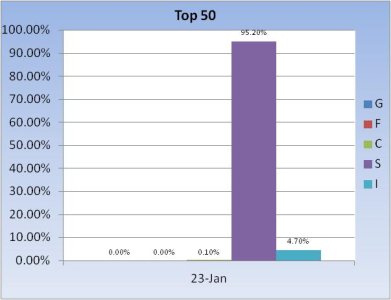

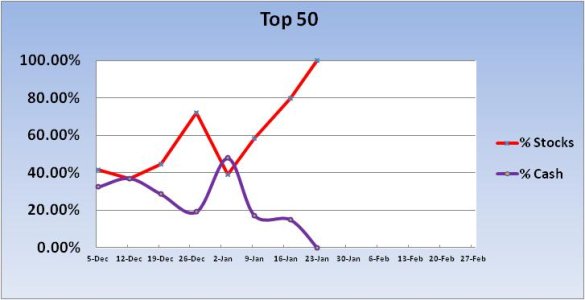

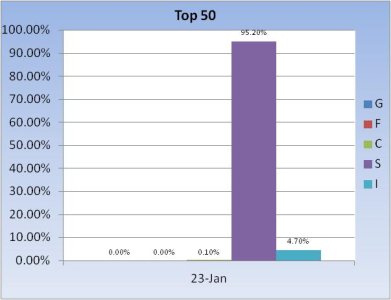

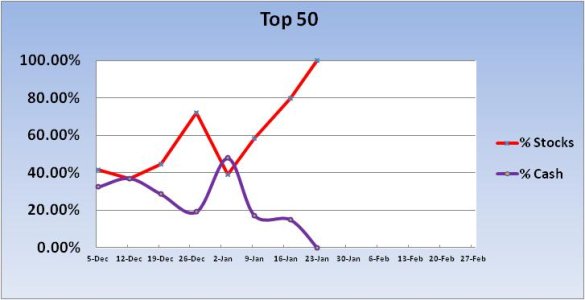

This is the first time I've seen it and it's notable. The Top 50 has a 100% stock allocation going into Monday's action. No G or F fund holdings. The herd on the other hand, is moving to safety.

Here's the charts:

Pretty self explanatory. Bullish? Maybe. The Seven Sentinels remain in a buy condition as does our sentiment survey. And given how much cash the herd has raised, I'd have to think that's bullish too.

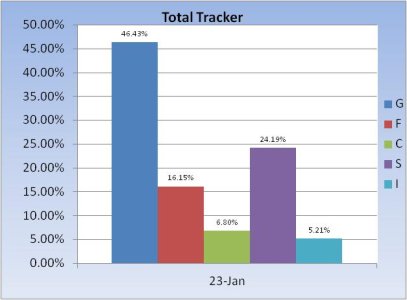

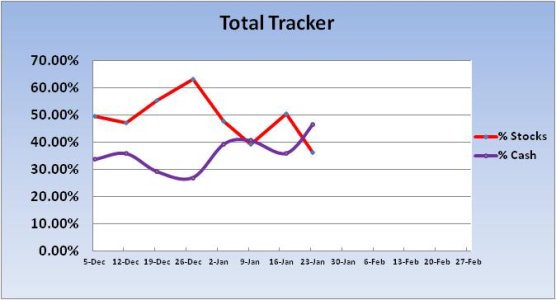

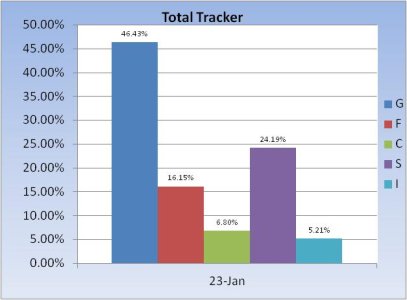

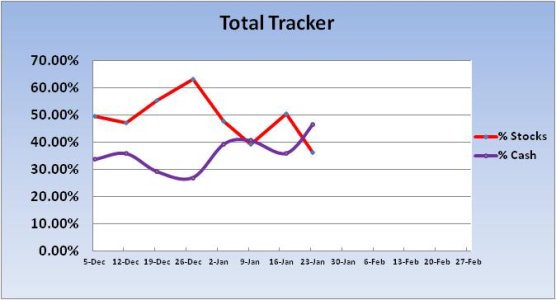

It looks like the "glass is half full" folks are now in the upper half of the charts, while the "glass is half empty" folks are are in the bottom half. We may get some selling as we are certainly overextended, but with a total stock allocation of only 36.19% I doubt any downside will be deep. That's the smallest stock allocation I've seen since I've been posting these charts. My guess is there are too many folks on the sidelines now, which may limit any selling pressure. But it could get interesting as some sentiment surveys are much more bullish than ours so volatility may be on the horizon again.

Here's the charts:

Pretty self explanatory. Bullish? Maybe. The Seven Sentinels remain in a buy condition as does our sentiment survey. And given how much cash the herd has raised, I'd have to think that's bullish too.

It looks like the "glass is half full" folks are now in the upper half of the charts, while the "glass is half empty" folks are are in the bottom half. We may get some selling as we are certainly overextended, but with a total stock allocation of only 36.19% I doubt any downside will be deep. That's the smallest stock allocation I've seen since I've been posting these charts. My guess is there are too many folks on the sidelines now, which may limit any selling pressure. But it could get interesting as some sentiment surveys are much more bullish than ours so volatility may be on the horizon again.