Back up the channel we go.

Now that the European Union has dodged another bullet (for the moment), it appears the market has something to cheer about again. A lawsuit filed to prevent Germany from providing more support towards European Union bailouts was tossed out by a German court. That sent the bourses into a significant rally of 3% to 4%, which then carried over into our own market.

From yesterday's intra-day low to today's closing price, the S&P 500 has rallied almost 5%. Resistance is not all that far off at this point, so should this market build on today's gains, it should be interesting to see if it can jump the creek for more than a day or two. That's assuming it even gets that far.

Here's today's charts:

NAMO and NYMO crossed back into buy territory today, but for now it's just a one day bounce unless more buyers pile in. And this is September, which is a historically weak month.

NAHL and NYHL also flipped back to buys. I should point out again, as I did a few blogs ago, that internals haven't done too bad in spite of the severe selling pressure this market has endured. That could be interpreted as a sign of some measure of strength.

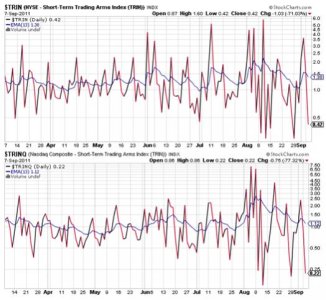

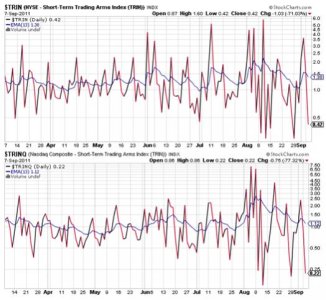

TRIN and TRINQ both spiked to very low levels are highly suggestive of an overbought market. We've seen this before in recent weeks, and it generally means weakness will follow very soon, but not always. But this is a bear market and once again it is September. (Sorry for the bearish tone, but it is what it is.)

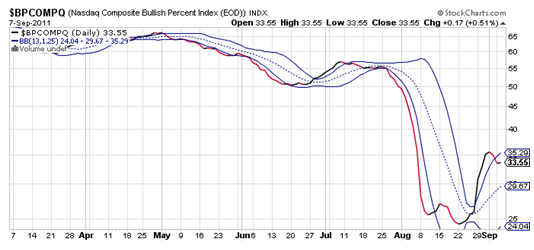

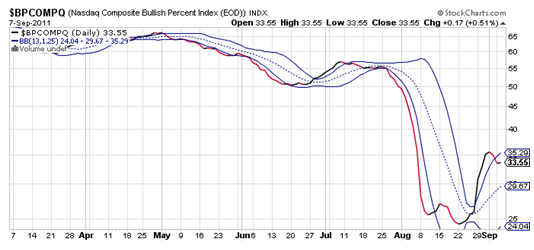

BPCOMPQ ticked a bit sideways and remains on a sell for now. This signal often gives us an early warning of longer term weakness when it turns lower into a sell condition. It may be early, but refer to my comment above about bear markets and the month of September.

So the signals are mixed and the system remains in a buy condition for now.

I continue to be uncomfortable with this market and prefer to preserve capital vice chase upward momentum. Today's rally is actually an extension of the bounce off the lows yesterday, which means if you bought this market today, you paid a premium price now that the S&P is back near 1200 again. And even if I believed another 2% or 3% upside may be coming I don't think it's worth the downside risk. In my view, a better opportunity could easily present itself later in the month.

Now that the European Union has dodged another bullet (for the moment), it appears the market has something to cheer about again. A lawsuit filed to prevent Germany from providing more support towards European Union bailouts was tossed out by a German court. That sent the bourses into a significant rally of 3% to 4%, which then carried over into our own market.

From yesterday's intra-day low to today's closing price, the S&P 500 has rallied almost 5%. Resistance is not all that far off at this point, so should this market build on today's gains, it should be interesting to see if it can jump the creek for more than a day or two. That's assuming it even gets that far.

Here's today's charts:

NAMO and NYMO crossed back into buy territory today, but for now it's just a one day bounce unless more buyers pile in. And this is September, which is a historically weak month.

NAHL and NYHL also flipped back to buys. I should point out again, as I did a few blogs ago, that internals haven't done too bad in spite of the severe selling pressure this market has endured. That could be interpreted as a sign of some measure of strength.

TRIN and TRINQ both spiked to very low levels are highly suggestive of an overbought market. We've seen this before in recent weeks, and it generally means weakness will follow very soon, but not always. But this is a bear market and once again it is September. (Sorry for the bearish tone, but it is what it is.)

BPCOMPQ ticked a bit sideways and remains on a sell for now. This signal often gives us an early warning of longer term weakness when it turns lower into a sell condition. It may be early, but refer to my comment above about bear markets and the month of September.

So the signals are mixed and the system remains in a buy condition for now.

I continue to be uncomfortable with this market and prefer to preserve capital vice chase upward momentum. Today's rally is actually an extension of the bounce off the lows yesterday, which means if you bought this market today, you paid a premium price now that the S&P is back near 1200 again. And even if I believed another 2% or 3% upside may be coming I don't think it's worth the downside risk. In my view, a better opportunity could easily present itself later in the month.