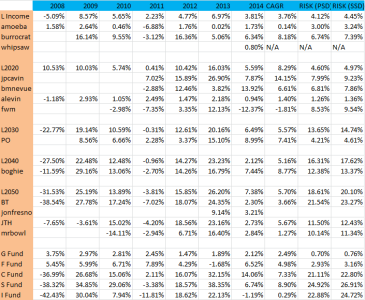

OK, December is finished so lets see how these Methods finished out the year.

[TD="bgcolor: #99CCFF, align: center"]G[/TD]

[TD="bgcolor: #99CCFF, align: center"]F[/TD]

[TD="bgcolor: #99CCFF, align: center"]C[/TD]

[TD="bgcolor: #99CCFF, align: center"]S[/TD]

[TD="bgcolor: #99CCFF, align: center"]I[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF[/TD]

[TD="bgcolor: #99CCFF, align: center"]LMBF-1[/TD]

[TD="bgcolor: #99CCFF, align: center"]C>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]CI>S[/TD]

[TD="bgcolor: #99CCFF, align: center"]SIM[/TD]

[TD="bgcolor: #99CCFF, align: center"]G>F[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jan[/TD]

[TD="align: right"]0.21%[/TD]

[TD="align: right"]1.58%[/TD]

[TD="align: right"]

(3.45%)

[/TD]

[TD="align: right"]

(1.91%)

[/TD]

[TD="align: right"]

(4.03%)

[/TD]

[TD="align: right"]

(1.82%)

[/TD]

[TD="align: right"]

(1.91%)

[/TD]

[TD="align: right"]

(1.91%)

[/TD]

[TD="align: right"]

(1.91%)

[/TD]

[TD="align: right"]

(1.91%)

[/TD]

[TD="align: right"]

(1.91%)

[/TD]

[TD="bgcolor: #FF99CC, align: left"]Feb[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]4.58%[/TD]

[TD="align: right"]5.43%[/TD]

[TD="align: right"]5.58%[/TD]

[TD="align: right"]

(2.82%)

[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="align: right"]0.62%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Mar[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]

(0.15%)

[/TD]

[TD="align: right"]0.85%[/TD]

[TD="align: right"]

(0.69%)

[/TD]

[TD="align: right"]

(0.57%)

[/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"]

(0.69%)

[/TD]

[TD="align: right"]

(0.69%)

[/TD]

[TD="align: right"]

(0.69%)

[/TD]

[TD="align: right"]

(0.69%)

[/TD]

[TD="align: right"]

(0.69%)

[/TD]

[TD="bgcolor: #FF99CC, align: left"]Apr[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.90%[/TD]

[TD="align: right"]0.75%[/TD]

[TD="align: right"]

(2.47%)

[/TD]

[TD="align: right"]1.51%[/TD]

[TD="align: right"]0.44%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.90%[/TD]

[TD="bgcolor: #FF99CC, align: left"]May[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]1.21%[/TD]

[TD="align: right"]2.35%[/TD]

[TD="align: right"]1.52%[/TD]

[TD="align: right"]1.72%[/TD]

[TD="align: right"]1.35%[/TD]

[TD="align: right"]1.72%[/TD]

[TD="align: right"]1.72%[/TD]

[TD="align: right"]1.52%[/TD]

[TD="align: right"]1.21%[/TD]

[TD="align: right"]1.72%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jun[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]0.14%[/TD]

[TD="align: right"]2.07%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]2.19%[/TD]

[TD="align: right"]2.07%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]4.45%[/TD]

[TD="align: right"]0.14%[/TD]

[TD="align: right"]2.07%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Jul[/TD]

[TD="align: right"]0.19%[/TD]

[TD="align: right"]

(0.19%)

[/TD]

[TD="align: right"]

(1.37%)

[/TD]

[TD="align: right"]

(4.38%)

[/TD]

[TD="align: right"]

(1.95%)

