-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Alternate LMBF methods

- Thread starter Cactus

- Start date

Cactus

TSP Pro

- Reaction score

- 38

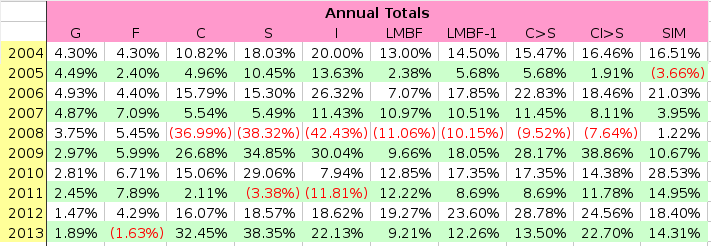

Now that 2013 is behind us, here are the updated tables including 2013's returns. This now gives us 10 years of data to look at.

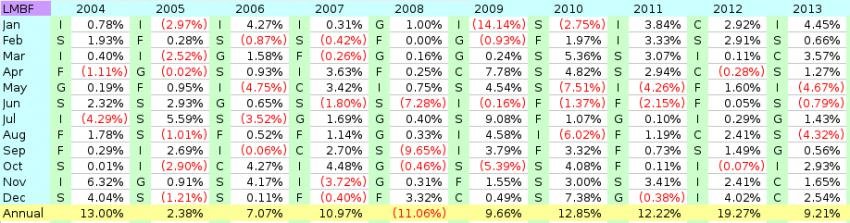

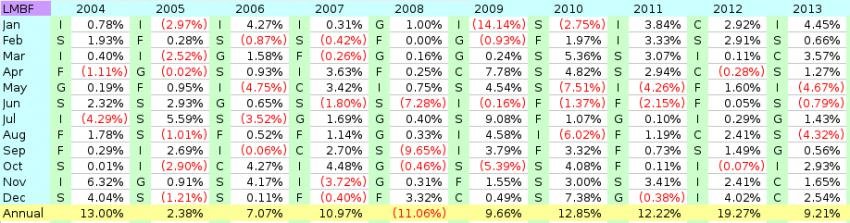

Table 1: LMBF Returns

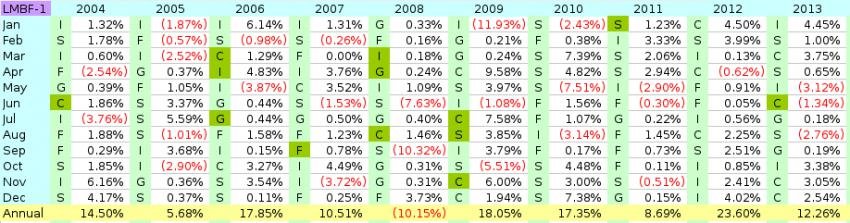

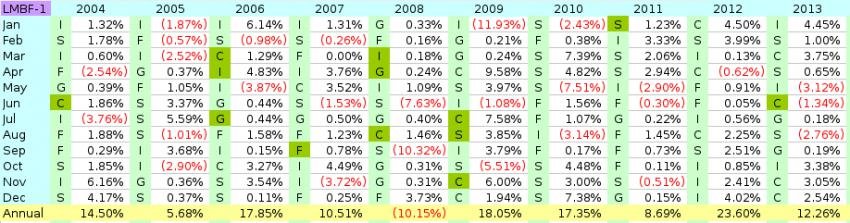

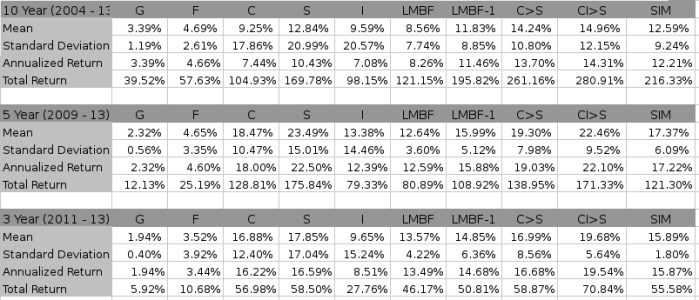

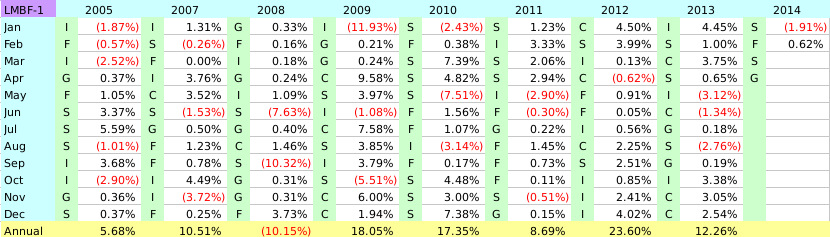

Table 2: LMBF-1 Day Returns

Note: The olive colored fund blocks represents months where the LMBF-1 chose a different fund from LMBF. This table also corrects the Nov 2009 Fund label that appeared in post #2 of this thread.

