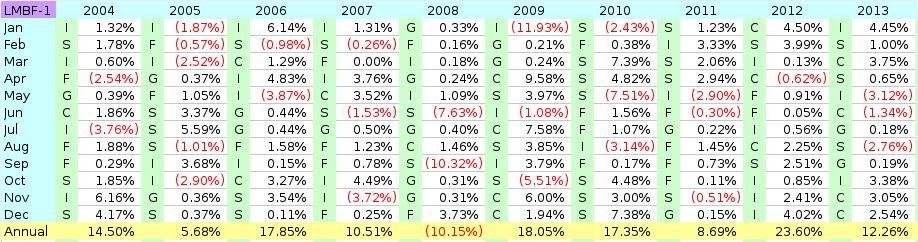

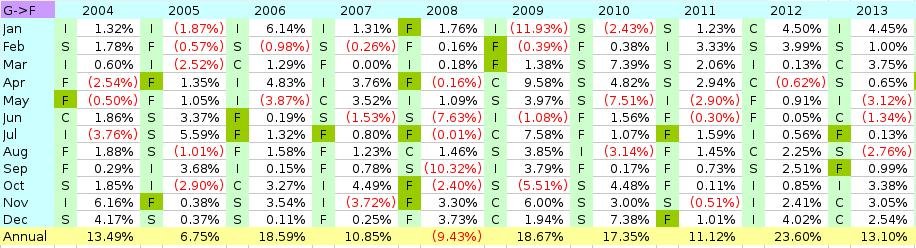

Here are 26 years of back-tested returns for the zero-latency LMBF method, LMBF0. It sets the whole next month to last month's best fund. This is only an indicator method that uses the TSP Fund monthly return data. We can't actually trade LMBF0 since we always have a 1 day lag between determining the best fund and exercising an IFT into it, but this gives us more data to back-test against since TSP Fund daily data only goes back to June 2003. Another caveat is that the S & I Funds only go back to January 2001 so they aren't used in LMBF0 before then. Have a look; analysis to follow.

[TD="bgcolor: #969696, align: left"]Year[/TD]

[TD="bgcolor: #969696, align: center"]G[/TD]

[TD="bgcolor: #969696, align: center"]F[/TD]

[TD="bgcolor: #969696, align: center"]C[/TD]

[TD="bgcolor: #969696, align: center"]S[/TD]

[TD="bgcolor: #969696, align: center"]I[/TD]

[TD="bgcolor: #969696, align: center"]LMBF[/TD]

[TD="bgcolor: #969696, align: center"]LMBF-1[/TD]

[TD="bgcolor: #969696, align: center"]LMBF0[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1988[/TD]

[TD="align: right"]8.81%[/TD]

[TD="align: right"]3.63%[/TD]

[TD="align: right"]11.84%[/TD]

[TD="align: right"]7.39%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1989[/TD]

[TD="align: right"]8.81%[/TD]

[TD="align: right"]13.89%[/TD]

[TD="align: right"]31.03%[/TD]

[TD="align: right"]23.47%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1990[/TD]

[TD="align: right"]8.90%[/TD]

[TD="align: right"]8.00%[/TD]

[TD="align: right"]

(3.15%)

[/TD]

[TD="align: right"]0.57%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1991[/TD]

[TD="align: right"]8.15%[/TD]

[TD="align: right"]15.75%[/TD]

[TD="align: right"]30.77%[/TD]

[TD="align: right"]11.80%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1992[/TD]

[TD="align: right"]7.23%[/TD]

[TD="align: right"]7.20%[/TD]

[TD="align: right"]7.70%[/TD]

[TD="align: right"]0.72%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1993[/TD]

[TD="align: right"]6.14%[/TD]

[TD="align: right"]9.52%[/TD]

[TD="align: right"]10.13%[/TD]

[TD="align: right"]3.56%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1994[/TD]

[TD="align: right"]7.22%[/TD]

[TD="align: right"]

(2.96%)

[/TD]

[TD="align: right"]1.33%[/TD]

[TD="align: right"]0.64%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1995[/TD]

[TD="align: right"]7.03%[/TD]

[TD="align: right"]18.31%[/TD]

[TD="align: right"]37.41%[/TD]

[TD="align: right"]29.43%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1996[/TD]

[TD="align: right"]6.76%[/TD]

[TD="align: right"]3.66%[/TD]

[TD="align: right"]22.85%[/TD]

[TD="align: right"]26.96%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1997[/TD]

[TD="align: right"]6.77%[/TD]

[TD="align: right"]9.60%[/TD]

[TD="align: right"]33.17%[/TD]

[TD="align: right"]9.52%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1998[/TD]

[TD="align: right"]5.74%[/TD]

[TD="align: right"]8.70%[/TD]

[TD="align: right"]28.44%[/TD]

[TD="align: right"]31.25%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]1999[/TD]

[TD="align: right"]5.99%[/TD]

[TD="align: right"]

(0.85%)

[/TD]

[TD="align: right"]20.95%[/TD]

[TD="align: right"]9.70%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2000[/TD]

[TD="align: right"]6.42%[/TD]

[TD="align: right"]11.67%[/TD]

