The S&P managed to rally out the gate today and tagged its 200 dma, but just like the two previous times when the S&P approached its 200 dma, it was rejected. This is some serious resistance. If the S&P doesn't clear it soon, we'll probably move right back down the ladder.

In today's action the euro was up as high as 1.5% vs the dollar, but retraced a third of that gain to close at $1.223.

It seems every time the major indicies get near their 200 dma lately, some EU news comes out to drop kick the rally. Around mid-day today the analysts at Moody's downgraded Greece's debt to Ba1 from A3. Well, we didn't exactly tank on the news, but the market did retrace much of its gains with the S&P actually finishing in negative territory by the close. The broader market was up almost 0.5%, but that was nowhere near its session highs.

The action was enough to trigger a buy signal in the Seven Sentinels today, but is that a slam dunk? Considering the S&P has now been turned away from its 200 dma for the third time and the fact that we've already had quite a bounce off the previous low, I'd not be too confident of this buy signal.

And again it's because of the fast paced action, which is moving prices faster than I can react. The last two buy signals were met with some stiff selling pressure. And this time may be no different.

Let's look at the charts:

So we've got a buy signal. But NYMO in particular is near its highest levels of the past 6 months. NAMO is not quite there yet. This is not where I'd like these signals to be when issuing a buy signal. Not unless we're really ready to take off anyway.

NAHL and NYHL are still on a buy.

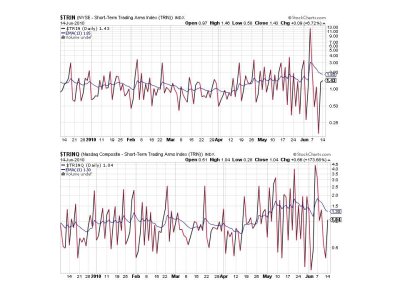

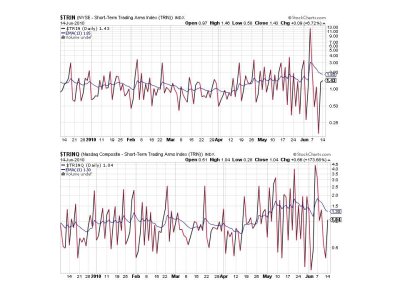

Same with TRIN and TRINQ

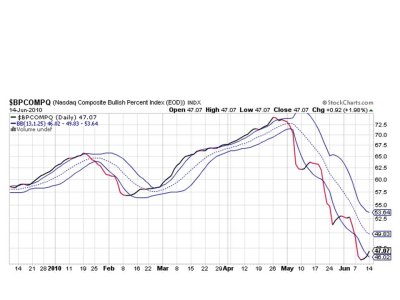

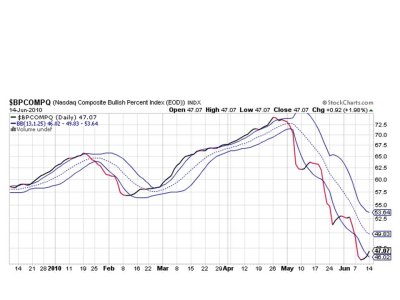

BPCOMPQ has crossed into positive territory and has flipped to buy. That's what happened on the last two buy signals too. And look what happened next. Remember, price on the S&P was just rejected yet again at its 200 dma.

So technically the system was still on a buy to begin with, and I was taken out of the market due to extreme selling pressure right after a buy signal. It proved to be the wrong move for me, but I had reason to believe the bottom was not in. That wasn't the case. At least not yet. Now we have another buy signal, but if the system was already on a buy then this signal is not as meaningful as it would be if we were on a sell.

I don't know many traders who aren't having fits with this market. It may be a day-trader's dream, but it's a nightmare for most others.

In today's action the euro was up as high as 1.5% vs the dollar, but retraced a third of that gain to close at $1.223.

It seems every time the major indicies get near their 200 dma lately, some EU news comes out to drop kick the rally. Around mid-day today the analysts at Moody's downgraded Greece's debt to Ba1 from A3. Well, we didn't exactly tank on the news, but the market did retrace much of its gains with the S&P actually finishing in negative territory by the close. The broader market was up almost 0.5%, but that was nowhere near its session highs.

The action was enough to trigger a buy signal in the Seven Sentinels today, but is that a slam dunk? Considering the S&P has now been turned away from its 200 dma for the third time and the fact that we've already had quite a bounce off the previous low, I'd not be too confident of this buy signal.

And again it's because of the fast paced action, which is moving prices faster than I can react. The last two buy signals were met with some stiff selling pressure. And this time may be no different.

Let's look at the charts:

So we've got a buy signal. But NYMO in particular is near its highest levels of the past 6 months. NAMO is not quite there yet. This is not where I'd like these signals to be when issuing a buy signal. Not unless we're really ready to take off anyway.

NAHL and NYHL are still on a buy.

Same with TRIN and TRINQ

BPCOMPQ has crossed into positive territory and has flipped to buy. That's what happened on the last two buy signals too. And look what happened next. Remember, price on the S&P was just rejected yet again at its 200 dma.

So technically the system was still on a buy to begin with, and I was taken out of the market due to extreme selling pressure right after a buy signal. It proved to be the wrong move for me, but I had reason to believe the bottom was not in. That wasn't the case. At least not yet. Now we have another buy signal, but if the system was already on a buy then this signal is not as meaningful as it would be if we were on a sell.

I don't know many traders who aren't having fits with this market. It may be a day-trader's dream, but it's a nightmare for most others.