Axial-Drifter Update for 27 Dec 2009

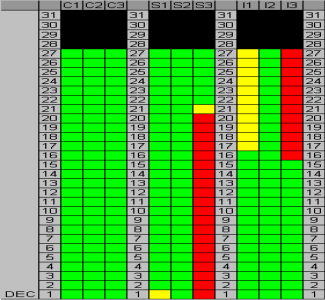

I don't have much to report here so I'll make it short. First off we have the Big 3 and I've highlighted the recent breakouts. For those invested in stocks it's a good sign when all 3 are trading above the 20MA. You can see where the transports once again have led the way followed by the Nasdaq and the S&P 500.

As for AGG's Bonds, over the last 4 weeks they have been putting in lower highs & lower lows, broken through the June ascending trendline, and are poised to test a 38.2% Fibonacci retracement. The slow (39, 1) Stochastic is on it's 3rd day below 20. It's currently sitting at 7.98, the previous two times it dipped below 20 it bounced off 2.96 an 0.00 From June's low to October's spike high we are sitting just above a 50% retracement.This is not a train I'd want to get in front of...

The Dollar has given us I-Funders a much needed pullback. At this level prices had some good reasons to stop and take a break. Tom pointed out the nice rejection at the 200 EMA. I'll only add that the previous symmetrical triangle's apex is at this same level and so is a 61.8% Fibonacci level. You can see from the yellow circle that prices spent some time consolidating at this level before the triangle's breakdown and continuation to the downside.

Of the 11 broad market charts I watch on a daily basis, 2 have yet to breakout. EFA and the Dow Jones World Index which I like to call the Black Widow. I need to see this chart make a breakout to be convinced this is more than a Santa rally.

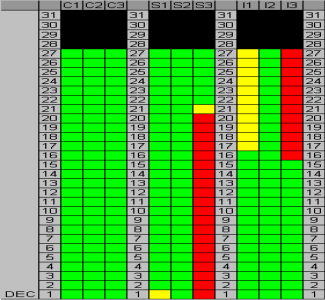

Lastly the Axial-Drifter's S3 signal pulled out of the red into the green. I've yet to devise a better system so I'll be following this one exclusively next year. My only regret is that I'm unable to back-test it beyond 2006 because some of the charts don't have that much history. As far as back-testing goes, this is an extremely short period of unproven time. But my faith doesn't depend solely on the indicators, it relies on the multitude of diverse charts and the rules as applied to them. Often times what breaks a system is not the system itself but the trader's inability to follow their own rules. Next year will prove for me to be a much needed lesson in patience and discipline.

Cheers... Jason

I don't have much to report here so I'll make it short. First off we have the Big 3 and I've highlighted the recent breakouts. For those invested in stocks it's a good sign when all 3 are trading above the 20MA. You can see where the transports once again have led the way followed by the Nasdaq and the S&P 500.

As for AGG's Bonds, over the last 4 weeks they have been putting in lower highs & lower lows, broken through the June ascending trendline, and are poised to test a 38.2% Fibonacci retracement. The slow (39, 1) Stochastic is on it's 3rd day below 20. It's currently sitting at 7.98, the previous two times it dipped below 20 it bounced off 2.96 an 0.00 From June's low to October's spike high we are sitting just above a 50% retracement.This is not a train I'd want to get in front of...

The Dollar has given us I-Funders a much needed pullback. At this level prices had some good reasons to stop and take a break. Tom pointed out the nice rejection at the 200 EMA. I'll only add that the previous symmetrical triangle's apex is at this same level and so is a 61.8% Fibonacci level. You can see from the yellow circle that prices spent some time consolidating at this level before the triangle's breakdown and continuation to the downside.

Of the 11 broad market charts I watch on a daily basis, 2 have yet to breakout. EFA and the Dow Jones World Index which I like to call the Black Widow. I need to see this chart make a breakout to be convinced this is more than a Santa rally.

Lastly the Axial-Drifter's S3 signal pulled out of the red into the green. I've yet to devise a better system so I'll be following this one exclusively next year. My only regret is that I'm unable to back-test it beyond 2006 because some of the charts don't have that much history. As far as back-testing goes, this is an extremely short period of unproven time. But my faith doesn't depend solely on the indicators, it relies on the multitude of diverse charts and the rules as applied to them. Often times what breaks a system is not the system itself but the trader's inability to follow their own rules. Next year will prove for me to be a much needed lesson in patience and discipline.

Cheers... Jason