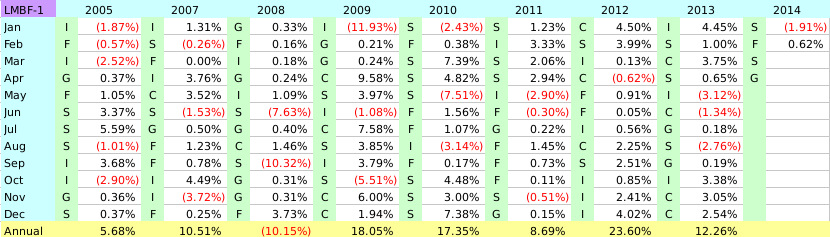

Table 3: LMBF-1 SIM (seasonal variant) Returns

Note: The olive colored fund blocks represents months where the SIM chose a different fund from LMBF-1.

Table 4: LMBF-1 C>S Returns

Note: The olive colored fund blocks represents months where the C>S chose a different fund from LMBF-1.

Table 5: LMBF-1 CI>S Returns

Note: The olive colored fund blocks represents months where the CI>S chose a different fund from LMBF-1.

Table 1: LMBF Returns

Table 2: LMBF-1 Day Returns

Note: The olive colored fund blocks represents months where the LMBF-1 chose a different fund from LMBF. This table also corrects the Nov 2009 Fund label that appeared in post #2 of this thread.

Table 3: LMBF-1 SIM (seasonal variant) Returns

Note: The olive colored fund blocks represents months where the SIM chose a different fund from LMBF-1.

Table 4: LMBF-1 C>S Returns

Note: The olive colored fund blocks represents months where the C>S chose a different fund from LMBF-1.

Table 5: LMBF-1 CI>S Returns

Note: The olive colored fund blocks represents months where the CI>S chose a different fund from LMBF-1.

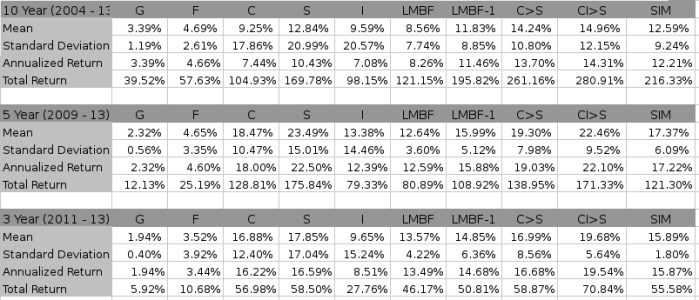

Now that 2013 is behind us, here are the updated tables including 2013's returns. This now gives us 10 years of data to look at.

Hey Cactus, thanks SOO MUCH for taking the time to compile these figures. I think it's such a great asset for us all. Now if I can get a pair of those sticky pants that Birchtree has so I don't abandon the market and stay disciplined to the system - any system...

I used the "manual" approach for this, so buyer beware, but using your tables, I came up with these 10 year total returns:

85.57 - lmbf

118.34 - lmbf-1

125.91 lmbf-1 SIM

142.40 - lmbf-1 C>S

149.58 - lmbf-1 CI>S

Any way you cut it, pretty darned good if you ask me.

Thanks again, and Happy New Year!

Cactus

TSP Pro

- Reaction score

- 38

jonfresno, I think you summed all the returns. It's is even more impressive when you take compounding into effect. Here are some more stats for you.

Here are the annual returns of these Methods/Funds for 10 years:

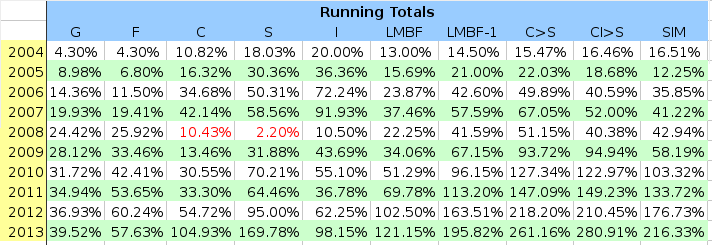

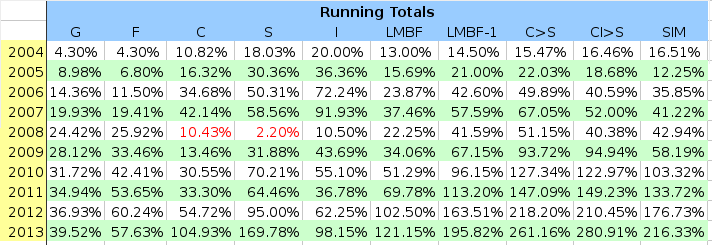

Here are the Running Totals:

Here are some stats on the 3, 5, & 10 year returns:

The Standard Deviations here is a measure of risk and volatility. If you want more information on that or on how to compute things like Total Return or Annualized return you can check out this thread (shameless plug) here: http://www.tsptalk.com/mb/ta-tools/18517-introduction-measuring-risk-tsp-funds.html

Note that the Annualized Return is what I term CAGR in that article.

Here are the annual returns of these Methods/Funds for 10 years:

Here are the Running Totals:

Here are some stats on the 3, 5, & 10 year returns:

The Standard Deviations here is a measure of risk and volatility. If you want more information on that or on how to compute things like Total Return or Annualized return you can check out this thread (shameless plug) here: http://www.tsptalk.com/mb/ta-tools/18517-introduction-measuring-risk-tsp-funds.html

Note that the Annualized Return is what I term CAGR in that article.

