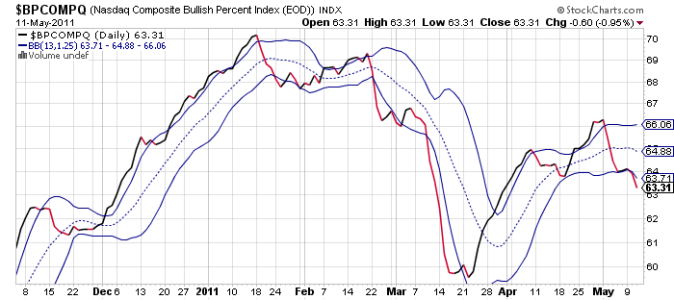

BPCOMPQ dropped lower still and remains on a sell. That means I have another "unconfirmed" sell signal here, but the system itself remains in a buy condition as NYMO has not hit a 28 day trading low.

Yesterday I said BPCOMPQ was suspect because in spite of an impressive rally, this signal saw very little movement to the upside and yesterday actually declined a bit. Further, this signal went to sell on May 2nd and has never re-triggered a buy. Today it fell below the lower bollinger band, which gives it a better chance to flip to a buy condition as it's much closer to crossing back up through that lower band than it was to the upper band. A positive cross of either of those bands can trigger a buy condition. But this signal seems to be finding it easier to drop than to rise.

Why is this important?

Because the direction of BPCOMPQ is proportional to the direction of the market. When this signal is trending up, so is the market. The same holds true when it is trending down. This makes reversals in BPCOMPQ important markers, as it indicates the market is reversing its trend. And right now it certainly seems to be saying the trend is down. But prices haven't fallen in proportion to this signal.

This could, at least in part, be due to Fed liquidity. It could also be that we're forming a complex top, which can be a volatile event that takes time to play out.

I also noticed that prior to today's selling pressure, a lot of traders seemed to be thinking higher prices down the road were a given. It wasn't a question of if, but when. And that may be true, but too many seemed to be jumping on that bandwagon too quickly, so more selling pressure may be on tap to ensure they back off that bullish tone.

It's tough to pick entry and exit points when the market acts like this. Especially with our limitations. But it looks like another dip is forming, so I'll be watching NAMO and NYMO again for another clue on when momentum might shift. But BPCOMPQ suggests that could be a risky bet if the trend eventually confirms a downward tack is developing.

Most of today's tone seems to be rooted in overseas data. Continued concerns involving higher interest rates and Greece's debt situation came back into focus. And in China, news that consumer prices spiked by 5.3% also didn't sit well with market forces.

And the dollar seems to be suggesting that its recent strength may not be particularly short term. Two big gains totaling about 2.4% last week were reversed during the first two trading days this week, but only by about 0.6% total. Today's reversal took that back and then some as the dollar gained 1.0% by the close.

Coinciding with a drop in the dollar was more weakness in the CRB Commodity Index, which fell 3.0%.

So now what? Here's the charts:

NAMO and NYMO have reversed back to a sell condition today. The question is whether downside momentum will carry them further to the downside. I can't be sure looking at these two charts, but a potential answer may be found elsewhere.

NAHL and NYHL also flipped back to sells today.

As did TRIN and TRINQ. TRIN suggests an oversold condition, but TRINQ does not.

BPCOMPQ dropped lower still and remains on a sell. That means I have another "unconfirmed" sell signal here, but the system itself remains in a buy condition as NYMO has not hit a 28 day trading low.

Yesterday I said BPCOMPQ was suspect because in spite of an impressive rally, this signal saw very little movement to the upside and yesterday actually declined a bit. Further, this signal went to sell on May 2nd and has never re-triggered a buy. Today it fell below the lower bollinger band, which gives it a better chance to flip to a buy condition as it's much closer to crossing back up through that lower band than it was to the upper band. A positive cross of either of those bands can trigger a buy condition. But this signal seems to be finding it easier to drop than to rise.

Why is this important?

Because the direction of BPCOMPQ is proportional to the direction of the market. When this signal is trending up, so is the market. The same holds true when it is trending down. This makes reversals in BPCOMPQ important markers, as it indicates the market is reversing its trend. And right now it certainly seems to be saying the trend is down. But prices haven't fallen in proportion to this signal.

This could, at least in part, be due to Fed liquidity. It could also be that we're forming a complex top, which can be a volatile event that takes time to play out.

I also noticed that prior to today's selling pressure, a lot of traders seemed to be thinking higher prices down the road were a given. It wasn't a question of if, but when. And that may be true, but too many seemed to be jumping on that bandwagon too quickly, so more selling pressure may be on tap to ensure they back off that bullish tone.

It's tough to pick entry and exit points when the market acts like this. Especially with our limitations. But it looks like another dip is forming, so I'll be watching NAMO and NYMO again for another clue on when momentum might shift. But BPCOMPQ suggests that could be a risky bet if the trend eventually confirms a downward tack is developing.