No, the Seven Sentinels did not go to a sell today, so we haven't yet been put between a rock and a hard spot deciding whether to ride it out or bail with no IFTs left. But we certainly need to see some upside action soon to avoid that situation.

Right now this market is not about our domestic economic data. We appear to have an unwinding of currency trades and a fear of a Greece contagion driving the action. As you know the Euro has been tanking in spite of the bail-out package that was agreed to last weekend. But the dollar and Yen are gaining strength. This is resulting in some significant volatility in the markets right now. And that means whipsaw action.

So happens next? I have no answers to that question, but I don't believe we're about to fall off the table. At least not just yet. Let's look at the charts:

Both NAMO and NYMO flipped to sells today. They are in moderately negative territory at this point.

NAHL and NYHL also flipped to sells.

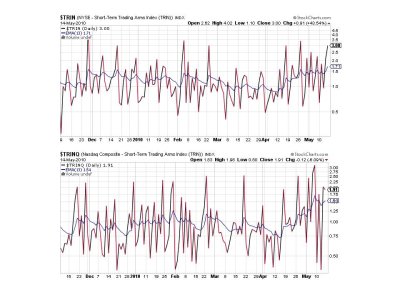

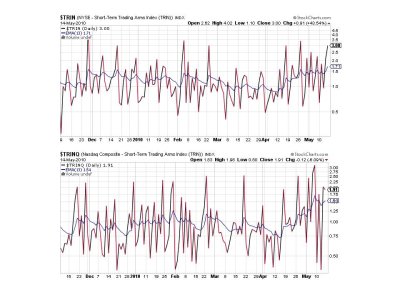

TRIN and TRINQ flipped to sells too.

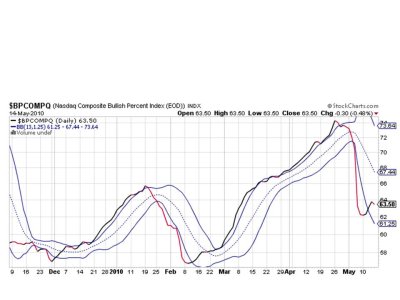

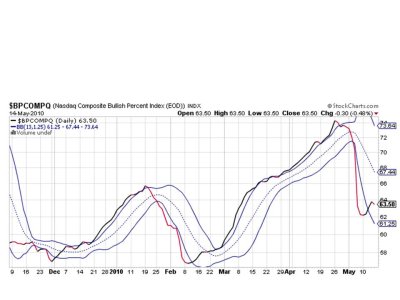

BPCOMPQ is the lone buy signal right now, and that's keeping the system on a buy.

Market uncertainty is probably going to make for some volatile trading in the coming days. But we do have some positives. Along with the SS being on a buy, our sentiment survey is also on a buy for next week, and after the past two days I think it probably went from a neutral stance to a bullish one.

We also saw how the Central Banks stepped in last week to prop up the Euro. It may have failed to this point, but they probably have more tricks up their collective sleeves. So intervention is a very real possibility.

I'm still waiting for the tracker to get updated, but the Top 50 and the Top 15 have about a 64% stock exposure each. While the Top 50 have certainly been much more bullish in the past, I still think that's a healthy stock position.

Monday is coming up. Will it be like so many other Monday's of the past 8 months or so? If it's not then something may indeed have changed. But all we can do for now is wait and see.

I'll be posting the updated Top 15 and Top 50 charts later this weekend. See you then.

Right now this market is not about our domestic economic data. We appear to have an unwinding of currency trades and a fear of a Greece contagion driving the action. As you know the Euro has been tanking in spite of the bail-out package that was agreed to last weekend. But the dollar and Yen are gaining strength. This is resulting in some significant volatility in the markets right now. And that means whipsaw action.

So happens next? I have no answers to that question, but I don't believe we're about to fall off the table. At least not just yet. Let's look at the charts:

Both NAMO and NYMO flipped to sells today. They are in moderately negative territory at this point.

NAHL and NYHL also flipped to sells.

TRIN and TRINQ flipped to sells too.

BPCOMPQ is the lone buy signal right now, and that's keeping the system on a buy.

Market uncertainty is probably going to make for some volatile trading in the coming days. But we do have some positives. Along with the SS being on a buy, our sentiment survey is also on a buy for next week, and after the past two days I think it probably went from a neutral stance to a bullish one.

We also saw how the Central Banks stepped in last week to prop up the Euro. It may have failed to this point, but they probably have more tricks up their collective sleeves. So intervention is a very real possibility.

I'm still waiting for the tracker to get updated, but the Top 50 and the Top 15 have about a 64% stock exposure each. While the Top 50 have certainly been much more bullish in the past, I still think that's a healthy stock position.

Monday is coming up. Will it be like so many other Monday's of the past 8 months or so? If it's not then something may indeed have changed. But all we can do for now is wait and see.

I'll be posting the updated Top 15 and Top 50 charts later this weekend. See you then.