Cactus

TSP Pro

- Reaction score

- 38

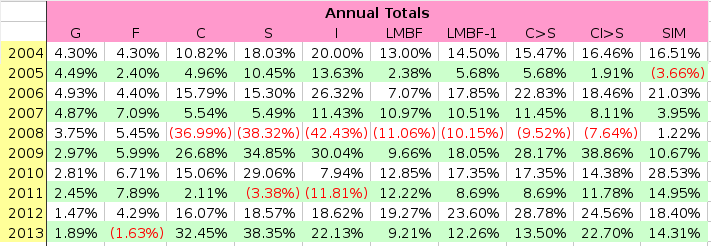

OK, December is finished so lets see how these Methods finished out the year.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMWF[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="align: right"]5.18%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="align: right"]1.36%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"]0.66%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.07%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]0.88%[/TD]

[TD="align: right"]3.57%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]0.88%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Apr[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"]1.02%[/TD]

[TD="align: right"]1.93%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]5.32%[/TD]

[TD="align: right"]1.27%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]1.02%[/TD]

[TD="bgcolor: #FF99CC, align: left"]May[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"] (1.78%) [/TD]

[TD="align: right"]2.34%[/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"] (3.12%)

[/TD]

[TD="align: right"] (4.67%) [/TD]

[TD="align: right"] (3.12%) [/TD]

[TD="align: right"] (3.12%) [/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"] (1.78%) [/TD]

[TD="align: right"]2.71%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jun[/TD]

[TD="align: right"]0.14%[/TD]

[TD="align: right"] (1.53%)

[/TD]

[TD="align: right"] (1.34%) [/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"] (2.77%) [/TD]

[TD="align: right"] (0.79%) [/TD]

[TD="align: right"] (1.34%) [/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"] (1.53%) [/TD]

[TD="align: right"] (1.53%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Jul[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]5.10%[/TD]

[TD="align: right"]6.88%[/TD]

[TD="align: right"]5.29%[/TD]

[TD="align: right"]1.43%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]5.29%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Aug[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"] (0.48%)

[/TD]

[TD="align: right"] (2.89%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (1.31%) [/TD]

[TD="align: right"] (4.32%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (0.48%) [/TD]

[TD="align: right"] (0.48%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Sep[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]3.14%[/TD]

[TD="align: right"]5.89%[/TD]

[TD="align: right"]7.41%[/TD]

[TD="align: right"]0.56%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]3.14%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Oct[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.89%[/TD]

[TD="align: right"]4.60%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]3.38%[/TD]

[TD="align: right"]2.93%[/TD]

[TD="align: right"]3.38%[/TD]

[TD="align: right"]3.38%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]0.89%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Nov[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"] (0.35%) [/TD]

[TD="align: right"]3.05%[/TD]

[TD="align: right"]2.49%[/TD]

[TD="align: right"]0.75%[/TD]

[TD="align: right"]1.65%[/TD]

[TD="align: right"]3.05%[/TD]

[TD="align: right"]2.49%[/TD]

[TD="align: right"]2.49%[/TD]

[TD="align: right"]3.05%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Dec[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.89%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.68%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"]32.45%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]38.35%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]22.13%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]9.21%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]12.26%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]13.50%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]22.70%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]14.31%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]11.12%[/TD]

Well-oh-well didn't all these methods finish out the year nicely. They did in fact end up well off their lows as we have been speculating. Who would have thought that in September. Hope your emotions didn't scare you out at the bottom.

The best fund turned out to be the S Fund which helped C>S and CI>S extend their lead. As I pointed out when we researched the C>S method, C is followed by S 2/3 of the time so this was expected. It was the back-to-back C Fund months that was the surprise.

The C Fund wasn't that far behind in 2nd place, so the remaining LMBF variants performed almost as well as those in the S Fund. We had nice returns in December all the way around.

Of course this was a Buy-N-Hold year, so maybe it wasn't a good test for following these methods. The C, S, or I Funds are the clear winners this year. If you had held any one or combination of these all year you would be ahead of most all our methods. I say most all because CI>S did finally manage to squeak ahead of the I Fund in December. The fact remains it was easier to make money by parking your funds in equities and leaving it there all year. But who knew? It won't be like that every year.

Then there was LMWF. Last month it was still above all but one of the LMBF family. This month it finds itself below all but one of them. That's quite a drop in position, but not so much in return. It's more like the LMBF-1 methods caught up and overtook LMWF. Hey, 11+% is a respectable return. Still, I wouldn't recommend it. I won't be commenting on it further in 2014, so if you are still interested in it, feel free to post the IFTs and performance on this thread.

We will see how things go in 2014. Every year is different and maybe 2014 is more conducive to trading.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMWF[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="align: right"]5.18%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]6.96%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="align: right"]1.36%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"]0.66%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]1.00%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]0.07%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]0.88%[/TD]

[TD="align: right"]3.57%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]4.69%[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]0.88%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Apr[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"]1.02%[/TD]

[TD="align: right"]1.93%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]5.32%[/TD]

[TD="align: right"]1.27%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]0.65%[/TD]

[TD="align: right"]1.02%[/TD]

[TD="bgcolor: #FF99CC, align: left"]May[/TD]

[TD="align: right"]0.12%[/TD]

[TD="align: right"] (1.78%) [/TD]

[TD="align: right"]2.34%[/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"] (3.12%)

[/TD]

[TD="align: right"] (4.67%) [/TD]

[TD="align: right"] (3.12%) [/TD]

[TD="align: right"] (3.12%) [/TD]

[TD="align: right"]2.71%[/TD]

[TD="align: right"] (1.78%) [/TD]