[TD="align: right"]

(9.14%)

[/TD]

[TD="align: right"]

(6.46%)

[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2001[/TD]

[TD="align: right"]5.39%[/TD]

[TD="align: right"]8.61%[/TD]

[TD="align: right"]

(11.94%)

[/TD]

[TD="align: right"]

(9.04%)

[/TD]

[TD="align: right"]

(21.94%)

[/TD]

[TD="align: right"]3.85%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2002[/TD]

[TD="align: right"]5.00%[/TD]

[TD="align: right"]10.27%[/TD]

[TD="align: right"]

(22.05%)

[/TD]

[TD="align: right"]

(18.14%)

[/TD]

[TD="align: right"]

(15.98%)

[/TD]

[TD="align: right"]

(1.65%)

[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2003[/TD]

[TD="align: right"]4.11%[/TD]

[TD="align: right"]4.11%[/TD]

[TD="align: right"]28.54%[/TD]

[TD="align: right"]42.92%[/TD]

[TD="align: right"]37.94%[/TD]

[TD="align: right"]38.73%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2004[/TD]

[TD="align: right"]4.30%[/TD]

[TD="align: right"]4.30%[/TD]

[TD="align: right"]10.82%[/TD]

[TD="align: right"]18.03%[/TD]

[TD="align: right"]20.00%[/TD]

[TD="align: right"]13.00%[/TD]

[TD="align: right"]14.50%[/TD]

[TD="align: right"]15.48%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2005[/TD]

[TD="align: right"]4.49%[/TD]

[TD="align: right"]2.40%[/TD]

[TD="align: right"]4.96%[/TD]

[TD="align: right"]10.45%[/TD]

[TD="align: right"]13.63%[/TD]

[TD="align: right"]2.38%[/TD]

[TD="align: right"]5.68%[/TD]

[TD="align: right"]5.70%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2006[/TD]

[TD="align: right"]4.93%[/TD]

[TD="align: right"]4.40%[/TD]

[TD="align: right"]15.79%[/TD]

[TD="align: right"]15.30%[/TD]

[TD="align: right"]26.32%[/TD]

[TD="align: right"]7.07%[/TD]

[TD="align: right"]17.85%[/TD]

[TD="align: right"]8.18%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2007[/TD]

[TD="align: right"]4.87%[/TD]

[TD="align: right"]7.09%[/TD]

[TD="align: right"]5.54%[/TD]

[TD="align: right"]5.49%[/TD]

[TD="align: right"]11.43%[/TD]

[TD="align: right"]10.97%[/TD]

[TD="align: right"]10.51%[/TD]

[TD="align: right"]13.78%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2008[/TD]

[TD="align: right"]3.75%[/TD]

[TD="align: right"]5.45%[/TD]

[TD="align: right"]

(36.99%)

[/TD]

[TD="align: right"]

(38.32%)

[/TD]

[TD="align: right"]

(42.43%)

[/TD]

[TD="align: right"]

(11.06%)

[/TD]

[TD="align: right"]

(10.15%)

[/TD]

[TD="align: right"]

(11.39%)

[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2009[/TD]

[TD="align: right"]2.97%[/TD]

[TD="align: right"]5.99%[/TD]

[TD="align: right"]26.68%[/TD]

[TD="align: right"]34.85%[/TD]

[TD="align: right"]30.04%[/TD]

[TD="align: right"]9.66%[/TD]

[TD="align: right"]18.05%[/TD]

[TD="align: right"]15.06%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2010[/TD]

[TD="align: right"]2.81%[/TD]

[TD="align: right"]6.71%[/TD]

[TD="align: right"]15.06%[/TD]

[TD="align: right"]29.06%[/TD]

[TD="align: right"]7.94%[/TD]

[TD="align: right"]12.85%[/TD]

[TD="align: right"]17.35%[/TD]

[TD="align: right"]17.35%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2011[/TD]

[TD="align: right"]2.45%[/TD]

[TD="align: right"]7.89%[/TD]

[TD="align: right"]2.11%[/TD]

[TD="align: right"]

(3.38%)

[/TD]

[TD="align: right"]

(11.81%)

[/TD]

[TD="align: right"]12.22%[/TD]

[TD="align: right"]8.69%[/TD]

[TD="align: right"]9.95%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2012[/TD]

[TD="align: right"]1.47%[/TD]

[TD="align: right"]4.29%[/TD]

[TD="align: right"]16.07%[/TD]

[TD="align: right"]18.57%[/TD]

[TD="align: right"]18.62%[/TD]

[TD="align: right"]19.27%[/TD]

[TD="align: right"]23.60%[/TD]

[TD="align: right"]23.63%[/TD]

[TD="bgcolor: #C0C0C0, align: right"]2013[/TD]

[TD="align: right"]1.89%[/TD]

[TD="align: right"]

(1.63%)

[/TD]

[TD="align: right"]32.45%[/TD]

[TD="align: right"]38.35%[/TD]

[TD="align: right"]22.13%[/TD]

[TD="align: right"]9.21%[/TD]

[TD="align: right"]12.26%[/TD]

[TD="align: right"]12.66%[/TD]