[/TD]

[TD="align: right"]

(4.58%)

[/TD]

[TD="align: right"]

(4.38%)

[/TD]

[TD="align: right"]

(4.38%)

[/TD]

[TD="align: right"]

(4.38%)

[/TD]

[TD="align: right"]

(0.19%)

[/TD]

[TD="align: right"]

(4.38%)

[/TD]

[TD="bgcolor: #FF99CC, align: left"]Aug[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]1.12%[/TD]

[TD="align: right"]4.01%[/TD]

[TD="align: right"]4.98%[/TD]

[TD="align: right"]

(0.14%)

[/TD]

[TD="align: right"]

(0.04%)

[/TD]

[TD="align: right"]4.01%[/TD]

[TD="align: right"]4.98%[/TD]

[TD="align: right"]4.98%[/TD]

[TD="align: right"]1.12%[/TD]

[TD="align: right"]4.01%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Sep[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]

(0.58%)

[/TD]

[TD="align: right"]

(1.40%)

[/TD]

[TD="align: right"]

(5.10%)

[/TD]

[TD="align: right"]

(3.82%)

[/TD]

[TD="align: right"]

(5.43%)

[/TD]

[TD="align: right"]

(5.10%)

[/TD]

[TD="align: right"]

(5.10%)

[/TD]

[TD="align: right"]

(5.10%)

[/TD]

[TD="align: right"]

(0.58%)

[/TD]

[TD="align: right"]

(5.10%)

[/TD]

[TD="bgcolor: #FF99CC, align: left"]Oct[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.96%[/TD]

[TD="align: right"]2.45%[/TD]

[TD="align: right"]4.11% [/TD]

[TD="align: right"]

(0.63%)

[/TD]

[TD="align: right"]

(1.28%)

[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.20%[/TD]

[TD="align: right"]0.96%[/TD]

[TD="align: right"]0.96%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Nov[/TD]

[TD="align: right"]0.17%[/TD]

[TD="align: right"]0.74%[/TD]

[TD="align: right"]2.70%[/TD]

[TD="align: right"]1.33%[/TD]

[TD="align: right"]0.51%[/TD]

[TD="align: right"]1.35%[/TD]

[TD="align: right"]1.33%[/TD]

[TD="align: right"]1.33%[/TD]

[TD="align: right"]1.33%[/TD]

[TD="align: right"]1.33%[/TD]

[TD="align: right"]1.33%[/TD]

[TD="bgcolor: #FF99CC, align: left"]Dec[/TD]

[TD="align: right"]0.18%[/TD]

[TD="align: right"]0.21%[/TD]

[TD="align: right"]

(0.24%)

[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]

(4.13%)

[/TD]

[TD="align: right"]

(1.09%)

[/TD]

[TD="align: right"]

(0.24%)

[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]0.99%[/TD]

[TD="align: right"]

(0.24%)

[/TD]

[TD="align: right"]

(0.24%)

[/TD]

[TD="bgcolor: #CCFFCC, align: left"]YTD[/TD]

[TD="bgcolor: #CCFFCC, align: right"]2.31%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]6.73%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]13.78%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]7.80%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]

(5.27%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"]

(10.06%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"]

(2.52%)

[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.93%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.73%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]1.94%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]

(1.09%)

[/TD]

Not too good as it turns out. This wasn't a

year but you still would have been better off holding any of our Funds except the I Fund this year. Ouch, that hurts when even the G Fund beats you. So this wasn't the year for these methods.

Comparing the methods to each other, we still see that the SIM, C>S, and CI>S options produce better results that LMBF-1 alone. It also helps that their returns were positive. The new G>F option also produced a better return even if the return was still negative. This option is probably better combined with one of the >S options.

Finally, notice that LMBF really had a hard time this year. Of course it could have gone the other way and LMBF-1 could have fallen hard. Comparing these two shows how much of a difference one day can make over time.