[TD="align: right"]2.71%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jun[/TD]

[TD="align: right"]0.14%[/TD]

[TD="align: right"] (1.53%)

[/TD]

[TD="align: right"] (1.34%) [/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"] (2.77%) [/TD]

[TD="align: right"] (0.79%) [/TD]

[TD="align: right"] (1.34%) [/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"] (0.99%) [/TD]

[TD="align: right"] (1.53%) [/TD]

[TD="align: right"] (1.53%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Jul[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]5.10%[/TD]

[TD="align: right"]6.88%[/TD]

[TD="align: right"]5.29%[/TD]

[TD="align: right"]1.43%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.13%[/TD]

[TD="align: right"]5.29%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Aug[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"] (0.48%)

[/TD]

[TD="align: right"] (2.89%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (1.31%) [/TD]

[TD="align: right"] (4.32%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (2.76%) [/TD]

[TD="align: right"] (0.48%) [/TD]

[TD="align: right"] (0.48%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Sep[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]3.14%[/TD]

[TD="align: right"]5.89%[/TD]

[TD="align: right"]7.41%[/TD]

[TD="align: right"]0.56%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]3.14%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Oct[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.89%[/TD]

[TD="align: right"]4.60%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]3.38%[/TD]

[TD="align: right"]2.93%[/TD]

[TD="align: right"]3.38%[/TD]

[TD="align: right"]3.38%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]0.89%[/TD]

[TD="align: right"]0.19%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Nov[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"] (0.35%) [/TD]

[TD="align: right"]3.05%[/TD]

[TD="align: right"]2.49%[/TD]

[TD="align: right"]0.75%[/TD]

[TD="align: right"]1.65%[/TD]

[TD="align: right"]3.05%[/TD]

[TD="align: right"]2.49%[/TD]

[TD="align: right"]2.49%[/TD]

[TD="align: right"]3.05%[/TD]

[TD="align: right"]0.18%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Dec[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]2.94%[/TD]

[TD="align: right"]2.54%[/TD]

[TD="align: right"] (0.56%) [/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.89%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.68%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"]32.45%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]38.35%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]22.13%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]9.21%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]12.26%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]13.50%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]22.70%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]14.31%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]11.12%[/TD]

Well-oh-well didn't all these methods finish out the year nicely. They did in fact end up well off their lows as we have been speculating. Who would have thought that in September. Hope your emotions didn't scare you out at the bottom.

The best fund turned out to be the S Fund which helped C>S and CI>S extend their lead. As I pointed out when we researched the C>S method, C is followed by S 2/3 of the time so this was expected. It was the back-to-back C Fund months that was the surprise.

The C Fund wasn't that far behind in 2nd place, so the remaining LMBF variants performed almost as well as those in the S Fund. We had nice returns in December all the way around.

Of course this was a Buy-N-Hold year, so maybe it wasn't a good test for following these methods. The C, S, or I Funds are the clear winners this year. If you had held any one or combination of these all year you would be ahead of most all our methods. I say most all because CI>S did finally manage to squeak ahead of the I Fund in December. The fact remains it was easier to make money by parking your funds in equities and leaving it there all year. But who knew? It won't be like that every year.

Then there was LMWF. Last month it was still above all but one of the LMBF family. This month it finds itself below all but one of them. That's quite a drop in position, but not so much in return. It's more like the LMBF-1 methods caught up and overtook LMWF. Hey, 11+% is a respectable return. Still, I wouldn't recommend it. I won't be commenting on it further in 2014, so if you are still interested in it, feel free to post the IFTs and performance on this thread.

We will see how things go in 2014. Every year is different and maybe 2014 is more conducive to trading.

Hallatauer

TSP Strategist

- Reaction score

- 6

Wow.... what a crappy month for equities. C,S,I all heavy in the red. At least the S Fund we have been in took the smallest hit out of the three. Unless there is a huge spike today, which isn't showing itself at all right now, the IFT looks like F Fund. We'll see the final numbers for the LMBF-1 month today after the COB.

Cactus

TSP Pro

- Reaction score

- 38

Here are the monthly returns as of 1/30/2014.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 30-Jan-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.21%[/TD]

[TD="bgcolor: #99CC00, align: right"]1.47%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (2.82%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.39%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (3.53%) [/TD]

The best fund is F so the following IFTs take place before noon eastern tomorrow, 1/31/2014:

LMBF-1 changes from the S Fund to the F Fund

LMBF-1 SIM changes from the S Fund to the F Fund

LMBF-1 C>S changes from the S Fund to the F Fund

LMBF-1 CI>S changes from the S Fund to the F Fund

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 30-Jan-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.21%[/TD]

[TD="bgcolor: #99CC00, align: right"]1.47%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (2.82%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.39%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (3.53%) [/TD]

LMBF-1 changes from the S Fund to the F Fund

LMBF-1 SIM changes from the S Fund to the F Fund

LMBF-1 C>S changes from the S Fund to the F Fund

LMBF-1 CI>S changes from the S Fund to the F Fund

Cactus

TSP Pro

- Reaction score

- 38

Here are the monthly returns as of 2/27/2014.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 27-Feb-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.17%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.62%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]4.29%[/TD]

[TD="bgcolor: #99CC00, align: right"]5.66%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]4.91%[/TD]

The best fund is S so the following IFTs take place before noon eastern tomorrow, 2/28/2014:

