On Monday's weakness I opted to follow my short term buy signal and upped my stock exposure to 60%. On Tuesday the stock market took off and never looked back, closing well above resistance on the S&P. I wasn't sure I'd get another gift dip to buy into as that rally seemed to be making a statement to the bears. But we got one today and so I deployed the rest of my capital, including a 20% allocation to the F fund, which has been a steady performer all year.

This morning saw some negative data released in the form of the September ADP Employment Change, which saw payrolls fall by -39,000 instead of the +18,000 economists had expected. However, data for the prior month was revised upward an additional +10,000. But the damage was done and stocks slid.

I know many traders are looking for signs that the bond bubble is nearing an end, but I personally see no end in sight. In fact, today the yields on 2-year, 3-year, 5-year, and 7-year notes set record lows. Even the 10-year Note caught a bid and saw its yield drop below 2.40%, while the 30-year Note dropped to 3.67%.

Of course most of us TSPers saw the I fund outperform today, which was an indication of how the dollar was trading. And of course that was down as it fell another 0.5% against competing currencies.

The fun continues tomorrow as the weekly jobless claims and consumer credit numbers for August are scheduled to be released.

Hope the bears are ready with their shorts. I know I'm ready.

Here's the charts:

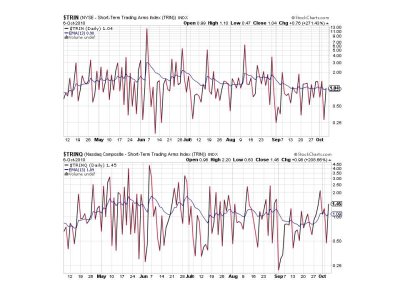

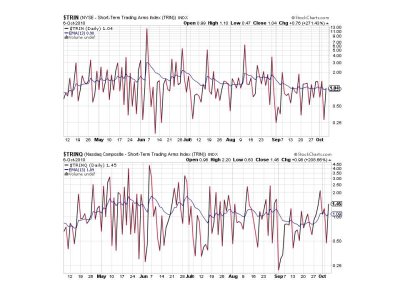

One sell and one neutral reading here. Certainly nothing to get excited about.

Both NAHL and NYHL remain on buys, but close to their 6 day EMAs.

Two sells here, but nothing dramatic.

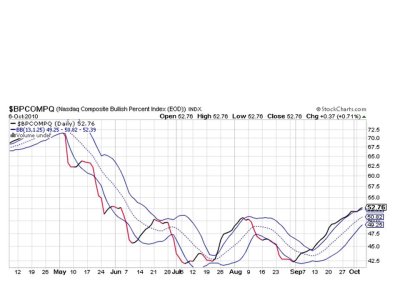

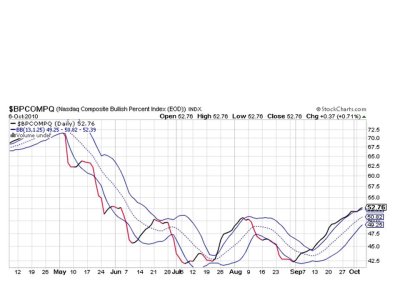

BPCOMPQ actually put some air between it and that upper bollinger band. I always feel a little easier when this signal acts bullish.

So the Sentinels are showing 3 buys, 3 sells, and 1 neutral reading, which keeps the system on a buy. All systems are go for now and I'm loaded for bear. See you tomorrow.

This morning saw some negative data released in the form of the September ADP Employment Change, which saw payrolls fall by -39,000 instead of the +18,000 economists had expected. However, data for the prior month was revised upward an additional +10,000. But the damage was done and stocks slid.

I know many traders are looking for signs that the bond bubble is nearing an end, but I personally see no end in sight. In fact, today the yields on 2-year, 3-year, 5-year, and 7-year notes set record lows. Even the 10-year Note caught a bid and saw its yield drop below 2.40%, while the 30-year Note dropped to 3.67%.

Of course most of us TSPers saw the I fund outperform today, which was an indication of how the dollar was trading. And of course that was down as it fell another 0.5% against competing currencies.

The fun continues tomorrow as the weekly jobless claims and consumer credit numbers for August are scheduled to be released.

Hope the bears are ready with their shorts. I know I'm ready.

Here's the charts:

One sell and one neutral reading here. Certainly nothing to get excited about.

Both NAHL and NYHL remain on buys, but close to their 6 day EMAs.

Two sells here, but nothing dramatic.

BPCOMPQ actually put some air between it and that upper bollinger band. I always feel a little easier when this signal acts bullish.

So the Sentinels are showing 3 buys, 3 sells, and 1 neutral reading, which keeps the system on a buy. All systems are go for now and I'm loaded for bear. See you tomorrow.