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 27-Feb-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.17%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.62%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]4.29%[/TD]

[TD="bgcolor: #99CC00, align: right"]5.66%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]4.91%[/TD]

- LMBF-1 changes from the F Fund to the S Fund

- LMBF-1 SIM changes from the F Fund to the S Fund

- LMBF-1 C>S changes from the F Fund to the S Fund

- LMBF-1 CI>S changes from the F Fund to the S Fund

Cactus

TSP Pro

- Reaction score

- 38

Here are the monthly returns as of 3/28/2014.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 28-Mar-2014 [/TD]

[TD="bgcolor: #99CC00, align: right"]0.17%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (0.13%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.05%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (2.22%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.16%) [/TD]

The best fund is G so the following IFTs take place before noon eastern Monday, 3/31/2014:

Note: that a good day on Monday could put LMBF into the C Fund for April. It has already diverged from the LMBF-1 family in March, being in I instead of S. It looks like that will work out for LMBF this month.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 28-Mar-2014 [/TD]

[TD="bgcolor: #99CC00, align: right"]0.17%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (0.13%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.05%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (2.22%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.16%) [/TD]

- LMBF-1 changes from the S Fund to the G Fund

- LMBF-1 SIM changes from the S Fund to the G Fund

- LMBF-1 C>S changes from the S Fund to the G Fund

- LMBF-1 CI>S changes from the S Fund to the G Fund

Note: that a good day on Monday could put LMBF into the C Fund for April. It has already diverged from the LMBF-1 family in March, being in I instead of S. It looks like that will work out for LMBF this month.

Cactus

TSP Pro

- Reaction score

- 38

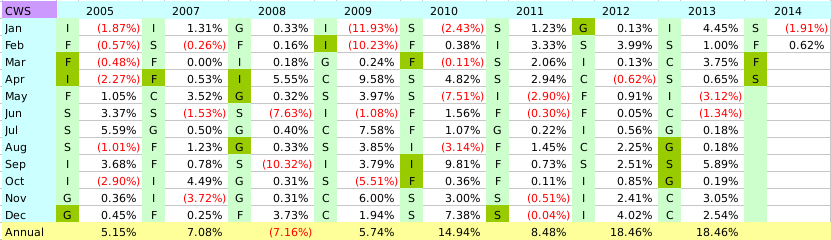

I pointed out in my last posts that we are being whipsawed again. This also happened last summer and begs the questions: 1) does this happen often? 2) Can we do anything about it? Well, in order to see we are being whipsawed, a fair amount of past performance must have already gone by and then we must ask: 3) is it too late to do anything about it?

I'll start by defining whipsawing. I see it as alternating months switching between equities (C, S, or I) and safety (G or F). The minimum amount of time it takes to see this is two months gone by as we make our choice for the third month. This was the case at the end of February (S to F to S).

So we can't take any action until the third month. Is this too late? Well, I don't know. The more basic question is what can we do? The way I see it we have three choices: 1) Do nothing -- keep following LMBF-1. 2) Don't participate. Stay put in the fund you are in until the whipsawing ends. 3) Choose a contrarian strategy opposite to the LMBF-1 choice to try to benefit from the whipsawing. Notice that if we implement 3 by choosing the best fund two months ago instead of the previous month (getting out of sync with the whipsaw) we end up with the same choice for the third month for options 2 and 3. Does this work?

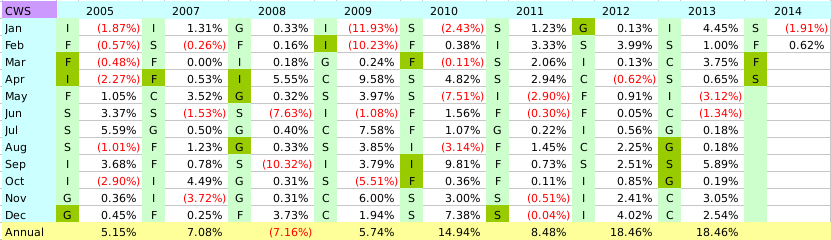

I have posted two tables below. The first lists the LMBF-1. The second, labeled CWS (Contrarian WhipSaw), shows where we tried to do something about it. The olive colored fund blocks start at the third month of the whipsaw. I have left out the years 2004 & 2006 as they had no whipsawing.

The first thing I notice is there are 5 occurrences of single blocks and 4 out of 5 of them resulted in worse choices. That comes as no surprise as we pulled out right when the whipsawing ends and suffered the consequences. That would speak against options 2 and 3 and indicate that it probably is too late to do anything about whipsawing. For those wondering where I got only 5 blocks from, don't forget that Dec 2011 wraps around into Jan 2012 so those aren't single blocks.

OK, what about those runs of two or more months. Do they produce better results. Well, look at the numbers. Yes, the first months in the run do produce better results but they all end and that end produces worse results just like the single blocks. We always end worse off. But half the blocks are runs of two or more. How does that all average out? Look at the annual returns. You get better returns with CWS in a couple of years but for most of them you do worse.

The total returns for the years listed is: LMBF-1 119.23% , CWS 93.41%. That tells me this doesn't work and you are better off just following LMBF-1. Sure if you knew in advance when the whipsawing was going to start and stop you could do better, but then why use LMBF at all? Just time the market and be so kind as to tell the rest of us.

I'll start by defining whipsawing. I see it as alternating months switching between equities (C, S, or I) and safety (G or F). The minimum amount of time it takes to see this is two months gone by as we make our choice for the third month. This was the case at the end of February (S to F to S).

So we can't take any action until the third month. Is this too late? Well, I don't know. The more basic question is what can we do? The way I see it we have three choices: 1) Do nothing -- keep following LMBF-1. 2) Don't participate. Stay put in the fund you are in until the whipsawing ends. 3) Choose a contrarian strategy opposite to the LMBF-1 choice to try to benefit from the whipsawing. Notice that if we implement 3 by choosing the best fund two months ago instead of the previous month (getting out of sync with the whipsaw) we end up with the same choice for the third month for options 2 and 3. Does this work?

I have posted two tables below. The first lists the LMBF-1. The second, labeled CWS (Contrarian WhipSaw), shows where we tried to do something about it. The olive colored fund blocks start at the third month of the whipsaw. I have left out the years 2004 & 2006 as they had no whipsawing.

The first thing I notice is there are 5 occurrences of single blocks and 4 out of 5 of them resulted in worse choices. That comes as no surprise as we pulled out right when the whipsawing ends and suffered the consequences. That would speak against options 2 and 3 and indicate that it probably is too late to do anything about whipsawing. For those wondering where I got only 5 blocks from, don't forget that Dec 2011 wraps around into Jan 2012 so those aren't single blocks.

OK, what about those runs of two or more months. Do they produce better results. Well, look at the numbers. Yes, the first months in the run do produce better results but they all end and that end produces worse results just like the single blocks. We always end worse off. But half the blocks are runs of two or more. How does that all average out? Look at the annual returns. You get better returns with CWS in a couple of years but for most of them you do worse.

The total returns for the years listed is: LMBF-1 119.23% , CWS 93.41%. That tells me this doesn't work and you are better off just following LMBF-1. Sure if you knew in advance when the whipsawing was going to start and stop you could do better, but then why use LMBF at all? Just time the market and be so kind as to tell the rest of us.

userque

TSP Legend

- Reaction score

- 36

I pointed out in my last posts that we are being whipsawed again. This also happened last summer and begs the questions: 1) does this happen often? 2) Can we do anything about it? Well, in order to see we are being whipsawed, a fair amount of past performance must have already gone by and then we must ask: 3) is it too late to do anything about it?

Has anyone considered basing the trading decision on fund performances as of the middle of the month AND the end of the month?

In the middle of the month, you would enter the best performing fund since the start of the month. At the end of the month, you would enter the best performing fund SINCE the middle of the month.

This would utilize both of your IFT's rather than see one go to 'waste' each month.

Has anyone ran the numbers on something like this?

(Variations include using a set date for the 'middle.' Using the start of the month rather than the end. And entering the WORST fund rather than the best.)

:blink:

Cactus

TSP Pro

- Reaction score

- 38

Yes, that's been mentioned several times on the Last Month's Best Fund Method Strategy thread. Here is a time (post 339 on 12/06/2012) where ILoveTDs computed some returns: http://www.tsptalk.com/mb/longer-te...-best-fund-method-strategy-29.html#post385079

They seam to produce more disapointing results because you are more likely to just be chasing gains instead of following an intermediate (~20 day) trend.

They seam to produce more disapointing results because you are more likely to just be chasing gains instead of following an intermediate (~20 day) trend.

Last edited:

Hallatauer

TSP Strategist

- Reaction score

- 6

Just got back from a two week trip with mostly no internet access to see a disappointing month again. Just have to remind myself my goals are long term. A bad month or two is to be expected.

userque

TSP Legend

- Reaction score

- 36

Yes, that's been mentioned several times on the Last Month's Best Fund Method Strategy thread. Here is a time (post 339 on 12/06/2012) where ILoveTDs computed some returns: http://www.tsptalk.com/mb/longer-te...-best-fund-method-strategy-29.html#post385079

They seam to produce more disapointing results because you are more likely to just be chasing gains instead of following an intermediate (~20 day) trend.

Thanks! Link worked. Should have known you guys would have thought of it already

Last edited:

Cactus

TSP Pro

- Reaction score

- 38

With the first quarter behind us, here are the results for the first three months of 2014:

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.21%[/TD]

[TD="align: right"]1.58%[/TD]

[TD="align: right"] (3.45%)

[/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (4.03%) [/TD]

[TD="align: right"] (1.82%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]4.58%[/TD]

[TD="align: right"]5.43%[/TD]

[TD="align: right"]5.58%[/TD]

[TD="align: right"] (2.82%)

[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"] (0.15%)

[/TD]

[TD="align: right"]0.85% [/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.57%)

[/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.58%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.06%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.83%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.70%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.75%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (3.15%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

The first thing you will notice is that all 5 TSP funds are positive for the year while all the LMBF Methods are negative. OUCH! What happened?

Well, this isn't the first quarter of 2013. You will remember last year the LMBF family wasn't doing as well as Buy-N-Hold of C and/or S. Yes, but at least we were making money. True, but in 2013 it was hard not to make money and this is not 2013.

The thing to notice here is that we did see results like this in 2013, but that happened from June through September. We didn't go negative because we started from a higher base later in the year, but we did lose money. Why? Whipsawing! We were in the market to lose the money and out of the market for the recovery. Simply put -- we zigged when we should have zagged. We were repeatedly out of sync with what's going on for months at a time. Is there anything we can do about it? Not really. Check out my analysis on whipsawing a couple of post back (Post #110) to see why. Just keep in mind that the whipsawing does stop eventually. If you can't live with that, this method is not for you.

The next thing to notice is that the four LMBF-1 Methods have not diverged from each other but they have diverged from LMBF in March and April. LMBF went into the I Fund in March while the LMBF-1 family went into the S Fund. This proved advantageous for LMBF as the I Fund didn't lose as much as the S Fund. LMBF actually made money in March because it was still in the February allocation (F Fund) on the first trading day of March. That helped to make up (but not quite) for the 3% hit it took on the first trading day in February while it was still in the S Fund.

Now in April LMBF and the LMBF-1 family have really diverged, of course, as LMBF remains in equities (C Fund this time) while the LMBF-1 family heads to the safety of the G Fund. It remains to be seen which method made the wiser choice, but it does look like LMBF-1 is still being whipsawed while LMBF just broke out of it. April has historically been a good month for equities. Let's see if this helps LMBF propel past LMBF-1 in May.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.21%[/TD]

[TD="align: right"]1.58%[/TD]

[TD="align: right"] (3.45%)

[/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (4.03%) [/TD]

[TD="align: right"] (1.82%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]4.58%[/TD]

[TD="align: right"]5.43%[/TD]

[TD="align: right"]5.58%[/TD]

[TD="align: right"] (2.82%)

[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"] (0.15%)

[/TD]

[TD="align: right"]0.85% [/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.57%)

[/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.58%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.06%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.83%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.70%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.75%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (3.15%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.98%) [/TD]

Well, this isn't the first quarter of 2013. You will remember last year the LMBF family wasn't doing as well as Buy-N-Hold of C and/or S. Yes, but at least we were making money. True, but in 2013 it was hard not to make money and this is not 2013.

The thing to notice here is that we did see results like this in 2013, but that happened from June through September. We didn't go negative because we started from a higher base later in the year, but we did lose money. Why? Whipsawing! We were in the market to lose the money and out of the market for the recovery. Simply put -- we zigged when we should have zagged. We were repeatedly out of sync with what's going on for months at a time. Is there anything we can do about it? Not really. Check out my analysis on whipsawing a couple of post back (Post #110) to see why. Just keep in mind that the whipsawing does stop eventually. If you can't live with that, this method is not for you.

The next thing to notice is that the four LMBF-1 Methods have not diverged from each other but they have diverged from LMBF in March and April. LMBF went into the I Fund in March while the LMBF-1 family went into the S Fund. This proved advantageous for LMBF as the I Fund didn't lose as much as the S Fund. LMBF actually made money in March because it was still in the February allocation (F Fund) on the first trading day of March. That helped to make up (but not quite) for the 3% hit it took on the first trading day in February while it was still in the S Fund.

Now in April LMBF and the LMBF-1 family have really diverged, of course, as LMBF remains in equities (C Fund this time) while the LMBF-1 family heads to the safety of the G Fund. It remains to be seen which method made the wiser choice, but it does look like LMBF-1 is still being whipsawed while LMBF just broke out of it. April has historically been a good month for equities. Let's see if this helps LMBF propel past LMBF-1 in May.

Cactus

TSP Pro

- Reaction score

- 38

Here are the monthly returns as of 4/29/2014.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 29-Apr-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.19%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.65%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.44%[/TD]

[TD="bgcolor: #CCFFCC, align: right"](3.04%)[/TD]

[TD="bgcolor: #99CC00, align: right"]1.15%[/TD]

The best fund is I so the following IFTs take place before noon eastern Tomorrow, 4/30/2014:

Note that LMBF-1 SIM will be in the F Fund until November.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 29-Apr-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.19%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.65%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.44%[/TD]

[TD="bgcolor: #CCFFCC, align: right"](3.04%)[/TD]

[TD="bgcolor: #99CC00, align: right"]1.15%[/TD]

- LMBF-1 changes from the G Fund to the I Fund

- LMBF-1 SIM changes from the G Fund to the F Fund

- LMBF-1 C>S changes from the G Fund to the I Fund

- LMBF-1 CI>S changes from the G Fund to the S Fund

Note that LMBF-1 SIM will be in the F Fund until November.

Cactus

TSP Pro

- Reaction score

- 38

With April behind us, here are the results for the first four months of 2014.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.21%[/TD]

[TD="align: right"]1.58%[/TD]

[TD="align: right"] (3.45%)

[/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (4.03%) [/TD]

[TD="align: right"] (1.82%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]4.58%[/TD]

[TD="align: right"]5.43%[/TD]

[TD="align: right"]5.58%[/TD]

[TD="align: right"] (2.82%) [/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"] (0.15%) [/TD]

[TD="align: right"]0.85%[/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.57%) [/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Apr[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.90%[/TD]

[TD="align: right"]0.75%[/TD]

[TD="align: right"] (2.47%) [/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"]0.44%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.78%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.98%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.59%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.17%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.28%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (2.72%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

Just like last month, the first thing you will notice is that all 5 TSP funds are positive for the year while all the LMBF Methods are negative. Things are getting better for the LMBF Methods, though. They all had positive returns in April, so their YTD is not as negative as last month. Also notice that the S Fund suffered quite a loss in April and is barely hanging on to its positive YTD. That is something you may want to consider if you are following one of the >S variants.

Speaking of the variants, how do they compare to each other? Well, that's hard to say because all the LMBF-1 variants were in the same funds through April and we only started to get separation there in May. That leaves us comparing LMBF to LMBF-1. As we can see from the table, LMBF came out ahead by being in the C Fund instead of the G Fund. This helped bring the difference between the two methods to under 1% now. It would have been even better had LMBF stayed in the I Fund from the previous month, but that's not how these methods work. After all, it could also have been worse if LMBF had chosen the S Fund. We did not have gains across all equities. This under performance of the S Fund with respect to the C & I is something we want to keep an eye on.

With a 3rd of the year behind us what can we say about the LMBF methods now compared to last year. 2014 is a different year from 2013. Anyone can see that. It is not a buy and hold year like 2013 was. Still, if you did buy and hold any of our 5 Funds you would be better off than any of the LMBF Methods today. That doesn't speak too well for us right now: different year, different market, same results.

I could throw in the explanation of the whipsaw we endured this year, but that is just making excuses and may still be going on for LMBF-1 for all we know. The whipsaw or any excuses are just a part of the method and must be considered together over the long term. The system either works or it doesn't. You've seen the historical returns from previous posts in this thread. Do they work? Maybe I'm wrong, but I don't think 2014 is any different. Maybe it's another 2005 where the returns aren't that great, but that's still too early to tell. It could equally well turn into a year like 2011 where LMBF keeps you from losing as much as holding equities all year.

We will just have to keep following these methods to see what happens. It certainly is more interesting (and I think realistic) than the previous year where the markets only went up, up, and up.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.21%[/TD]

[TD="align: right"]1.58%[/TD]

[TD="align: right"] (3.45%)

[/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (4.03%) [/TD]

[TD="align: right"] (1.82%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="align: right"] (1.91%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]4.58%[/TD]

[TD="align: right"]5.43%[/TD]

[TD="align: right"]5.58%[/TD]

[TD="align: right"] (2.82%) [/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"] (0.15%) [/TD]

[TD="align: right"]0.85%[/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.57%) [/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"] (0.69%)

[/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="align: right"] (0.69%) [/TD]

[TD="bgcolor: #FF99CC, align: left"]Apr[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.90%[/TD]

[TD="align: right"]0.75%[/TD]

[TD="align: right"] (2.47%) [/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"]0.44%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.78%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.98%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.59%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.17%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.28%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (2.72%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"] (1.79%) [/TD]

Just like last month, the first thing you will notice is that all 5 TSP funds are positive for the year while all the LMBF Methods are negative. Things are getting better for the LMBF Methods, though. They all had positive returns in April, so their YTD is not as negative as last month. Also notice that the S Fund suffered quite a loss in April and is barely hanging on to its positive YTD. That is something you may want to consider if you are following one of the >S variants.

Speaking of the variants, how do they compare to each other? Well, that's hard to say because all the LMBF-1 variants were in the same funds through April and we only started to get separation there in May. That leaves us comparing LMBF to LMBF-1. As we can see from the table, LMBF came out ahead by being in the C Fund instead of the G Fund. This helped bring the difference between the two methods to under 1% now. It would have been even better had LMBF stayed in the I Fund from the previous month, but that's not how these methods work. After all, it could also have been worse if LMBF had chosen the S Fund. We did not have gains across all equities. This under performance of the S Fund with respect to the C & I is something we want to keep an eye on.

With a 3rd of the year behind us what can we say about the LMBF methods now compared to last year. 2014 is a different year from 2013. Anyone can see that. It is not a buy and hold year like 2013 was. Still, if you did buy and hold any of our 5 Funds you would be better off than any of the LMBF Methods today. That doesn't speak too well for us right now: different year, different market, same results.

I could throw in the explanation of the whipsaw we endured this year, but that is just making excuses and may still be going on for LMBF-1 for all we know. The whipsaw or any excuses are just a part of the method and must be considered together over the long term. The system either works or it doesn't. You've seen the historical returns from previous posts in this thread. Do they work? Maybe I'm wrong, but I don't think 2014 is any different. Maybe it's another 2005 where the returns aren't that great, but that's still too early to tell. It could equally well turn into a year like 2011 where LMBF keeps you from losing as much as holding equities all year.

We will just have to keep following these methods to see what happens. It certainly is more interesting (and I think realistic) than the previous year where the markets only went up, up, and up.

Cactus

TSP Pro

- Reaction score

- 38

Here are the monthly returns as of 5/29/2014.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 29-May-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.19%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.23%[/TD]

[TD="bgcolor: #99CC00, align: right"]2.16%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.82%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.67%[/TD]

The best fund is C so the following IFTs take place before noon eastern Tomorrow, 5/30/2014:

LMBF-1 changes from the I Fund to the C Fund

LMBF-1 SIM Remains in the F Fund through October

LMBF-1 C>S changes from the I Fund to the S Fund

LMBF-1 CI>S Remains in the S Fund

Looks like we are getting even more separation between the funds this month.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 29-May-2014 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.19%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.23%[/TD]

[TD="bgcolor: #99CC00, align: right"]2.16%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.82%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.67%[/TD]

LMBF-1 changes from the I Fund to the C Fund

LMBF-1 SIM Remains in the F Fund through October

LMBF-1 C>S changes from the I Fund to the S Fund

LMBF-1 CI>S Remains in the S Fund

Looks like we are getting even more separation between the funds this month.